Types of Crypto Liquidity You Might Need As a Business

The increasing popularity of the crypto market and the expansion of international markets have generated a substantial need for easily accessible funds to uphold stability in the trading of investment instruments, especially crypto. As many distinct kinds of crypto tools exist in the framework of trading in the crypto market, many kinds of crypto liquidity businesses have sprung up.

Grasping the various forms of cryptocurrency liquidity and their implications is vital for firms that want to adeptly manoeuvre through the intricacies of the market. Each type of liquidity, whether it pertains to direct trading, margin trading, or derivatives, fulfils a unique role and caters to particular requirements within your business activities.

This article will explain crypto liquidity and how it matters to the crypto market. You will also learn about what types of crypto liquidity exist and what companies should pay attention to when using it.

Key Takeaways

- Crypto liquidity is the driving force behind the crypto market, keeping its soundness and robust functioning, especially during periods of high volatility.

- Crypto liquidity is classified into different categories depending on the trading instrument for which it is intended.

- When determining the need for crypto liquidity, establishments are advised to evaluate trading volumes, market depth, and the reliability of their partner’s crypto liquidity provider.

What Does Crypto Liquidity Stand For?

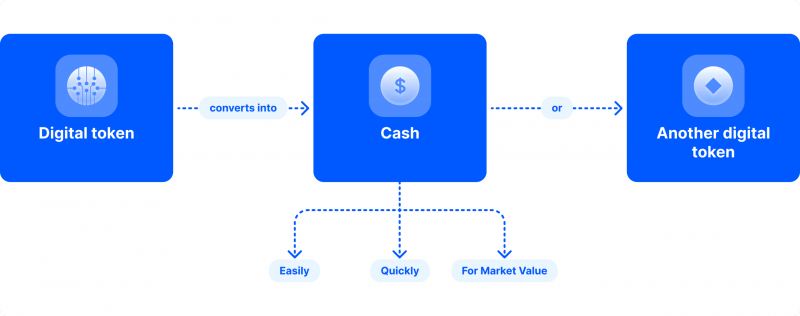

Cryptocurrency liquidity pertains to the ability to purchase or sell crypto in the market with minimal impact on its price. A market characterised by high liquidity features a substantial number of buyers and sellers, facilitating swift and effective transactions. In contrast, a market with low liquidity has fewer participants, which can complicate trading and lead to notable fluctuations in price.

The nature of liquidity in the market of virtual securities is of the utmost importance for investors and traders, as it determines how easily assets can be exchanged. When liquidity is high, transactions can occur rapidly, allowing participants to confidently enter and exit positions. On the other hand, low liquidity can create challenges, as trades may require more time and can result in larger price swings, making it riskier for those involved.

Understanding crypto liquidity is essential for anyone engaged in the digital currency space. It not only influences the efficiency of trading but also impacts the overall market stability. A liquid market is generally more attractive to investors, as it provides the assurance that they can execute trades without radically altering the asset’s value, whereas a lack of liquidity can deter participation and lead to heightened speculation.

Crypto liquidity has the highest demand in the market relative to liquidity intended for other types of trading markets due to the high popularity of crypto trading.

Why Does Crypto Liquidity Matter in the Crypto Market?

Liquidity, the engine of the trading process in any market, ensures the smooth functioning of the system of interrelated elements of the market model within the framework of which the conclusion of transactions on the purchase or sale of those or other financial assets is carried out.

In particular, liquidity in the crypto market, which is the most volatile of all existing markets, is a vital resource that supports its stability and has the following characteristics that determine its importance:

Smooth Trading Operations

The high level of liquidity in the market ensures that trades can be carried out swiftly and efficiently, minimising any potential delays and significantly reducing the likelihood of price slippage, which can impact trade execution outcomes.

Additionally, the presence of a larger number of participants in the market means that large orders can be absorbed without causing substantial price movements. This leads to a more stable and predictable market environment, providing a favourable trading landscape for market participants.

