What Kind of Businesses Need a Liquidity Provider in 2026?

Nowadays, in the financial sector, which is experiencing profound changes not only in the regulatory arrangements of specific sectors but also in the technical modernisation of systems that ensure the movement of financial flows, there is more than ever before an urgent need for quality liquidity to assure the resiliency of business processes, not least those related to the trading of investment assets. This problem is solved by liquidity providers.

This article will explore how liquidity companies shape the financial ecosystem and what varieties of liquidity companies exist. You will also learn which types of businesses need a source of liquidity and how to find a liquidity provider in 2026.

Key takeaways

- Liquidity providers give rise to considerable exertion on the operation of stock markets and even companies by offering the ability to ensure the stability of cash flows and trading.

- Among the most common business models in need of liquidity are FX brokerage houses and trading infrastructures.

- The highest-profile liquidity suppliers are considered to be large international banks.

Influence of Liquidity Providers on Financial Landscape

Liquidity providers (LPs) are significant participants in the broader financial landscape, as they assume a pivotal part in sustaining the efficient functioning of markets and ensuring an adequate supply of liquidity for a vast spectrum of financial tools and transactions. Their significance lies in their potential to streamline smooth and seamless trading activities, enabling market participants to buy and sell assets without substantial price disruptions or delays.

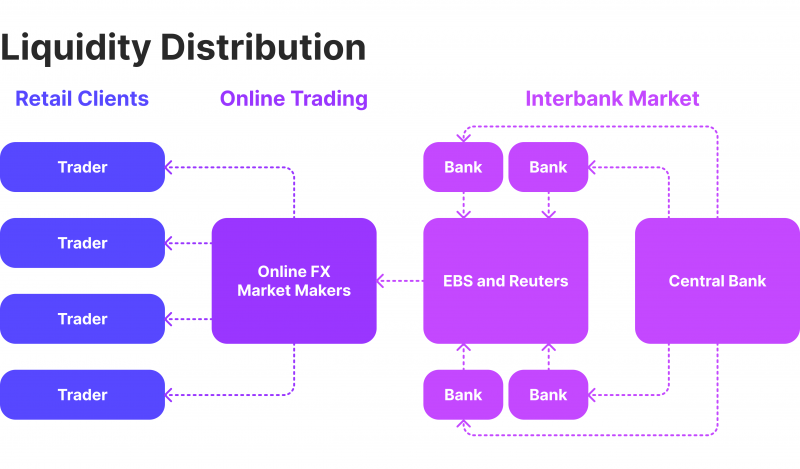

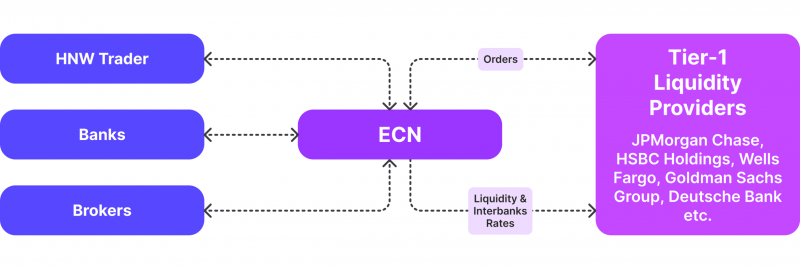

The centrality of liquidity sources in the global economic ecosystem is multifaceted. Firstly, they act as liaisons who connect buyers and sellers, providing the ability to buy or sell assets at below-market prices. By doing so, they provide immediate liquidity to the market, countenancing users to fill their orders instantly and accurately. Secondly, liquidity sources help to narrow the bid-ask spread, which is the discrepancy that exists between the highest price a buyer is keen to pay and the lowest price a seller is able to accept. This reduction in spread enhances market efficiency and reduces transaction costs for investors.

Liquidity firms play a vital role in sustaining market robustness by addressing imbalances in supply and demand for specific assets. During periods of market turbulence or uncertainty, these firms step in to offer liquidity and prevent drastic price swings. This function becomes even more significant when economic conditions are uncertain, as it encourages market participants to engage in trading activities. By ensuring a consistent accession of liquidity, these firms contribute to bolstering market confidence and stability, ultimately benefiting all stakeholders in the financial ecosystem.

