What Makes Crypto Go Up? How Does the Market Dynamics of Digital Assets Work?

The cryptocurrency industry has been a rollercoaster ride for most of its existence. From the early days to the crypto winter of 2022 and the recent Bitcoin’s all-time high of nearly $74,000, this market’s volatility has always attracted investors and traders eager to capitalise on its significant fluctuations.

But what causes cryptocurrency to rise and fall? Who controls the value of cryptocurrency? What market dynamics drive this industry forward?

Key Takeaways

- Cryptocurrency prices are largely determined by supply and demand dynamics.

- Many factors can influence the prices of digital assets, including their tokenomics, governmental policies, adoption, and more.

- Large investors, known as “whales,” and liquidity providers can influence crypto prices.

- Navigating the volatility in the crypto market requires strategic diversification, thorough research, a risk management plan, and emotional control.

Supply and Demand: The Bedrock of Crypto Pricing

Cryptocurrencies, like any other tangible asset, are affected by the basic principles of supply and demand. The simple yet powerful relationship between a digital asset’s availability and the market’s appetite for it is the primary determinant of its value.

When the demand for a cryptocurrency outpaces its supply, prices naturally rise as investors compete to acquire a limited resource. Conversely, when the supply exceeds the demand, prices fall as sellers struggle to find willing buyers.

