Order Matching Engine: What It Is, How It Works, and Choosing the Right Solution

In today’s high-speed trading world, every second and even millisecond matters. Whether you’re launching a Forex trading platform, a crypto exchange, or a multi-asset brokerage firm, the order matching engine is a critical part of your ecosystem.

This invisible yet fundamental element impacts your competitive advantage and determines how swiftly trading orders are connected and settled, delivering requests placed by end-users quickly and efficiently.

Modern platforms rely on machine engines to automate trade execution in real time, reduce slippage, and maintain market integrity while dealing with thousands of simultaneous transactions. The faster and more accurate the engine, the smoother the trading experience for your clients.

Let’s explain how matching engines work, what algorithms they follow, and how you can choose the right system for your brokerage activities.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

What Is a Matching Engine?

The matching engine is the heart of any online-based trading desk—whether retail brokerages or institutional exchange platforms. The main function of this technology is matching compatible buy and sell orders and settling the trader’s request. This operation typically happens within milliseconds, ensuring all orders are executed at the most accurate and fair price available.

It works by continuously scanning incoming orders and comparing them with existing ones in the order book, ensuring seamless trade delivery and transparent price discovery. This process also maintains market liquidity and eliminates the inefficient manual handling of orders in traditional trading floors.

These engines follow strict logic and timing rules set through algorithms to enforce fairness and adhere to regulatory requirements. A powerful engine also supports stop orders, limit orders, and other advanced order techniques that follow defined parameters, such as price, time, and priority.

If you are launching a new brokerage firm, a matching engine is non-negotiable to ensure top-notch speed, transparency, and reliability, and attract sophisticated traders who will stay on your platform for years.

B2BROKER’s Crypto Broker Turnkey solution helps you launch a compliant, high-liquidity crypto brokerage with advanced trading and risk management.

07.07.25

What is the Difference Between the Order Book and the Matching Engine?

The order book and matching engine work hand-in-hand to find and execute trading orders. However, they work very differently.

The order book is a dynamic, real-time ledger that displays all active buy and sell orders, organized by price level and time, and offering a visual representation of the market depth and sentiment.

The matching engine is a mechanism that processes and executes these pending orders when two of them are compatible, finalizing the trade, updating the order book, and reflecting the position in the trader’s interface.

