Dealing With Bear Traps in Trading: How To Predict A Pitfall And Avoid Losses

Financial markets are complex and unpredictable, making trading challenging, and some common pitfalls can deplete even experienced traders. One such pitfall is the bear trap — a formidable market situation that could result in substantial losses if not approached with caution. From this article, you can learn the concept of bear traps, their mechanism of formation, and some tips on how to spot and avoid them.

Key Takeaways

- A bear trap occurs after a rapid price increase, luring traders into long positions.

- Bear and bull traps are types of whipsaw patterns leading to substantial losses.

- Bear traps can be formed by institutional investors buying assets at wholesale prices.

Explaining The Concept of A Bear Trap

A bear trap is a short position that tricks bearish investors into buying at the worst possible time. It occurs after a rapid price increase: an unexpected upward movement, called a “sucker rally,” convinces traders that the market has bottomed out and lures them into long positions. Bearish traders short-sell the asset, but the bearish price movement is short-lived, and the asset continues its upward movement. As a result, traders who fall into its grasp face the choice to close their trade with a certain loss or stay in the trade with open risk and unknown reward potential.

Bear traps can also apply to traders holding long positions who are tricked into selling, missing out on additional profits from the continued upward movement.

A bear trap meaning can be explained as a trading illusion that leads traders to believe that a downward trend in an asset or market may soon reverse, creating an opportunity to buy. It traps traders who enter bullish positions prematurely at what appears to be a trend reversal.

A bear trap can occur in any financial instrument, be it stocks, indices, commodities, or cryptocurrencies. A false reversal from an uptrend into a downtrend can lead traders to open short positions, expecting profit from the asset’s price decline, or sell off their assets to prevent losses. However, the asset continues on its uptrend, causing bears to suffer losses or opportunity costs.

Here is an example of a bear trap in the crypto realm:

In May 2021, the crypto market experienced a bear trap when Bitcoin’s price dropped from $65,000 to $30,000. Many investors sold their Bitcoin due to fear of market decline. However, Bitcoin’s price rebounded to nearly $40,000 a few weeks later, trapping those who sold out and missing out on potential profits.

The term “bear trap” comes from its analogy with bears using traps to capture their prey: bearish investors are trapped in their losing positions, waiting for prices to fall, just like bears waiting for their prey.

Bull Trap vs Bear Trap

Bull traps and bear traps are types of whipsaw patterns where assets suddenly change direction in volatile markets, causing significant losses for traders. Understanding these patterns can help investors take appropriate risk mitigation measures.

Bull traps occur within a bearish market trend, enticing traders with a rally before resuming the downtrend, causing losses for those who enter long positions. Bear traps occur within an overall bullish market trend, tricking traders with a decline before the market resumes its upward trajectory, causing losses for those who sell assets expecting the downtrend to continue.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Bear and bull traps are financial market scenarios where temporary pauses or reversals create a false impression of trend reversals, leading traders to make incorrect decisions. To avoid these traps, traders should use caution, employ risk management strategies, and conduct further analyses before making investment decisions based on these false signals.

How Are Bear Traps Formed?

A bear trap can be used as a market manipulation technique to create a downward trend artificially. There exist many ways traders can form such a trap.

Thus, such traps can occur when large institutional players in the industry, such as pension funds, banks, or investment corporations, attempt to break out weak longs or shorts by buying assets at wholesale prices: traders intentionally sell large volumes of an asset to lower its price, creating a false market impression and causing other traders to believe the asset is losing value and sell their positions. Traders create a bear trap when asset prices reach a low point, buying large volumes at the artificially low price, increasing demand, and driving the price back up.

The bear trap can be formed by traders who create false signals, such as a sudden increase in selling volume or a sharp price drop, to convince investors to sell their assets, which in turn drives the price even lower, causing the market to drop.

FUD (Fear, uncertainty, and doubt) is another method to create a bearish trap. Traders employ FUD tactics by spreading rumours or news stories predicting a market crash, leading investors to panic and sell their assets.

Short selling is a strategy where traders borrow assets from another investor, sell them at the current market price, wait while a price drops, then buy them back at a lower price, return them to the original owner, and pocket the difference, creating a possibility of a bear trap.

