Comprehensive Overview of The MetaTrader 4 Web Platform

FX trading can involve significant financial risk and might be intimidating if you are unfamiliar with advanced trading platforms. The MetaTrader 4 platform has changed how people trade on the financial market. It is recognised as one of the most popular and widely used trading systems globally. In this article, we will review the core features of the MetaTrader 4 web platform and discuss its advantages.

Key Takeaways

- MT4 was developed by MetaQuotes Software in 2005.

- MT4 offers over 80 markets for trading, including FX, commodities, indices, and crypto.

- Among the MT4 key features are advanced charting tools, auto trading, copy trading and sophisticated tools for technical analysis.

A Brief Introduction to MetaTrader (MT4)

MT4 is a trading platform developed by MetaQuotes Software in 2005, primarily associated with forex trading but also trading over 80 markets, including indices and commodities. Moreover, MT4 offers Bitcoin trading platform software, which is essential for the ever-evolving demand for crypto trading. MT4’s popularity has grown due to its exceptional customisation options, automation capabilities, and educational resources.

MetaTrader 4 web platform offers a comprehensive demo account for beginners, copy trading, and automated Expert Advisor applications. It is highly customisable to individual trading needs and can automate trading by implementing algorithms.

MT4 distinguishes itself from its predecessors by integrating automated trading robots, known as Expert Advisors, for auto trading. For seasoned traders, MT4 offers advanced analytics and charting capabilities, providing in-depth market insights. The proprietary MQL4 programming language allows traders to create personalised trading indicators. MT4’s ease of use and high reliability enable millions of traders worldwide to operate safely on major financial markets.

MT4 is a third-party trading platform that connects to a broker to trade FX assets. You must open a live trading account with a supporting broker to place trades within MT4. You can choose among many MT4 brokers, for example, IC Markets, FP Markets, or Pepperstone.

Core Features of MetaTrader 4 Web Platform

MT4 is a widely used charting and analysis software globally, offering a user-friendly interface and customisable features. It provides a comprehensive platform for traders to chart assets, place orders, and manage positions, offering immediate order execution and real-time results. Here are some core features of MT4 that make it a popular choice for traders worldwide.

Smooth User Experience

The MT4 desktop platform is understandable, with a simple interface that allows simple navigation, a quick analysis of trades using charts and candles, and easy trade execution.

Mobile Accessibility

MT4 offers a mobile trading platform, offering traders complete account control and 24/7 access to their accounts from any place. Moreover, it provides a free tool for communication with fellow traders.

Technical Analysis Tools

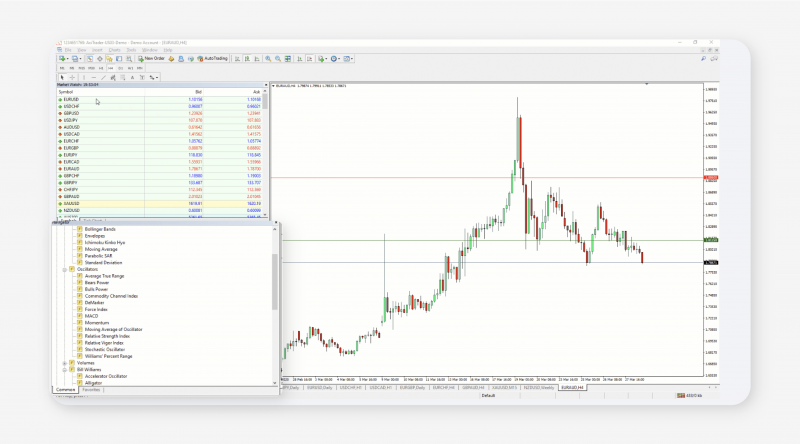

MT4 features numerous built-in indicators for technical analysis, providing traders with a graphical interface to visualise their results. These indicators aid in identifying trends, setting up trades, and monitoring price movements, ultimately assisting in making informed decisions and maximising profits.

MT4’s news feed includes an economic calendar, allowing traders to plan their activities around significant events and anticipate market fluctuations.

MT4 also offers real-time financial alerts and tools, providing updates on market events, interest rates, and geopolitical developments.

The news feed also offers customisation options, allowing traders to filter news based on their preferred markets, instruments, or sources, ensuring relevant and timely updates.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Security

The MT4 platform is a highly secure trading platform that ensures the safety and protection of traders’ money and profits. Its encryption technology prevents FX brokers from accessing clients’ accounts and maintains secure communication between traders and brokers. This makes it a popular choice for traders and brokers, as it prevents easy hacking and retains its reliability in trading.

Automated Trading With Expert Advisors

MT4 introduces automated trading via Expert Advisors (EAs), which analyse market quotes and execute trades using predefined algorithms. EAs enable traders to set parameters for opportunities and positions opening and closing using yes/no rules. They can be built or imported, and by combining multiple rules into a complex mathematical model, EAs can execute sophisticated trading strategies, making decisions and acting on them almost instantly.

Copy Trading Features

Copy trading on MT4 is enabled by TradingSignals. This feature allows traders to follow and copy the strategies of successful traders. Copy trading on MT4 offers multiple signal providers and a transparent asset management platform. Users can easily visualise the trade history and performance charts of advanced traders and can change trade parameters without risking their portfolios.

Charting Tools

MT4 Forex is a powerful trading platform that presents a wide array of charting features to aid traders in analysing market dynamics and making informed decisions. It supports three types of charts: broken line charts, bar sequence charts, and Candlesticks, and provides 30 built-in indicators and 23 analytical objects to suit traders’ needs.