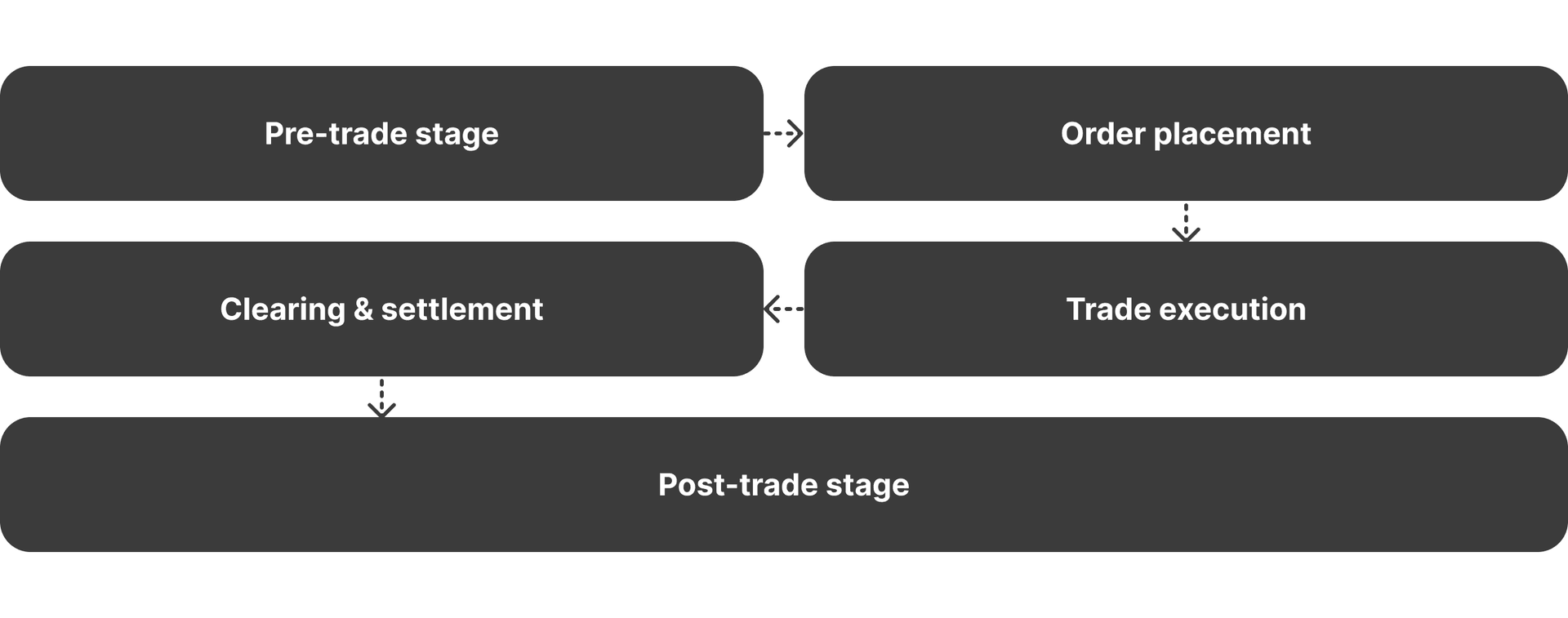

How Do Matching Engines Work?

Matching engines crawl the order book using complex algorithms to find and settle suitable requested trades. The technology collects data from order books provided by different brokers and platforms to find both sides of the trade, and matches them together at the best possible price.

However, this process involves multiple layers of verification and prioritisation, including price checks, filling rates, order sequence, and risk validation. Performance benchmarks typically include:

- Latency: Below 100 microseconds for high-frequency trading.

- Uptime: 99% or higher activity for uninterrupted service.

- Throughput: Processing tens of thousands of orders per second.

Order matching also involves risk management modules, ensuring trades comply with margin, exposure, and regulatory constraints before execution. The result is a fast, scalable, and compliant trading ecosystem capable of supporting global market activity.