How to Recognise A Bear Trap

Bear traps can be identified by observing the market’s prolonged direction, which may indicate manipulation. Another crucial indicator is a sudden shift in market sentiment, which is unexpected and opposite to what is expected. Here are some features you should pay attention to to identify a market bear trap.

Bear Trap Chart

You can identify a bear trap by looking at the chart: a downtrend with high-volume trades close to the support line. The trap is confirmed when the trend reserves within five candlesticks above the support line and rapidly crosses the resistance level.

Trading Indicators

Among many technical analysis tools, traders use technical indicators like MACD and RSI to differentiate between a true reversal and a bear trap. Momentum indicators should move downward with the asset price during a bearish reversal.

A bear trap may be identified by a false breakout below a key support level or a quick reverse of a significant moving average.

It’s also crucial to check if a downward price movement is breaking through Fibonacci levels and support levels, as bearish traps often stop at Fibonacci levels.

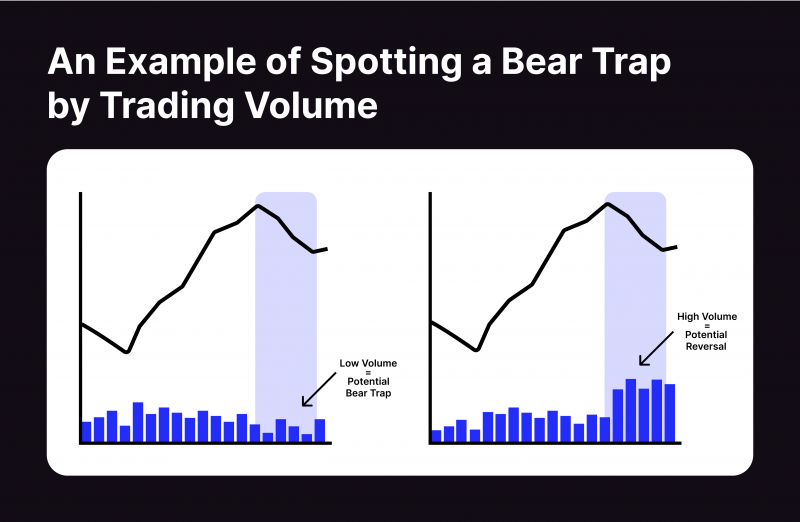

Trading Volume

To identify a bear trap, examine trading volume. True trend reversals typically involve high volume, while bear traps often involve low volume. If a strong uptrend seems to fizzle or break down below a support level on low trading volume, it’s highly suspicious.

High RSI

A high RSI and overbought conditions can indicate high selling pressure and a potential bear trap. Major players may push prices lower to reduce pressure and re-enter at lower prices for better positions. This influx in buying demand will drive prices back up. The initial downtrend is temporary due to profit-taking and institutional payers’ manipulations, and the price will increase again once institutions scoop available assets. Thus, a high RSI can also indicate a potential bear trap.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

How to Avoid A Bear Trap

To avoid a bear trap, you must first conduct thorough research and analysis before making trading decisions. However, there are some more tips on how to bypass these traps.

Avoid Short Positions

It can also be useful to avoid shorting in a primary uptrend before it confirms a reversal. However, short sellers can successfully survive a bear trap by carefully monitoring price action, such as a hammer candle indicating buyers enter at lower prices and a decline in trading volume indicating a short-lived reversal. Ensure momentum indicators continue to point downward with the price, as they may indicate a rejection of the reversal.

Use Stop-Loss Orders

To avoid bear trap trading, consider stop-loss price levels before entering a trade, especially if it’s short. If the stop-loss is triggered, you should immediately cut your losses; otherwise, you can be caught in a bear trap and lose your assets.

Conduct Market Analysis

Thorough market analysis and multiple indicators tracking can help you predict and bypass an impending bear trap, while robust risk management strategies can help avoid significant losses.

Final Takeaways

Bear traps are unavoidable events that can be difficult to spot. But with proper analysis and market indicators, as well as with continuous education and improving your trading skills, you can learn to identify a bear trap pattern and bypass it, keeping your funds untouched.