Price Stability

The stability of prices in the market plays a crucial role in building confidence among investors and traders. When prices remain stable, it fosters trust and encourages more active participation and investment in the market.

A liquid market with consistent pricing also provides predictability, allowing businesses and investors to formulate and execute strategies more effectively. This predictability is invaluable, as it enables better planning and decision-making, ultimately contributing to the market’s overall health.

Lower Transaction Costs

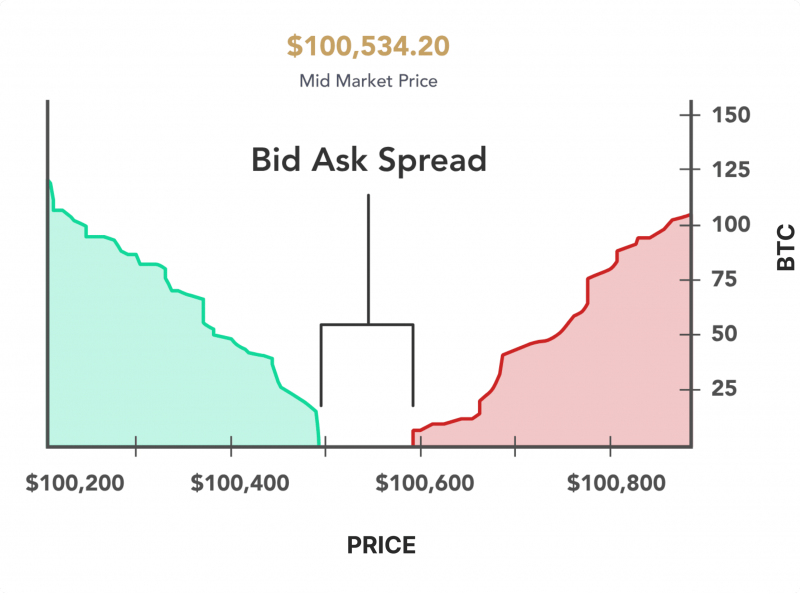

When there is high liquidity in a market, it usually leads to narrower bid-ask spreads. This means there is a smaller deviation between the prices at which traders can buy and sell, allowing them to deal closer to the prevailing market rate.

Lower transaction costs associated with high liquidity attract more traders and investors, leading to increased market activity and growth generally.

Risk Management

Investors benefit from easier entry and exit in liquid markets, which means they can buy and sell positions without severely dampening market prices. This facilitates better risk management as they can execute their trading strategies more effectively.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Besides, liquid crypto markets enable investors to utilise hedging strategies to manage and mitigate risks. This means they can protect their positions against potential losses by offsetting positions in related assets.

Enhanced User Experience

Traders can expect to benefit from better order execution, with faster and more reliable execution, which results in higher satisfaction and increased engagement. Further, the high liquidity available on the platforms provides reassurance to users, allowing them to trade efficiently and ultimately increasing their trust in trading platforms and exchanges.

Support for Large Transactions

Attracting corporate investors is highly dependent on maintaining high levels of liquidity, as they often need to execute large orders without causing significant disruption to the market.

Having a deep market with high liquidity is essential for handling substantial volumes, allowing businesses and large traders to conduct their operations smoothly and effectively.

Main Types of Crypto Liquidity

Today, cryptocurrency brokers and exchanges offer access to different tools for trading crypto assets, each with its own characteristics. At the same time, each instrument has its own type of liquidity and its characteristics. Among the main types of crypto liquidity are the following:

1. Crypto Spot Liquidity

Crypto spot liquidity denotes the level of convenience and swiftness involved in purchasing or selling a cryptocurrency at the prevailing market rate within a spot market. This type of market is a transparent financial platform where various financial instruments or commodities are exchanged for instant delivery. Specifically in the realm of cryptos, it involves the exchange of digital assets such as Bitcoin, Ethereum, and alternative coins for immediate transaction finalisation.