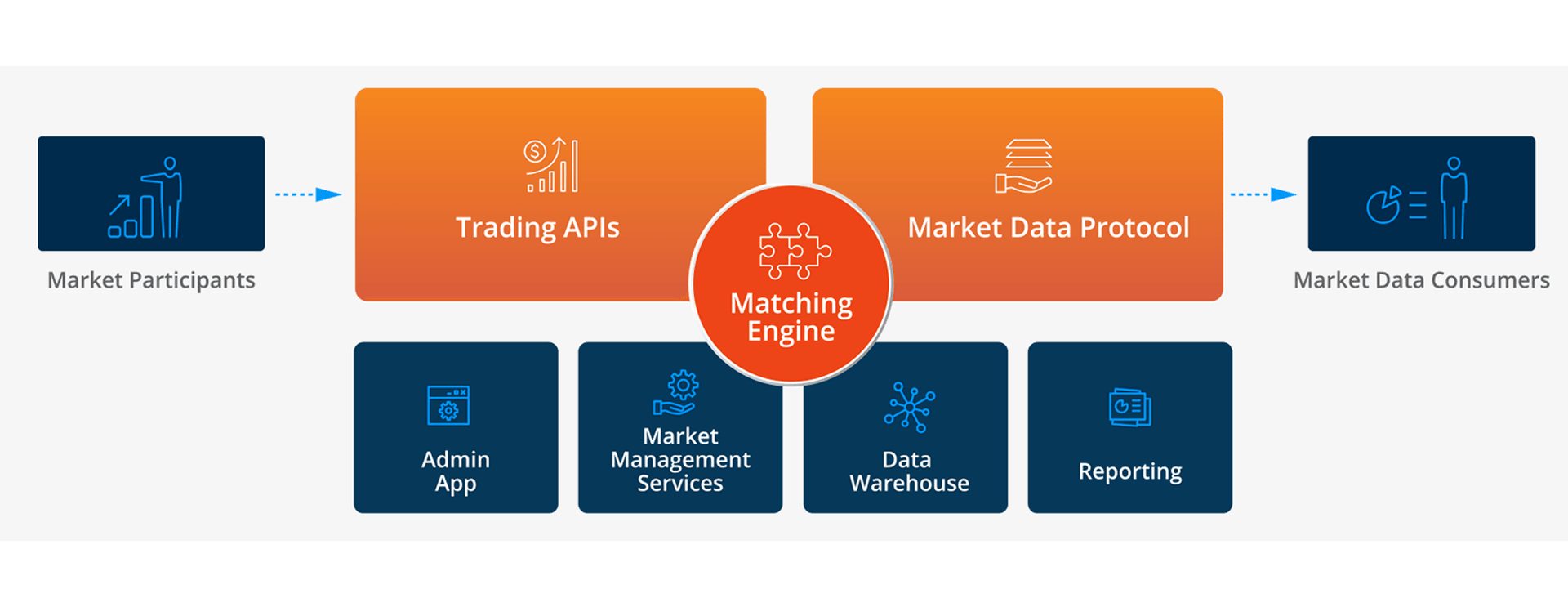

Key Components of an Order Matching System

Every matching engine consists of several elements and core modules that work together to deliver reliability and perform according to routing logic.

Order Book Management

The order book maintains a live record of all pending sell and buy orders waiting to be matched, sorted by timestamp and price. It refreshes in real time as new orders are submitted, modified, or cancelled. Offering a transparent track of market depth, liquidity zones, and investors’ sentiment.

Efficient order book management ensures fairness and integrity that build trust with clients and offer a seamless trading experience.

Trade Matching Logic

The matching logic is core for execution operations. The logic is determined by algorithms that decide which orders get filled first and at what price. Most routing algorithms follow the price-time priority, which executes the orders with the best price first, with precedence to earlier entries.

Managing the order execution logic is crucial to adhering to the client’s personal requirements and the brokerage-specific rules.

Real-Time Risk Checks

Before an order gets executed, the system performs pre-trade checks to ensure the position does not exceed exposure limits, margin requirements, or order size. Then, a post-execution check takes place, confirming compliance, clearing, and accuracy.

This protective layer is key to adhering to regulatory regulations and safeguarding the platform’s integrity from additional exposure or market risks.

Matched Trades Settlement

Once the orders are matched, settlements take place to update account balances, send confirmations, and notify all involved parties, whether an increase or decrease in the trader’s equity.

Ensuring a swift settlement process is vital for maintaining accuracy, avoiding reconciliation delays, and offering uninterrupted operations across all trading sessions. Also, a clear and seamless settlement cycle enables end-users to track their holdings without waiting for a long time.

Market Data Module

The market data module is another vital element in the matching engine process. It continuously broadcasts real-time updates, including order book changes, trade confirmations, price feeds, and liquidity patterns.

Streaming this data must be consistent and timely across all trading desks, liquidity providers, API connections, and other connected parties.