Liquidity providers are often confused with market makers, but their functional features are strikingly different.

The Major Types of Liquidity Providers

Today, within the financial world, there are a number of structures and formations in the person of which sources of market liquidity work, providing a stable and comfortable process of trading investment assets within the framework of different markets. On the other hand, given the diversity of these markets, there are also multiple types of liquidity.

Here are the main types of liquidity sources in the world of trading:

Market Makers

Market makers are financial institutions, such as banks, broker-dealers, or specialised firms, that provide continuous bid and ask prices for financial instruments. They maintain a two-way market, ensuring that there are always buyers and sellers feasible, and they profit from the bid-ask spread. Examples of market makers include large investment banks, high-frequency trading firms, and electronic market-making firms.

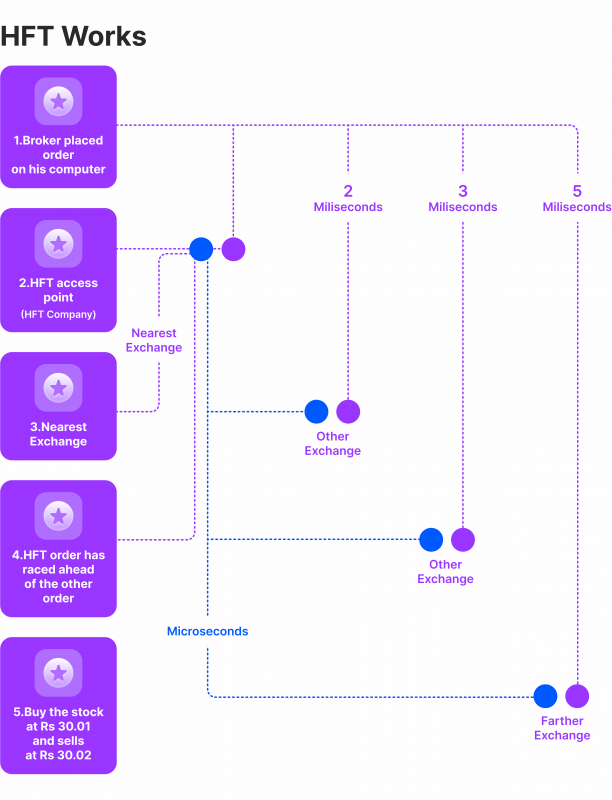

High-Frequency Trading (HFT) Firms

HFT firms use advanced algorithms and high-speed trading methods to generate liquidity in securities markets. They rapidly buy and sell financial instruments, taking advantage of small price movements and earning profits from the bid-ask spread. HFT firms often act as market makers, providing quotes and facilitating trades in various asset classes, such as stocks, currencies, and commodities.

Corporate Investors

Large institutional investors, such as pension funds, mutual funds, and insurance companies, can also act as liquidity suppliers. These entities often have significant assets under management and can provide liquidity by exchanging financial tools in large quantities. Their participation helps to improve market depth and reduces the impact of individual trades on prices.

Retail Market Makers

Retail market makers are financial corporations that deliver liquidity to retail investors in the FX and derivatives markets. They quote bid and ask prices for various currency pairs, options, and other derivative products, enabling retail traders to carry out their trades. Retail market makers earn revenue from the bid-ask spread and various trading fees.

Central Banks

Central banks can also act as liquidity agents in financial markets, particularly during times of market stress or crisis. They can provide liquidity through various monetary policy tools, such as open market operations, lending facilities, and asset purchase programs. Central bank interventions aim to maintain financial stability and ensure the harmonious performance of the financial system.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Hedge Funds

Hedge funds are absolutely essential in introducing liquidity to the equity markets. By participating in multiple trading operations, hedge funds help ensure a constant market buying and selling flow.

Through their active involvement in the markets, hedge funds help facilitate price discovery and guarantee that the assets can be bought or sold without adversely impacting their prices. This liquidity coverage benefits individual investors and contributes to the financial system’s overall functioning.