The concept of crypto spot liquidity is critical for market participants as it impacts the efficiency and effectiveness of their transactions within the crypto market. High spot liquidity ensures that assets can be easily bought or sold without significant price fluctuations, providing a seamless trading experience. Understanding and monitoring crypto spot liquidity is paramount for making deliberate decisions and maximising the possibilities in virtual assets’ dynamic and fast-paced world.

2. Crypto CFD Liquidity

Liquidity in Crypto CFDs pertains to the capacity to swiftly purchase or sell these financial derivatives at consistent prices. Unlike traditional investments, a CFD enables traders to predict cryptos’ price patterns without possessing the virtual assets. Adequate liquidity is essential for facilitating seamless and effective trading activities within the CFD sector.

The CFD market’s smooth operation heavily relies on liquidity availability for crypto CFDs. Traders depend on this liquidity to carry out transactions promptly without significant price discrepancies. Ensuring sufficient liquidity in crypto CFDs is imperative for maintaining a stable and efficient trading environment that benefits all participants involved in the market.

Crypto CFD Liquidity Explained by John Murillo, CDO at B2BROKER | iFX Cyprus Keynote

At iFX Cyprus, John Murillo, CDO of B2BROKER, presented a detailed analysis of Crypto CFD Liquidity. The speech covered the formation of this liquidity type, its distinction from perpetual futures, and its variance from crypto spot liquidity. This presentation offers valuable insights for those keen on understanding the nuances of crypto finance.

3. Perpetual Futures Crypto Liquidity

The term “perpetual crypto futures liquidity” pertains to the ability of traders to swiftly execute buy or sell orders for perpetual futures contracts related to cryptocurrencies while maintaining consistent pricing. Unlike conventional futures contracts, perpetual futures do not come with a set expiration date, enabling traders to maintain their positions for as long as they desire. This characteristic has contributed to the growing popularity of perpetual futures as a favoured tool for speculating on the fluctuations in cryptocurrency prices.

The liquidity of favoured perpetual crypto futures is crucial for traders seeking to get involved in the market efficiently. The absence of an expiration date in these derivative contracts allows for indefinite holding of positions, which enhances their appeal among investors looking to capitalise on price changes in the cryptocurrency landscape. As a result, perpetual futures have emerged as a significant instrument for those aiming to navigate the volatile nature of crypto trading.

4. Spot Margin Crypto Liquidity

Crypto spot margin liquidity refers to how readily and effectively traders can buy or sell crypto coins on a spot market using borrowed funds. In margin trading, traders leverage borrowed assets to increase the size of their trades, which can amplify both gains and losses. This liquidity is crucial as it determines how smoothly and efficiently trades can be executed, especially when using borrowed funds to enhance trading positions.

The significance of spot margin crypto liquidity is rooted in its ability to provide traders with the necessary flexibility to engage in margin trading. By borrowing funds, traders can take larger positions than their initial capital would allow, potentially leading to increased profits. However, this also comes with elevated risk, as the possibility of larger losses is inherent in leveraged trading. High liquidity ensures that these trades can be conducted with minimal slippage, reduced trading costs, and better overall execution, thereby supporting efficient trading practices and risk management.

5. Futures Crypto Liquidity

The ability to quickly buy or sell cryptocurrency futures contracts at steady prices is called crypto futures liquidity. These contracts are financial tools that allow traders to agree to purchase or sell an asset at a specific future time and price. In the realm of cryptocurrencies, futures contracts provide a way to speculate on the price changes of virtual assets without physically owning them.

The idea of futures crypto liquidity emphasises the significance of effective and stable trading of cryptocurrency futures contracts. By enabling fast and dependable transactions at predetermined prices, liquidity in crypto futures markets ensures that traders can quickly enter or exit positions based on their market expectations. This liquidity is critical in allowing market players to intervene in speculative activities associated with digital assets without needing direct ownership.