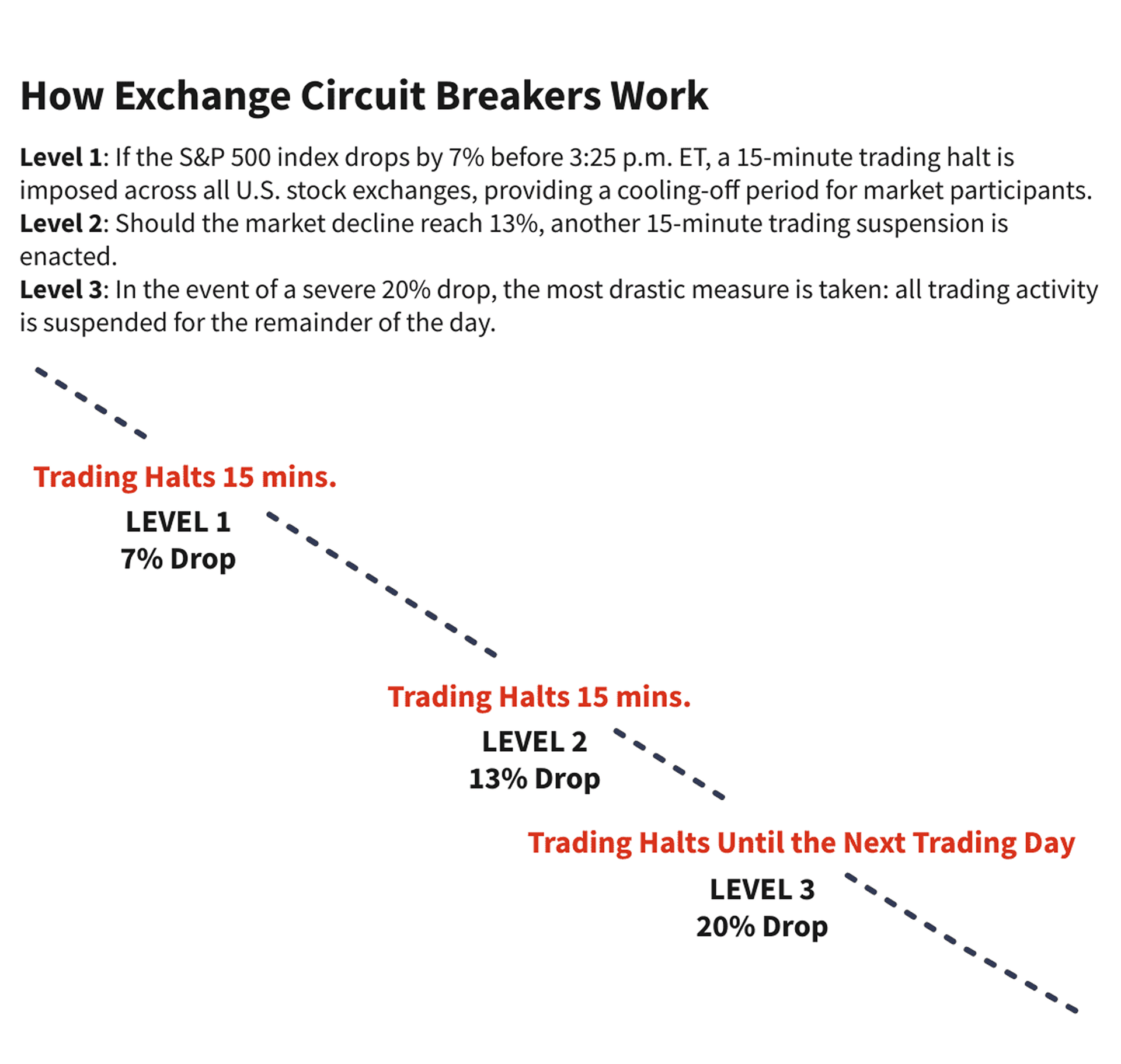

Circuit Breakers and Volatility Controls

Matching engines use circuit breakers to protect the platform during extreme conditions by temporarily pausing all trading activities when prices move abnormally fast. This mechanism prevents cascading volatility major liquidity shifts, reducing systemic risk and giving market participants time to rebalance.

Failover and Redundancy Systems

System reliability and consistency in performance are non-negotiable if you want to grow a reputable brokerage firm. Therefore, you need to integrate failover mechanisms to ensure continuous uptime, prevent outages, and minimize panic even during high-stress events.

The redundancy infrastructure automatically transfers operations to backup servers during server maintenance or unexpected hardware failure, which can majorly impact the trader’s experience, prices, slippage, and liquidity.

Understanding Exchange Matching Engine Algorithms

Algorithms determine how a matching engine allocates trades among competing orders, following the broker’s or the client’s preferences and risk tolerance. As such, different models serve different market structures and liquidity goals.

FIFO Price Time Priority

The FIFO, or First In, First Out, matching algorithm is the most common and straightforward approach, which prioritises orders first by best market price, then the earliest submission time.

This transparent logic rewards quick participation and ensures a fully auditable trade history for regulators and investors.

Pro Rata Allocation

The Pro Rata “proportion” model distributes execution proportionally based on order size rather than time. This way, large orders placed by financial institutions or liquidity providers are handled first, receiving a greater share of executions.

This model is also popular in low-liquidity and volatile environments that require depth and filling rate over settlement time.

Time Weighted Matching

Time-weighted algorithms combine order size and submission time. They offer the advantages of ultra-low latency and speedy execution while ensuring fairer market participation.

Many exchanges and trading platforms use the hybrid version to balance liquidity incentives with equitable execution.