Proprietary Trading Firms

Proprietary trading firms have a major impact in the equity markets by acting as liquidity dealers. These firms use their capital to trade various trading instruments, such as stocks, bonds, and derivatives, with the aim of generating profits. By continually staying in the market, they provide liquidity by buying and selling these instruments, thereby ensuring that there is a continuous flow of trading activity.

What Types of Businesses Depend on a Liquidity Provider?

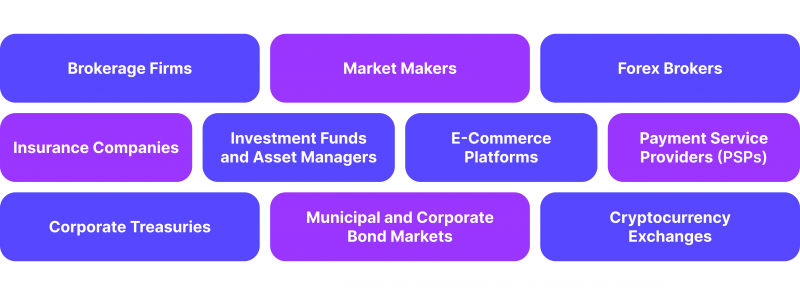

Due to the systematic development of the e-commerce sector as well as technical modernisation and restructuring of business processes, companies from different industries need a stable and constant source of liquidity. Here are the main ones:

Brokerage Firms

Financial third-party agents function as a liaison on behalf of investors and securities markets, crucially ensuring that client orders are executed efficiently and at competitive prices. Their primary objective is to facilitate the smooth and effective flow of funds between investors and the financial markets while providing valuable insights and expertise to their clients. This involves executing trades, managing risks, and providing financial advice to help clients make informed investment decisions.

Market Makers

Market makers play a fundamental role in preserving the liquidity of equity markets by persistently negotiating buy and sell prices for various financial products. This facilitates smooth trading activities and enables market participants to buy or sell assets easily. However, despite their pivotal role, market makers require liquidity makers to hedge their positions effectively and manage risks.

Forex Brokers

Forex brokers play a crucial role in the financial market by enabling the trading of foreign currencies for both retail and corporate clients. To provide the best trading experience, they rely on liquidity companies to ensure tight spreads, high execution speeds, and the capability to handle large trade volumes.

Insurance Companies

Insurance companies offer a valuable service by providing individuals and businesses with financial protection against various risks. In addition to safeguarding policyholders from potential losses, these companies also play a crucial role in the economy by serving as liquidity providers.

By managing investment portfolios and ensuring liquidity for claim payments, insurance companies help maintain steadiness in the financial system. Their ability to efficiently allocate capital and manage risks is essential for the smooth functioning of the insurance industry and the overall economy.

Investment Funds and Asset Managers

Investment funds and asset managers are necessary to manage investment portfolios for various clients, including mutual funds, hedge funds, and pension funds. One critical requirement for these funds and asset managers is the need for LPs.

Liquidity providers enable them to place large order quantities with no gravely hampering market prices. This is essential for efficient and effective portfolio management while minimising market impact.

E-Commerce Platforms

E-commerce platforms enable online transactions for a wide range of goods and services. They serve as digital marketplaces where buyers and sellers can connect and conduct business transactions conveniently anywhere.

E-commerce platforms rely on LPs to process multi-currency transactions effectively and minimise foreign exchange risks to ensure smooth operations. By partnering with these providers, e-commerce platforms can offer seamless payment options to customers across different regions, enhancing the overall user experience and expanding their global reach.

Payment Service Providers (PSPs)

Payment Service Providers (PSPs) facilitate payment processing services for merchants and consumers. These providers ensure smooth and secure transactions, allowing businesses and individuals to make and receive payments conveniently. However, PSPs rely on LPs to effectively manage cash flows and settlements, particularly for international transactions.

LPs are essential for PSPs as they offer the necessary funds to ensure seamless payment operations. These providers ensure that PSPs have access to sufficient liquidity, enabling them to handle transactions efficiently and meet the demands of their clients. In international transactions, LPs become even more vital as they help PSPs navigate the complexities of cross-border payments, ensuring timely settlements and minimising potential disruptions.