Pros And Cons of MT4

MetaTrader 4 is a simple and functional platform that suits both beginners and professionals, although it has advantages and drawbacks.

Pros

MT4 Forex trading platform is lightweight, easy-to-deploy and user-friendly, offering a seamless trading experience.

Its convenient and easy-to-understand interface is perfect for beginners and is cross-platform compatible with various operating systems.

MT4 also offers automated trading capabilities, allowing users to program trading strategies and create custom indicators.

Its robust security framework ensures a safe trading environment, connecting users with licensed brokers through its trusted third-party platform.

The platform is beneficial not only for traders but for brokers, too. MT4 CRM solutions can help brokers identify their best customers and target the audience with relevant campaigns.

The platform offers to open a demo account. The MetaTrader 4 demo account is an excellent starting point for new traders, offering similar functionality to a real account but with the added benefit of trading with virtual money.

Cons

MT4 historical data for backtesting is limited, potentially constraining traders seeking extensive insights.

Also, its execution speed may not be suitable for high-frequency trading strategies, and its web-based platform lacks support for automated trading, limiting its functionality for traders preferring web-based access.

MetaTrader 4 vs 5

MT4 and MT5 are both designed for the seamless trading of forex, futures, CFDs, stocks, and other asset classes. They might have many similar features; however, there exist some discrepancies you need to review when picking the preferred platform that suits your objectives.

Thus, both MT4 and MT5 support algorithmic trading, which automates the entire trading process and allows successful trades even when the machine is off. But MT4 executes auto trading through an order system, and MT5’s automatic trading function implements a positional system, allowing traders to hold positions for extended periods.

MT4 offers interactive charts with nine timeframes, 30 in-built indicators, and 31 graphical objects, while MT5 offers 21 timeframes, 38 technical indicators, including Fibonacci and Elliot tools, and 44 graphical objects. Both platforms offer alert functionality and provide ongoing financial news to traders.

MT4 offers over 2000 custom and 700 paid indicators, while MT5 has unlimited charts.

MT5, the latest software version, runs excellently on 64-bit operating systems, whereas MT4 is ideal for a 32-bit operating system.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

MT4 is a more straightforward platform for forex traders, allowing customisation of its interface. At the same time, MT5 is more complex and offers more features and trading options, allowing traders to trade stocks and futures markets.

Key Elements of The MT4 Interface

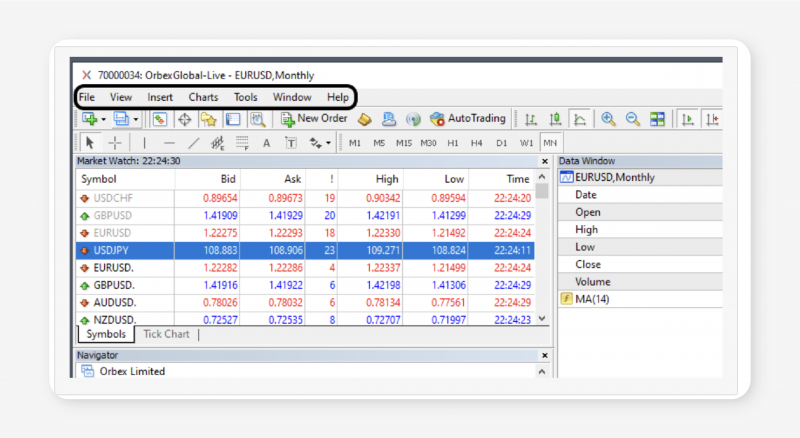

Despite the outdated look, the MT4 web platform’s interface is intuitive, easy to use, and customisable. It consists of the following sections:

- Main Menu – Here, you can find the commands and functions that can be executed on the platform.

- Market Watch – This section shows the quotes for the securities; the ‘Symbol’ field contains the security name, and the ‘Bid’ and ‘Ask’ fields show the corresponding prices.

- Navigator – With the help of this window, you can switch between accounts and get functions for running trading robots, such as Expert Advisors, Scripts, or Indicators.

- Charting Window – It displays price charts of financial instruments using technical indicators and analytical objects. You can customise the charts to suit your personal needs.

- Terminal Window – This section displays all the trade positions and tabs with news, account history, alerts, mailbox, journals, etc.

How to Trade on The MetaTrader 4

You cannot access MT4 online. MT4 is a platform accessible only through licensed and authorised financial brokers, ensuring user safety and money security, as all financial trading venues and brokers must comply with financial services regulations.

MT4 is available as a desktop software or mobile app, allowing users to open and close positions, monitor open and pending orders and modify stops and limits on open positions.

Let’s look at the example of opening a position:

- Navigate to the main menu or click the “New Order” icon on the toolbar.

- Choose the trading instrument symbol and specify the position volume.

- Specify the order levels: Stop Loss (to limit possible losses) or Take Profit.

- The “Type” field is set by default to the “Market Execution” option; it also offers two buttons: “Sell by Market” and “Buy by Market.”

- Click the “Sell by Market” button to open a short position at the specified price, or click the “Buy by Market” to open a long position.

- To place a pending order, choose “Pending Order” from the “Type” drawdown list.

- Choose the order type (Buy Limit, Sell Limit, Buy Stop, or Sell Stop).

- Specify the opening price and the order expiration date, and click “Place order.”

Your Pending order is now placed.

Conclusion

Risk is inherent in investing. Therefore, it’s important to do your research and choose a trustworthy platform. The MetaTrader 4 web platform is a widely used and relevant trading environment because of its extensive features, user-friendly design, and compatibility with a wide variety of devices. These attributes make the platform a good alternative for beginning and expert traders.