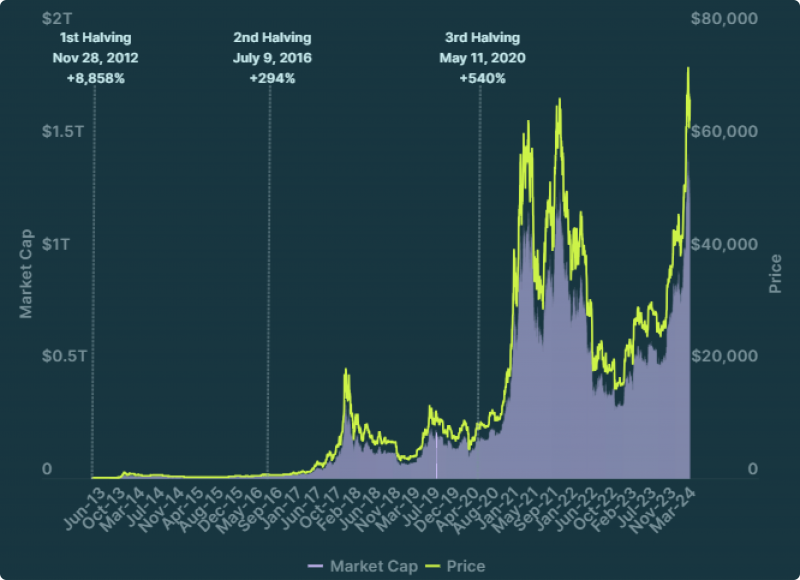

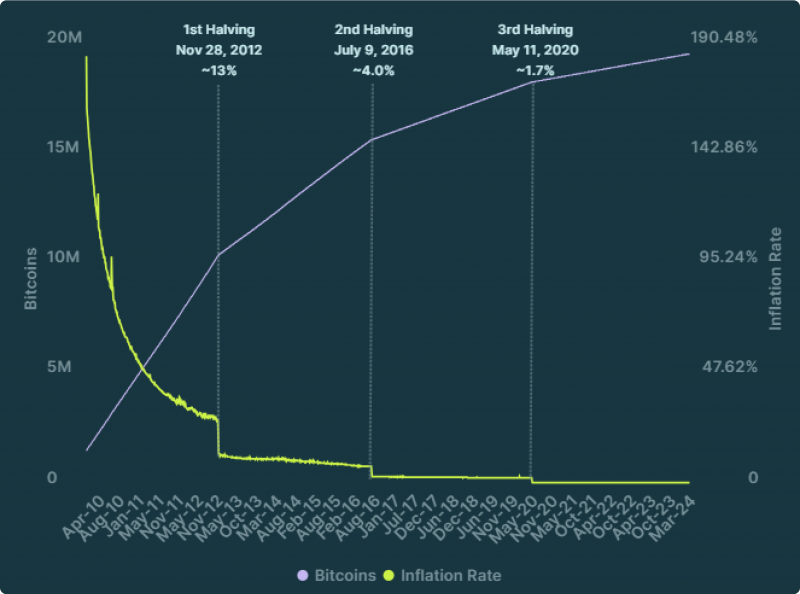

This dynamic is particularly pronounced in the cryptocurrency market, where the crypto token supply of some assets is capped or programmed to increase at a predetermined rate. Bitcoin, for instance, has a fixed supply of 21 million coins, with the rate of new issuance halving every four years. This built-in scarcity and growing mainstream adoption have been a significant driver of Bitcoin’s meteoric price rises over the years.

The most recent Bitcoin halving happened on April 19th, 2024. It reduced the rewards earned by miners to 3.125 BTC from 6.25. The final halving is set to occur in 2140 when the total supply of Bitcoins will reach its cap of 21 million.

How Tokenomics Influence Crypto Asset Prices

A cryptocurrency’s tokenomics, or the economic design, can be a crucial factor in determining its price movements. Factors such as the total supply, the rate of new token issuance, and the mechanisms for token distribution and burning can all influence investor demand and, consequently, the trading prices of these digital assets.

Why is Bitcoin going up? Cryptocurrencies with a fixed or limited total supply, like Bitcoin, tend to be more attractive to investors as they are perceived to be less susceptible to inflationary pressures. Conversely, cryptocurrencies with an unlimited or rapidly increasing supply may face downward price pressure as the market grapples with the potential for dilution.

The token distribution model and the allocation of tokens to various stakeholders, such as the development team, early investors, and the broader community, can also impact the crypto price movement. If a significant portion of the token supply is concentrated in the hands of a few entities, it can raise concerns about centralisation and lead to price volatility.

Additionally, the presence of token-burning mechanisms, where a portion of the token supply is permanently removed from circulation, can contribute to price appreciation by reducing the overall available supply and increasing scarcity.

Government Policies Also Impact Crypto Markets

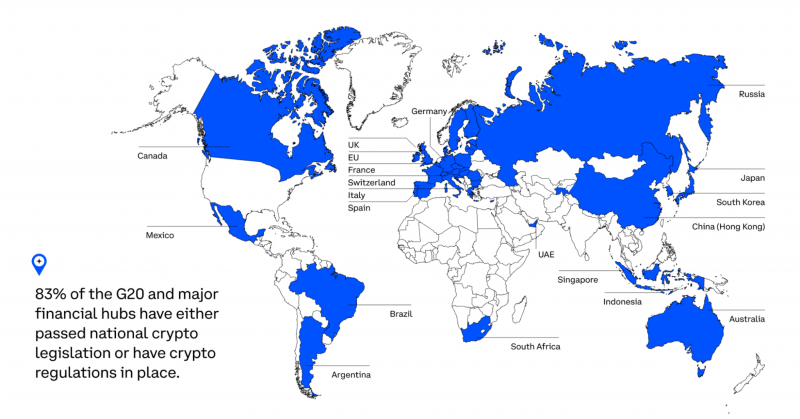

The cryptocurrency market is governed by a complex web of national and international regulations, and policymakers’ decisions can profoundly impact digital asset prices. Governments worldwide have taken vastly different approaches to regulating cryptocurrencies, ranging from outright bans to embracing them as legal tender.

When a country imposes restrictions or bans on cryptocurrency activities, such as trading, mining, or using digital assets as a medium of exchange, it can trigger a significant sell-off as investors become wary of the potential legal and financial risks. Conversely, when a government takes a more favourable stance towards cryptocurrencies, such as by providing clear regulatory frameworks or even adopting them as legal tender, it can boost investor confidence and drive up prices.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

The recent example of China’s crackdown on cryptocurrency mining in 2021 illustrates this point. The news of the ban and the subsequent exodus of mining operations from the country caused a sharp decline in Bitcoin’s price as the market grappled with the implications of reduced network security and the potential for supply disruptions.