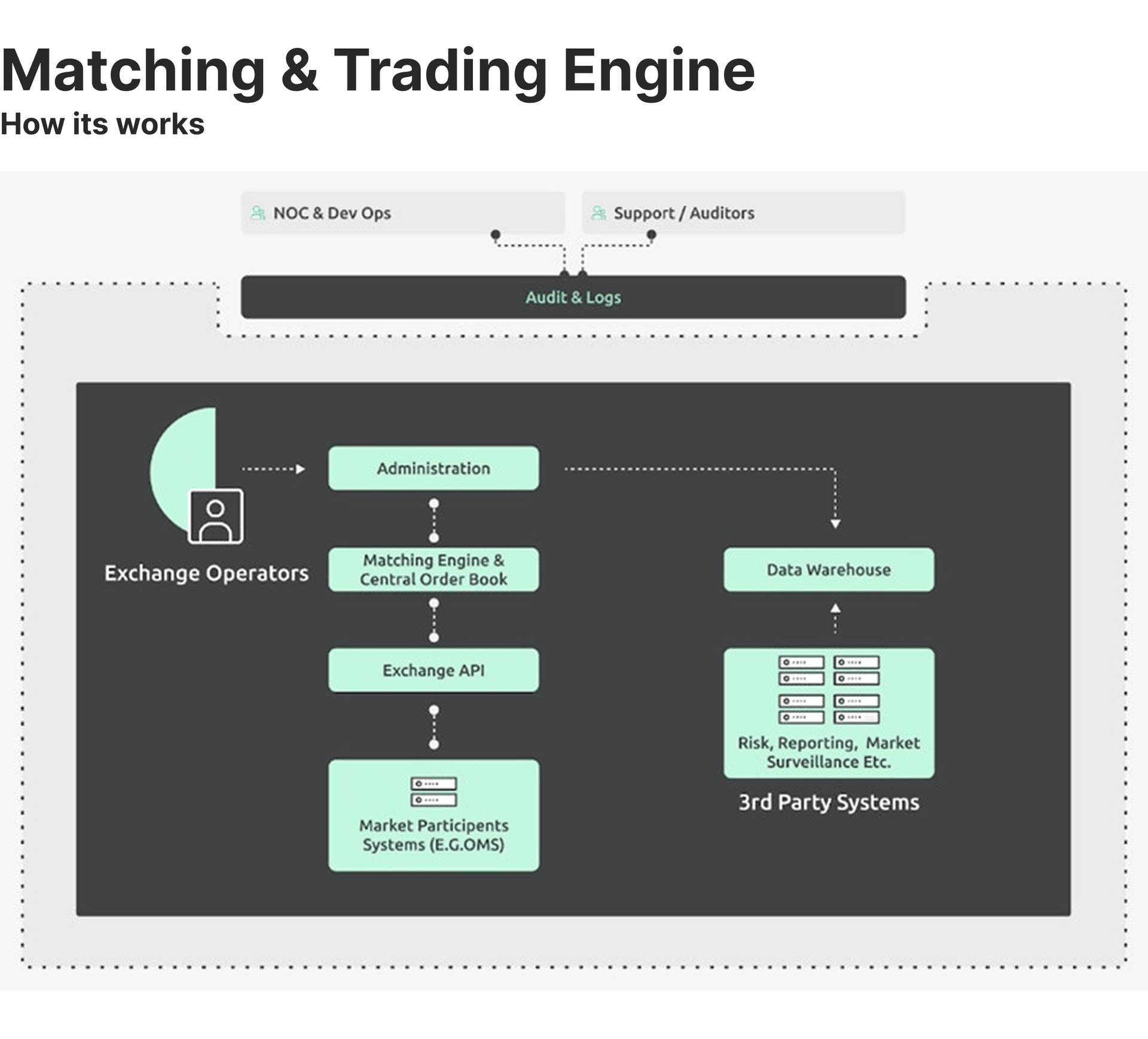

Centralized vs Decentralized Matching Engines

Matching engines can be centralized or decentralized, which defines the way orders are managed, the execution speed, and the tech factors about server outage or peak performance.

A centralized matching engine operates under a single authority and manages the order flow from a central server. This architecture offers ultra-low latency, straightforward compliance, and operational control. Such a setup is ideal for regulated exchanges and brokers prioritising speed and oversight.