Factors Business Must Consider When Determining Crypto Liquidity Needs

Businesses must carefully assess their crypto liquidity requirements by taking into account various essential factors to guarantee they possess sufficient liquidity to function efficiently and deal with risks. It is crucial for businesses to evaluate the following key factors:

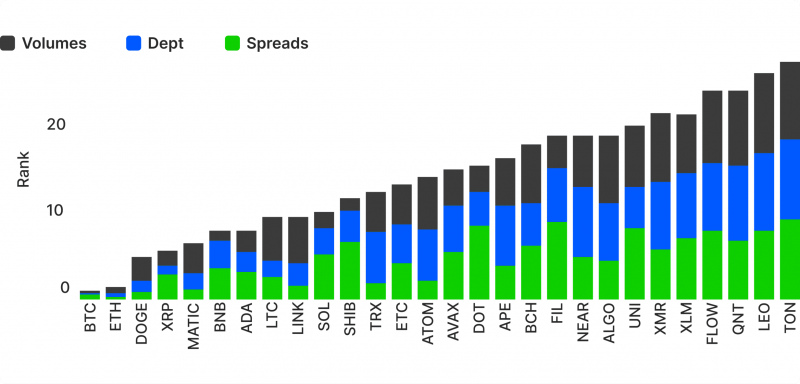

Trading Volume and Frequency

Cryptocurrency trading volume refers to the total amount of a particular cryptocurrency being traded over a specific period, typically measured in terms of the base currency (e.g., US dollars). It also encompasses the frequency of trades occurring within the same timeframe.

Businesses with high crypto trading volumes or frequent transactions require sufficient liquidity to facilitate large orders and ensure seamless trading operations. Adequate liquidity helps prevent significant price slippage and enables these businesses to execute trades without causing substantial market disruptions.

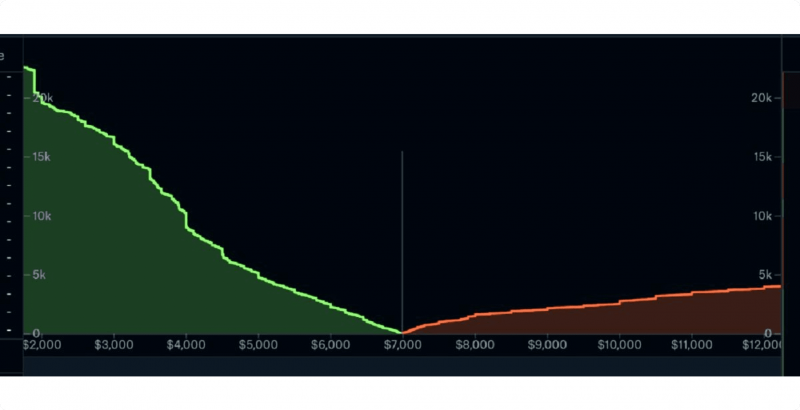

Market Depth

The term “market depth” refers to the volume of buy and sell orders available at multiple price levels in a capital market’s order book. Market depth is a key indicator of the liquidity and stability of a market. It reflects the willingness of market players to buy or sell an asset at various price levels.

Adequate market depth is essential for ensuring that large trades can be carried out without causing drastic changes in the market price. This is important for maintaining stable trading conditions and preventing significant price shocks.

Bid-Ask Spreads

The bid-ask spread represents the variance between the strongest price a buyer is willing to pay for a security and the lowest price a seller is willing to accept. It reflects the cost of executing a trade in the market.

Narrow bid-ask spreads indicate high market liquidity, meaning a high volume of buyers and sellers for a particular security. A narrow spread also suggested that there is less of a price discrepancy between what buyers are willing to pay and what sellers are willing to accept. This can benefit businesses by reducing trading costs and ensuring they can execute trades at more favourable prices. Therefore, companies should carefully consider bid-ask spreads to gauge market conditions and make prudent trading decisions.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Liquidity Sources

Liquidity sources refer to the various avenues through which a business can access funds or assets quickly and with minimal impact on their value. These sources include market makers, liquidity providers, financial authorities, and trading partners.

It is necessary for businesses to thoroughly assess and understand the reliability and accessibility of an array of liquidity sources. Establishing strong relationships with liquidity providers can help ensure the business can effectively meet its trading and financial needs, especially during elevated market volatility or financial strain.

