What is Time in Force Order, and When Do You Use It?

Anyone familiar with the trading markets knows the importance of timely execution. Even the most stable trading assets fluctuate frequently and considerably in specific periods, making the entire trading landscape time-sensitive.

Previously, traders had to rely on their smarts and organisational skills to manually initiate and cancel orders, which led to many unsuccessful deals, slippages and portfolio losses.

Time-in-force orders have shifted this status quo, allowing traders to harness the power of digital trading tools and execute deals with surgical precision. This article will discuss the time-in-force order and its positive effects on price volatility and overall trading efficiency.

Key Takeaways

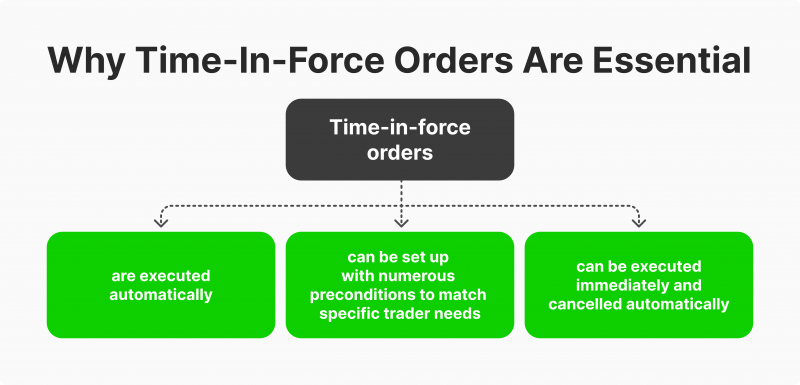

- Time-in-force orders are highly effective automated tools that allow traders to set the preconditions of their deals. Each time-in-force order is executed and placed automatically.

- Time-in-force orders allow traders to minimise human error and automate routine parts of their trading schedule.

- The four major subtypes of time-in-force orders are IOC, FOK, AON and GTC orders.

- Each subtype is effective in a specific market and context. So, it is important to learn about each one’s strengths and weaknesses.

What Does Time in Force Mean?

Time-in-force order types are among the digital trading revolution’s most innovative and essential tools. These timed orders are all executed automatically, leaving no room for delays or slippages. They also enable traders to set different types of preconditions, selecting a desired price, preferred volume and other deal details.

As a result, deals are only executed if all conditions are met, and traders effectively eliminate the risk of unwanted deal outcomes.

There are numerous time-in-force order variations, with different levels of customisation opportunities and fundamental functions. The most popular options on the market include an immediate or cancel order, fill or kill order, good til cancelled order and all or none order. Each of these subtypes offers its unique advantages but has corresponding trade-offs to consider.

The opportunity to acquire greater control over trading deals unites all of them. Traders can now avoid being at the mercy of frequently changing market conditions and unstable asset volumes.

After all, a sound trading strategy only works when the variables stay unchanged. Time-in-force orders were created to achieve precision and predictability in trading executions.

Most Popular Variations of Time-in-Force Orders

As mentioned above, IOC, FOK, all or none and good till cancelled orders are by far the most popular options on the market thanks to their high degree of usability and flexibility. Let’s discuss each of these time-in-force variations and discover their unique benefits.

Immediate or Cancel (IOC) Order

The IOC orders are the go-to choice for traders due to their high probability of success and diversity. IOC orders have two main preconditions – the asset price and volume.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

However, these conditions are soft limitations in the case of IOC. The volume, especially, is not required to be filled, and the price condition depends on the IOC subtypes. Suppose a trader chooses a limit order subtype.

In that case, the price condition is a hard limitation, meaning that the specific price the trader selects matches precisely or the deal is cancelled altogether.

In the case of the market order time in force, the price can be slightly off, but if the asset in question is strongly demanded, the deal will still go through. Naturally, limit orders allow for more precision, but market orders are much more likely to be executed.

However, The asset volume can be partially fulfilled, and the IOC order will still execute the deal. This way, traders can at least achieve a part of their desired strategy instead of losing the entire deal.

Fill or Kill Order

The FOK orders, on the other hand, are much stricter than IOC orders. Both price and volume conditions are hard constraints in this case, and the entire order matches both variables or gets cancelled immediately.

Naturally, FOK orders are much less likely to be honoured since they have an additional requirement of complete volumes. However, their utility is valued within the high-liquidity and low-margin sectors like forex, while the IOC orders are more widely appreciated in the stock market and similar sectors.

Since the FOK order ensures that the deal is filled immediately or cancelled, it is much easier for traders to control a large quantity of their investments simultaneously. FOK can be set to cancel unprofitable deals automatically, and investors will no longer have to worry about human error.

All or None Order

The all-or-none order is almost identical to the FOK order but has one significant distinction. Instead of the hefty requirement to be executed immediately, AON orders remain active during the trading day, searching for the exact match for both price and quantity. This way, deals have more probability to succeed and be honoured. However, it might take a considerably longer time to execute the agreement, if at all.

The AON orders scour the market on open offerings to see if anything matches, which could take days or even weeks in particular cases. While this approach is excellent for individuals prioritising price and volume, it might be detrimental to time-sensitive deals. In some cases, traders must get a favourable deal in a specific timeframe, and AON orders are not a perfect match in such circumstances.

Good Til Canceled Order

Finally, the most basic time-in-force order types are the good-till-cancelled (GTC) orders. However, this does not mean that GTC orders are unpopular or have no value. On the contrary, GTC orders are prevalent across different trading markets. GTCs function similarly to the IOC orders but remain open until the client decides to cancel the deal.

The GTC orders can usually stretch from 30 to 90 days, depending on the trader’s preferences. This period is considerably more significant than the immediate execution of IOC orders and is best suited for investors with longer strategy roadmaps.

GTC orders are no longer permitted on the NYSE due to their potential risks to investor portfolios. The automatic execution can be triggered by temporary volatility spikes, which could lead to severe investment losses.

What is The Best Time to Use Each Variation?

All four of the above-mentioned time-in-force variations have unique use cases and depend on the preferences of specific traders. However, there are broad applications and preferred markets for all of them.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

For example, IOC orders are frequently employed in the stock market and the crypto sector as well since both markets are highly price-sensitive. While IOC orders might fail to deliver the entire volume, their exact price match and immediate execution are great matches with stocks and cryptos.

FOKs, on the other hand, are popular in high-liquidity scenarios like forex since the volume in this sector is essential. It only makes sense to trade with some currencies if the volumes are appropriately high. Otherwise, the meagre profit margins are nothing to write home about.

AON and GTC orders are the natural extensions and modifications of FOK and IOC orders. Both of these variations allow traders to choose a preferred strategy. In the case of AON, traders can give themselves a better chance to execute deals with sufficient volumes, which could be a great strategy within the forex market. GTCs are also great alternatives for IOC orders, letting traders take their time and increase their chances of trade execution without a limit on open orders.

Final Thoughts

Time-in-force orders are indispensable mechanisms for modern trading, regardless of the industry. Their effectiveness is unmatched in the stock market, crypto, forex and other major trading sectors.

However, utilising them well depends on your specific circumstances and trading strategies. Each subtype is helpful if applied correctly and in the proper trading situation. So, consider your options well before choosing a time-in-force variation, as it could make or break your portfolio returns.