A decentralized matching engine distributes operations across multiple nodes, enhancing transparency, resilience, and fault tolerance. However, this approach may come with a higher latency and coordination complexity.

Therefore, the choice depends on business objectives. If you prefer speed, simplicity, and compliance, then choose a centralized engine, while if you prioritize transparency, resilience, and autonomy, decentralized are better suited.

Advantages And Disadvantages of Crypto Matching Engines

Crypto matching engines come with a handful of advantages and disadvantages. One of the key benefits to these technologies is seamless flow of orders and requests if well engineered. However, its high costs and complexity are major shortcomings.

Benefits

- Enhancing user experience with sub-millisecond execution speeds.

- Real-time liquidity aggregation across multiple venues.

- Transparent order handling and fair price discovery.

- Scalable architecture for expanding volumes and asset classes.

- Vast integration capabilities with wallets, APIs, and compliance tools.

- Cost efficiency compared to building a full exchange infrastructure.

Challenges

- High technical complexity and integration costs.

- Continuous maintenance is required to sustain ultra-low latency.

- Regulatory compliance differences across multiple jurisdictions.

- Need for constant monitoring to prevent manipulation or overload.

- Infrastructure expenses for redundancy systems and 24/7 uptime.

Criteria to Consider When Choosing a Matching Engine

Besides the speed and performance metrics that you must prioritize for your matching engine, there are other crucial factors that you need to consider.

Integrations: The engine’s capability to integrate with different applications and service providers using multiple APIs to provide a better service, like fast data exchange, secure connection and more.

Uptime: Ensuring the matching engine does not face downtime or gets disconnected from the server frequently, which affects how your crypto exchange works.

User interface: It is important for the matching process to be easy to understand for traders and accessible for CRM owners. This helps developers address issues when they arise and interact swiftly with them.

Scalability: The matching engine’s ability to provide for a larger user base as the trading volume increases or business grows without having to change the entire engine.

Security: The matching engine should ensure data protection through advanced encryption, pre/post-trade comfirmations, and continuous system monitoring to prevent breaches and maintain the integrity of transactions.

Compliance: The engine must adhere to relevant financial and data protection regulations, building long-term client trust and aligning with global standards to ensure lawful and transparent trading operations.

Support: A reliable vendor should offer robust technical support, clear service-level agreements, and regular upgrades to guarantee system stability and long-term performance.

How to Choose the Right Order Matching Engine for Your Business

Selecting the right matching engine solution is a strategic decision that directly influences trading performance, client satisfaction, and operational efficiency. You need a system that supports multiple assets classes, integrates easily, scale seamlessly, and can be customized to your needs. Here’s how you can begin.

Define Your Business Model and Asset Coverage

Firstly, assess your business goals and market scope. A spot exchange has different technical requirements and routing logic than a multi-asset platform. Understanding your model clarifies which features — from multi-asset support to cross-margining — are essential.

As such, spot trading platforms needs real-time execution and low latency, while derivatives trading systems require advanced risk management, margining, and complex order types.

Similarly, single-asset engines are simpler and market-specific, while multi-asset platforms need flexible integrations, unified pricing, and cross-market risk management.

Retail-focused platforms focus on ease of use and fast execution, whereas institutional-focused brokers prioritize advanced APIs, FIX support, low latency, and regulatory compliance.

Evaluate Performance and Scalability Requirements

Execution speed defines trader confidence and attracts new clients to your platform. Look for engines with sub-100-microsecond latency and 99.99% uptime.

Moreover, scalability is equally crucial. The system should maintain consistency during volume spikes, such as news events or volatile markets, without bottlenecks or delays.

Assess Integration and API Capabilities

APIs are the connective tissue of trading infrastructure with crucial third-party services. A robust engine must integrate effortlessly with trading terminals, market makers, liquidity providers, regulatory reporting tools, and currency exchanges.

You ensure smooth integrations, your platform must support FIX, REST, and WebSocket protocols to ensure flexibility and detailed documentation for accelerated development and deployment.

Prioritize Security, Compliance, and Risk Controls

The matching engine should employ strong data encryption, advanced fraud-detection systems, and continuous risk monitoring. These techniques ensure the platform’s integrity and keep it clean from malicious activity.