Market Conditions and Trends

Crypto market sentiment refers to the collective mood and perception of market players towards the crypto market, including their outlook on price swings and potential prospects.

Being attuned to the prevailing sentiment in the crypto market is imperative for businesses as it can provide valuable insights into the potential shifts in investor behaviour, market volatility, and liquidity dynamics. By staying abreast of market sentiment, businesses can make informed decisions to adapt their strategies, manage their risks, and optimise their liquidity operation.

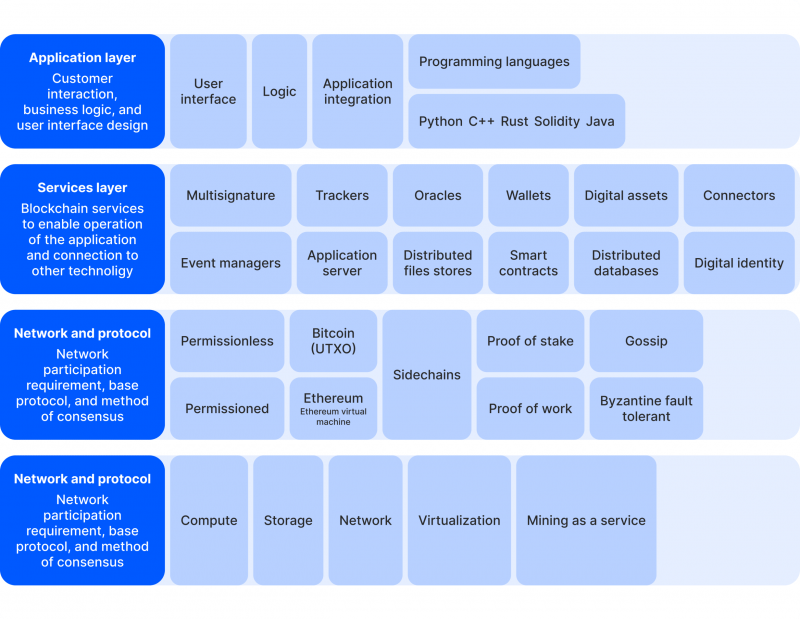

Technology Stack and Infrastructure

Regarding the systems and platforms used for trading and handling liquidity, businesses are advised to ensure that their technology architecture can accurately support their liquidity prerequisites.

This includes having the capability for swift execution of trades, reliable access to various markets and counterparties, and efficient risk management tools that can accurately assess and mitigate potential risks. Businesses must have a robust and resilient technological framework to effectively meet their liquidity needs.

Conclusion

Each type of crypto liquidity plays a unique role in facilitating diverse trading and investment patterns. By assessing the specific liquidity exigencies associated with their activities, businesses can optimise their trading yield, negotiate risks more proficiently, and seize on market chances to profit.

Ample liquidity also contributes to market safety, reinforced price recognition, and general operational efficacy, enabling businesses to thrive in the competitive and fast-paced crypto market.

FAQ

What is spot market liquidity, and why is it so valuable?

Spot market liquidity is defined as the capacity with which cryptos can be bought or sold at current market prices. It’s crucial for businesses because it assures that transactions can be settled quickly and at stable prices, reducing transaction charges and minimising slippage.

What is futures market liquidity, and how does it benefit businesses?

Futures market liquidity refers to the ability to trade futures contracts, which are obligations to buy or sell an asset at a future date. High liquidity in futures markets ensures that large trades can be made without causing major price changes.

How does CFD liquidity impact trading portability and fees?

CFD liquidity involves the ability to trade contracts for differences, which are derivatives, allowing speculation on price shifts without owning the underlying asset. High CFD liquidity ensures that trades can be conducted accurately, with narrow bid-ask spreads reducing trading costs.

What factors should businesses consider when assessing their liquidity needs?

Businesses should consider several factors, including trading volume, market depth, bid-ask spreads, leverage and margin constraints, price volatility, risk reduction strategies, operational costs, regulatory obligations, liquidity sources, and technological infrastructure.