Corporate Treasuries

Corporate treasuries’ responsibilities extend beyond mere financial management. They are entrusted with the vital task of preserving unobstructed cash flow and mitigating potential risks for large-scale companies. To fulfil these objectives, treasuries often collaborate with LPs, who offer valuable support in managing cash requirements and safeguarding against potential financial hazards.

Municipal and Corporate Bond Markets

Municipal and corporate bond markets heavily depend on liquidity services, such as broker-dealers, to uphold a thriving secondary market for their bonds. This crucial reliance ensures that investors have easy access to buying and selling these fixed-income instruments, ultimately boosting the liquidity and effectiveness of the bond markets as a whole.

Cryptocurrency Exchanges

Cryptocurrency exchange platforms serve as the marketplace for individuals to buy, sell, and trade digital assets. These platforms are crucial in facilitating accurate trading by connecting buyers and sellers. These exchanges rely on LPs who offer deep order books and favourable pricing to ensure smooth transactions. With sufficient liquidity, these platforms can allow users to carry out trades rapidly and at favourable prices.

How to Find a Steadfast Liquidity Provider in 2026?

The market for liquidity providers is growing at a steady pace, as is the demand for their services. Not all companies offer wide opportunities for using high-quality liquidity, so if you need to find such a service, you should think about the following criteria and aspects:

1. Reputation and Track Record

Look for liquidity providers with a proven track record of reliability, stability, and consistent performance, even while in phases of market tumult. Research the provider’s reputation, financial strength, and regulatory compliance within the industry.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

2. Diversified Liquidity Sources

Prioritise LPs that have access to multiple sources of liquidity, such as a diverse network of qualified investors, MMs, and other liquidity providers. This diversification can help ensure a more stable and resilient liquidity supply, even if one source experiences disruptions.

3. Technological Capabilities

Assess the liquidity provider’s technological infrastructure, including advanced trading algorithms, low-latency connectivity, and robust risk management systems. These capabilities enable the provider to adapt quickly to changing market conditions and provide consistent liquidity.

4. Regulatory Supervision and Compliance

Ensure that the LP is appropriately licensed, regulated, and compliant with relevant financial regulations in their jurisdictions. This can provide additional assurance of the provider’s stability and trustworthiness.

5. Customised Liquidity Solutions

Look for LPs that offer tailored liquidity solutions to meet your business’s specific needs, such as adjusting trading parameters, providing dedicated market-making services, or offering specialised liquidity pools. This level of customisation can ensure a better fit with your business requirements.

6. Transparency and Reporting

Prioritise LPs that offer high levels of transparency, including detailed reporting on liquidity provision, execution quality, and other performance metrics. This can help you monitor the provider’s performance and assure they meet your expectations.

7. Ongoing Support and Relationship Management

Consider the liquidity provider’s responsiveness, communication, and willingness to collaborate closely with your business to address liquidity-related challenges or opportunities. A strong relationship and a commitment to supporting your business can be valuable in maintaining a steadfast liquidity supply.

Conclusion

The rapidly changing financial services market encourages businesses to use modern and innovative technologies, including crypto, which generate demand for the use of stable and high-quality sources of liquidity, while ensuring the functionality and continuity of business processes, which is vital, especially within a fiercely competitive environment.

FAQ

Why do businesses need liquidity services?

Businesses need liquidity sources to maintain an active and efficient secondary market for their securities, alleviate trading in their investment assets, and foster advantageous pricing and trading prospects for their stakeholders.

What types of businesses typically require liquidity suppliers?

The main types of businesses that require liquidity solutions include FX brokerage firms, payment services providers, corporate treasures, crypto exchanges, insurance firms and so on.

How can a business evaluate the performance of its liquidity source?

Businesses can evaluate their liquidity provider’s performance by monitoring metrics such as trading volume, bid-ask price differentials, execution quality, and the supplier’s propensity to sustain liquidity under instances of market uncertainty.