One of the latest developments in government policies is the introduction of the Markets in Crypto-Assets (MiCA) regulation by the European Commission. This landmark framework addresses the growing popularity and potential risks associated with crypto-assets in the European Union.

Institutional Adoption and Its Price Implications

The growing involvement of institutional investors, such as hedge funds, pension funds, and large corporations, has been a significant catalyst for the rise in cryptocurrency prices.

The entry of institutional investors can also lend legitimacy and stability to the crypto market, attracting the broader public and further fueling cryptocurrency price appreciation. For instance, the SEC’s approval of Bitcoin-linked ETFs in January 2024 led to a great deal of capital flowing to Bitcoin, resulting in its price rise.

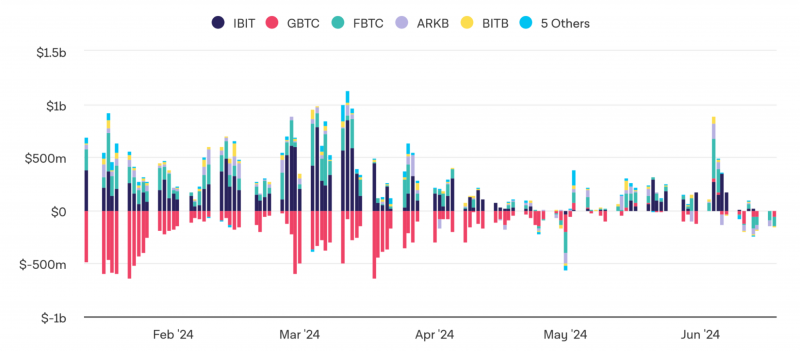

In contrast, in mid-June 2024, the crypto market experienced substantial outflows from the US-listed Bitcoin ETFs. Following several consecutive days of outflows, these withdrawals totalled over $700 million, causing BTC prices to plummet from above $70,000 to around $64,000. This scenario highlights the undeniable impact of institutional adoption and supply and demand dynamics.

Influence of Big News and Investor Sentiment on Cryptocurrencies

The media and news events hold significant sway over the crypto market. Recent positive news of the approval of Ethereum ETFs sparked a buying frenzy of ETH and drove prices up massively—and these investment vehicles are only about to hit the market.

Conversely, negative news, such as massive hacks, scams, project failures (a great example of this is the FTX collapse), or regulatory crackdowns, can trigger a wave of fear and panic selling, leading to substantial price declines. The impact of media narratives is particularly pronounced in the crypto market, where emotions like greed and fear can quickly take over and cause investors to make impulsive decisions.

Crypto Competition And Real-World Use Cases Impact Supply and Demand

The cryptocurrency market is a highly competitive arena, with thousands of digital assets vying for investor attention and market share. As new cryptocurrencies emerge, they often challenge the dominance of established players by offering unique features, improved functionality, or more attractive tokenomics.

When a new project gains traction and captures investor interest, it can drive up the prices of its associated tokens. Conversely, if a cryptocurrency is perceived as falling behind in terms of innovation or adoption, its price may suffer as investors shift their focus to more promising alternatives.

ETH vs SOL

The competition between Ethereum and Solana is a recent example of such a scenario. Both are major Layer 1 players, with passionate communities and vibrant ecosystems backing them. However, they have different strengths and unique selling points that make them attractive to investors.

Ethereum, as one of the earliest and most established blockchains, has a strong first-mover advantage. Its smart contract capabilities have paved the way for decentralised applications (dApps) and DeFi, making it the go-to platform for developers looking to build on blockchain technology.

Solana emerged as a competitor to ETH. Built for speed and scalability, Solana offers significantly faster transaction speeds and lower fees compared to Ethereum. This has attracted developers seeking a more efficient platform and investors seeking lower transaction costs. As a result, Solana’s native token SOL has seen a sharp increase in demand, rising 1000+% year-on-year.

How Whales and Liquidity Providers Shape Crypto Trading

In the cryptocurrency market, a relatively small number of large institutional investors, often called “whales,” can have an outsized influence on price movements. These deep-pocketed players, who hold significant amounts of a particular cryptocurrency, can trigger dramatic price swings by engaging in large-scale buying or selling activities.

