Why Does Every Brokerage Need a Copy Trading Tool?

Choosing a trading strategy can cause some serious headaches because making a decision about where to start can be a real burden. There is a reason why the copy trading solution has grown in popularity among traders and, naturally, among brokerages.

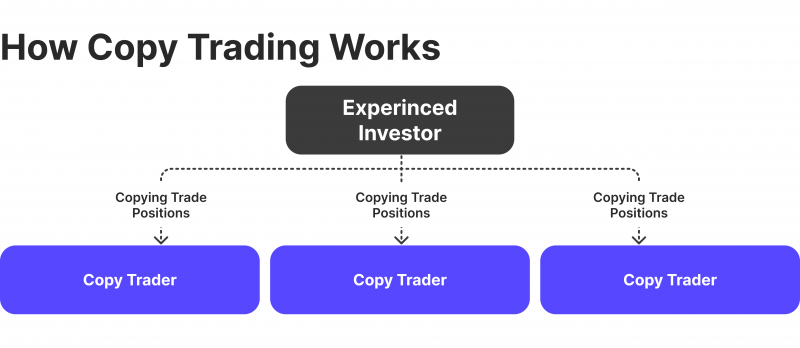

Using this approach, novice traders can mimic the positions and trading choices of experienced ones. A copy trading platform enables these kinds of transactions by establishing a network that allows inexperienced traders to mimic the strategies of seasoned traders automatically.

With the development of technology, the idea of a social trading network has grown and is now a fundamental component of contemporary brokerage services.

These platforms assist brokerages in attracting and keeping customers by giving traders a modern trading experience and serving as a forum for exchanging trading tactics and ideas. In this article, we will explain the concept of copy trading and why these tools are essential for every brokerage business.

Key Takeaways

- Copy trading platforms lower entry barriers and streamline trading, which helps brokerages draw in and keep customers.

- Through such platforms, beginner traders can pick up tips from more seasoned traders, enhancing their trading tactics and market comprehension.

- Copy trading enables traders to diversify their methods across many markets and provides tools for risk control.

- Brokerages that want to maintain client trust and transparency must select regulated copy trading platforms that comply with financial regulations.

Overview of Copy Trading

Conventional trading methods, frequently called for manual trade execution and individual analysis, require high financial market expertise. Since then, technological developments have changed these strategies, resulting in the development of contemporary trading methods, including copy, social, and mirror trading.

With copy trading, newcomers can automatically imitate the trading choices and tactics of seasoned traders. Through professional traders’ trading history and track record, this approach makes it possible for new traders to profit from tried-and-true tactics without requiring in-depth market research. This method is expanded upon by social trading, which adds a network where traders exchange ideas and insights to improve decision-making and collective knowledge.

Another trading strategy is mirror trading, in which traders replicate particular methods rather than individual traders. This entails trading using an automated system or manually following a predetermined strategy modelled after profitable market trends.

Technology breakthroughs have played a significant role in the spread of these contemporary trading techniques. More processing power and internet connectivity have made creating complex software and platforms for copy trade easier.

These platforms enable new and seasoned traders to successfully engage in the financial markets by including risk management tools and automated trading capabilities.

Additionally, traders can mimic trading scenarios without taking financial risks thanks to the option to access these platforms through a demo trading account. This accessibility is essential for new traders who wish to become acquainted with market circumstances and trading tactics.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Benefits of Copy Trading for Brokerages

Copy trading platforms significantly improve brokerages’ client acquisition and retention. By making trading more accessible and lowering the initial barrier to entry, these platforms draw in new and more experienced traders.

Without having a thorough understanding of technical analysis or market movements, novice traders might execute trades by mimicking the moves made by more knowledgeable traders. Because of this accessibility, brokerages may more easily attract clients whom the complexity of the cryptocurrency or forex market might otherwise put off.

Brokerages also give new traders a hands-on learning platform where they may see more seasoned traders’ trading decisions and methods by providing copy trading services. As consumers gain confidence and become more active in trading, this educational component helps to retain clients.

Brokerages can distinguish themselves by using advanced social trading tools. These tools enable a social trading network where traders may exchange tactics and ideas, improving their connection to the community even further.

Also, replicating trades made by profitable traders with a track record offers a strong value proposition. Customers who experience actual returns from duplicating deals are more likely to stick with the platform and give the brokerage a steady income stream. By establishing capital allocation criteria and executing trades manually or following another trader, these platforms also enable clients to oversee their own trading strategies and risk tolerance.