Additionally, you must ensure compliance with frameworks such as MiFID II, FCA, or SEC standards, meeting global regulatory expectations and instilling trust among users. You will also need to integrate automated reporting and audit trails to reinforce trust with both clients and regulators.

Consider Vendor Reputation and Long-Term Support

Partnering with a reliable technology provider is as important as the engine itself. Look for vendors offering 24/7 support, regular version updates, and timely server maintenance.

Choose a matching engine developer with a proven track record, transparent pricing, and responsive technical support to minimize downtime at your brokerage and avoid costly disruptions.

Build Your Brokerage on Solid Foundations

Take your brokerage to the next level with B2BROKER’s all-in-one solutions for liquidity, technology, risk management, and compliance. Discover how our next-gen solutions powers leading financial institutions worldwide.

Integrating a Matching Engine With Existing Infrastructure

Adding a matching engine to your existing infrastructure is a structured process that requires precision and planning. Each step must ensure minimal disruption while maximizing system synergy. Here’s how it goes.

API Connectivity

A robust API framework forms the backbone of seamless integration between the matching engine and existing ecosystem, such as trading terminals, liquidity hubs, risk modules, and data analytics tools.

By using standard communication protocols like FIX and REST, APIs ensure interoperability, scalability, and low-latency data exchange, allowing brokers to maintain flexible, high-performance infrastructures adaptable to evolving market requirements.

Every Forex trader can select their preferred trading platform. However, not every business can offer its own software, so the choice of a platform for a trader is limited to the offer of a certain Forex broker. Many brokers provide accessibility to the trading platform via a "bridge," which is a software component that links a Forex broker's dealing system to the platform. If the bridge fails or is delayed, it might have a negative impact on trade management and execution.

Liquidity Provider Integration

Connecting multiple liquidity providers enhances pricing and execution quality by creating deeper order books and offering more competitive rates consolidated from multiple sources.

Liquidity aggregation combines quotes from various venues, narrowing spreads and improving order fill rates. Smart order routing further optimizes execution by dynamically selecting the best available prices across venues, ensuring traders consistently achieve best execution and minimizing slippage under volatile conditions.

Deep, Reliable Liquidity Across 10 Major Asset Classes

FX, Crypto, Commodities, Indices & More from One Single Margin Account

Tight Spreads and Ultra-Low Latency Execution

Seamless API Integration with Your Trading Platform

Legacy System Migration

Migrating from legacy systems to a modern matching engine requires strategic planning to avoid downtime and service disruptions. Therefore, you must implement parallel runs to allows both systems to operate simultaneously for validation and testing with interruptions.

Phased transitions introduce new modules gradually, reducing operational risk, with rollback mechanisms providing a safety net to revert changes if performance issues or integration failures arise during deployment.

Power your Brokerage with Next-Gen Multi-Asset & Multi-Market Trading

Advanced Engine Processing 3,000 Requests Per Second

Supports FX, Crypto Spot, CFDs, Perpetual Futures, and More in One Platform

Scalable Architecture Built for High-Volume Trading

Transform Your Platform’s Execution Speed With B2BROKER

A professional-grade matching engine doesn’t just enhance execution; it transforms the entire trading experience at your platform to meet and exceed user expectations. From liquidity aggregation to compliance automation, B2BROKER’s ecosystem creates a foundation for growth and resilience.

B2TRADER delivers institutional-grade performance with ultra-low latency, advanced risk control, and multi-asset support, specially designed for brokers and exchanges aiming to scale with ease.

Ready to Launch Your Trading Platform?

Our experts can help you integrate a powerful matching engine and complete brokerage ecosystem, tailored to your business model and goals. Book a consultation to start building today.

Frequently Asked Questions about Order Matching Engine

- How does a matching engine handle partial fills?

When only part of an order can be matched, the available quantity is executed immediately while the remaining portion stays active until another compatible order is sent to the order book.

- Can one matching engine support both crypto and traditional securities?

Yes. Modern multi-asset matching engines are customized to support different instruments and financial markets, each governed by asset-specific trading rules and compliance requirements.

- What is the typical ROI timeline for implementing a new matching engine?

Most brokerages achieve return on investment within 12–18 months, thanks to improved execution efficiency, higher trading volumes, and enhanced client retention.