When a whale decides to liquidate a substantial portion of their holdings, it can create a sudden surge in the supply of the cryptocurrency, leading to a sharp decline in its price. Conversely, if a whale makes a large purchase, it can increase demand and push the price higher. The big players can create a ripple effect throughout the broader market as other investors react to the perceived changes in crypto supply and demand.

Crypto liquidity providers, who offer buy and sell orders to facilitate trading, also play a crucial role in shaping crypto prices. The depth and consistency of the liquidity available in the market can impact price volatility, as well as the ease with which investors can enter and exit their positions. Illiquid markets, where there is a lack of available buy and sell orders, can experience more dramatic price swings as the impact of individual trades becomes more pronounced.

Inflation and Macroeconomic Factors

Theoretically, during periods of high inflation, investors might flock to cryptocurrencies as a potential store of value, thereby driving up their prices, especially Bitcoin, often seen as a digital equivalent to gold and a hedge against the devaluation of fiat currencies.

Conversely, when central banks raise interest rates to combat inflation, holding cryptocurrencies can become less appealing compared to traditional fixed-income investments, leading to price declines.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

However, while cryptocurrencies are often touted as a hedge against traditional financial market volatility, they are not entirely immune to the broader macroeconomic landscape. Factors such as inflation, interest rates, and the performance of other asset classes largely determine their values.

The cryptocurrency market is just not mature enough to serve as a safe haven. Cryptocurrencies remain highly speculative, with their prices significantly swayed by market sentiment.

For instance, an announcement by the US Federal Reserve to do only one rate cut in 2024 instead of two, had an immediate impact on Bitcoin, consequently pulling down the prices within the broader crypto market.

Moreover, there is a correlation between cryptocurrencies and other asset classes, such as stocks and commodities. When there is a broader market downturn in stocks, investors liquidate their crypto holdings to cover losses or reduce their risk exposure, leading to a decline in cryptocurrency prices.

How to Navigate Crypto Volatility

Here are some key strategies that can help you be ready for large price fluctuations:

- Diversify your portfolio: Invest in various cryptocurrencies with varying characteristics and use cases to reduce risk and exposure to market volatility.

- Stay informed about the latest news: Keep up-to-date on regulatory changes, technological advancements, and mainstream adoption trends in the crypto ecosystem to gain insights into potential future price movements.

- Do your research: Before investing in any cryptocurrency, make sure to thoroughly research its background, technology, team, and community to better understand its potential for growth and risks involved.

- Have a risk management plan: Develop a risk management plan to mitigate potential losses and protect your investments during periods of high volatility.

- Take advantage of opportunities: Volatility can also create opportunities for higher returns. Be prepared to take advantage of dips in prices or emerging trends that could lead to significant gains.

- Keep emotions in check: It’s important not to let emotions drive investment decisions, especially during times of extreme market volatility. Instead, rely on research and strategy to guide your actions.

- Stay adaptable: Be always prepared to adjust strategies as needed based on market conditions.

Conclusion

The cryptocurrency market is inherently volatile. Its complexity requires investors to understand what drives price changes and develop smart risk management strategies. Identifying and responding to what makes crypto go up significantly impacts your investment.

FAQs

What makes cryptocurrency prices go up?

Cryptocurrency prices are largely dependent on market demand and supply. When there is a high interest in buying but limited availability of the currency, the price goes up. Conversely, the price will decrease if there is low interest in buying and a large supply available.

How does one predict a crypto rise?

To predict cryptocurrency price changes, you can use various methods, such as crypto technical analysis, fundamental analysis, on-chain research, and market sentiment evaluation.

Technical analysis involves analysing historical market data and patterns, while fundamental analysis focuses on evaluating a cryptocurrency’s underlying value. On-chain research examines network activity and transactions, while market sentiment evaluation looks at public perception and emotions towards a particular cryptocurrency.

Can Bitcoin go to zero?

Theoretically, yes. However, for Bitcoin to reach zero, people must abandon its use and completely stop trading. As long as there is demand for Bitcoin and people continue to use it, it will maintain its value. However, many tokens reach near-zero value due to scam schemes, lack of interest, or other factors.