In addition, clients can make well-informed trading decisions by using copy trading platforms that offer real-time data on past performance, future performance forecasts, and liquidity risk evaluations.

By being transparent, the brokerage positions itself as a trustworthy partner in the trading process and develops a relationship of trust between the client and the brokerage.

Traders initially used newsletters to announce their trading plans. This developed into virtual trading rooms where traders posted trades, and their followers could view and replicate them. This process marks the inception of copy trading.

Advantages for Traders Using Copy Trading Platforms

Platforms for copy trading have many advantages for traders. Access to expert methods lowers the learning curve of becoming a financial markets expert by enabling rookie traders to mimic the trades of more seasoned traders. With this method, novice traders can make money while they observe and study.

Copy trading offers several benefits, one of which is diversification. Traders can emulate several profitable traders who work in various spheres, including the crypto market and use diverse trading techniques. This diversity can help distribute risk and achieve a more steady performance under different market conditions.

With capabilities like stop losses and choices to modify the amount of capital allotted to each replicated deal, copy trading platforms improve risk management. Based on their own risk tolerance and financial objectives, these parameters assist traders in controlling the level of risk they are willing to assume.

Legal and Regulatory Considerations in Copy Trading

Copy trading takes place inside complex, jurisdiction-specific legal systems. These rules protect investors and maintain the stability of the financial system. Compliance with these regulations ensures the integrity and legality of trading operations.

Copy trading platforms are subject to strict rules enforced by financial regulators to guarantee transparency and equity. Platforms must be open about the risks involved in copy trading, traders’ historical performance, and the connections between copied traders and those who copy them. This is necessary to manage financial risk and prevent fraud successfully.

Pick a copy trading platform that conforms with applicable financial regulations to ensure the platform runs transparently and maintains investor confidence. Regulated platforms are more likely to provide robust risk management capabilities and run their business in a way that protects their customers’ interests.

Choosing the Right Copy Trading Platform

Copy trading tools are essential to modern brokerage operations to improve trader engagement and boost brokerage profitability. With these tools, inexperienced traders can mimic the moves of more experienced traders, making trading more accessible. By offering an accessible option to engage in trading with less risk, this feature draws in new customers and helps existing ones stick around. This is important for building lasting connections with clients.

The primary functions of the best copy trading software tackle several issues that brokerages frequently encounter, including market competition and client retention. For example, social trading networks allow traders to communicate and exchange strategies, creating a communal atmosphere that increases client loyalty. In addition, tracking the transactions of profitable traders gives inexperienced traders confidence and promotes continuous participation.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Incorporating technology innovations in copy trading software, like real-time trading updates and automated risk management systems, allows brokerages to provide innovative services catering to a tech-savvy customer base. These characteristics are essential for brokerages to maintain their competitiveness.

For brokerages, using cutting-edge copy trading platforms offers strategic advantages. It sets them apart in a congested market and appeals to a broader spectrum of customers, from novices seeking advice to seasoned traders seeking effectiveness and simplicity. Offering services like PAMM and MAM accounts can increase the attractiveness even more by giving money managers and clients with different investment sizes and degrees of involvement options.

Final Thoughts

Tools for copy trading are essential to the expansion and viability of brokerage firms. By implementing these technologies, brokers can improve their operating capabilities and draw in both new and seasoned traders.

By simplifying to attract and keep clients, these platforms help brokerages by providing a unique trading experience that leverages the knowledge of seasoned traders. Clients, often without prior extensive trading experience, can participate profitably in the most liquid markets by learning to emulate the deals made by professional traders.

In the end, copy trading benefits brokerages and their customers by offering adaptable trading options that accommodate different levels of knowledge and risk tolerance.

FAQ

What makes copy trading crucial?

It is one of the simplest methods to benefit from another trader’s extensive experience. It also implies that you maintain complete control over the result. You can still finish deals and start new ones whenever you’d like.

Is Copy Trading Illegal or Not?

Copy trading is typically considered lawful in the US as long as it is carried out via an authorised broker or trading platform.

Is it wise to copy trade?

The primary motivation for copy trading is to get the same financial rewards as an established trader. However, it’s crucial to research the specifics of the market you’re entering before choosing to duplicate trade.