Forex Back Office Software: Definition & Overview

Forex trading has become so popular today that virtually all brokers providing direct access to trading currency pairs and having a large client base use special professional software, which can significantly facilitate and accelerate the process of control, accounting and reporting, as well as processing and storage of personal and trading information about their clients. This task is solved using Forex back office software.

In this article, we will examine in detail what Forex back office software is, the structure of such a program, and its key features. You will also learn the cost of an average Forex back office solution and which companies use this solution as part of many Forex CRM platforms.

Key Takeaways

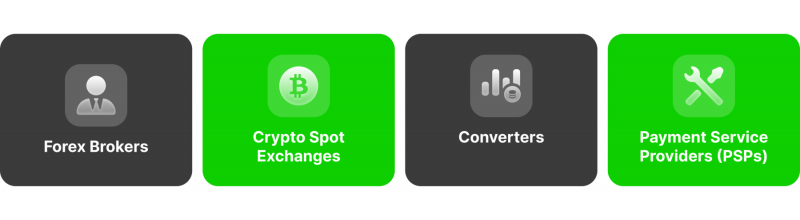

- The main financial institutions that use Forex back office software are Forex brokers, crypto spot exchanges, converters and PSPs.

- Back office software is part of the professional FX CRM system, where there is also front office software that directly interacts with users in the process of using the trading platform.

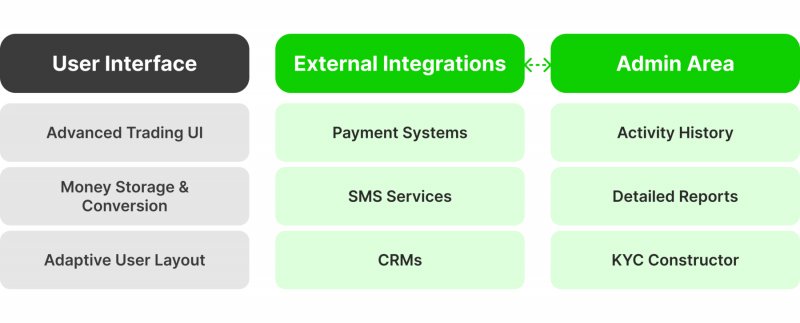

- The structure of the Forex back office software consists of three components: admin area, user interface and external integrations.

What is Back Office Software in Forex?

Forex back office software is used to manage business operations unrelated to the trading process and interfaces that are generally not visible to clients. As a rule, business processes managed by Forex back office software include a whole ecosystem of client account management, consisting of several important areas: admin area, user interface, and external integrations.

Forex back office software, whose main purpose is to control and organise the technical side of the client’s interaction with the platform, is fundamentally different from front office software, which usually refers to customer relationship management (CRM) and trader’s room software used to report on the number of registered users, manage accounts, organise environment portfolio and also other activities that are performed directly by clients.

In general, back office software solutions have evolved with the advent of cloud-based software as a service (SaaS). Many CRM software providers offer cloud services that simplify and optimise back office management functions, especially for Forex brokers with a comprehensive service model that provides access to various markets to trade various trading instruments besides just currency pairs.

Forex CRM platforms with back office software have become, for the brokerage companies, an alternative to Business Process Outsourcing (BPO), which involves transferring back office management to a third-party service provider. With back-office software, brokers can extract actionable intelligence from the system without any particular expertise.

Who Should Use Forex Back Office Software?

Back office software in Forex is an integral and important part of any CRM platform, which is a key link in terms of interaction between a brokerage firm and its users.

FX back office is a universal tool that allows you to manage user data and their trading activity easily. Among the financial institutions using this instrument regularly, the following can be distinguished:

Forex Brokers

Today, the Forex market is one of the most popular markets to trade because. Its popularity has played into the hands of fans of risky trading, thanks to which numerous companies have appeared that provide direct access to trading in various financial instruments within the international Forex market. As the flow of traders in the market grows daily, brokerage companies need a functional back office system to give their clients the best experience.

Crypto Spot Exchanges

Over the past few years, the crypto space has been developing at lightning speed, being the foundation for creating new branches of development and improvement of blockchain technology.

Cryptocurrencies, being one of the brightest examples of innovations in the field of information technology, give rise to the creation of crypto exchanges, which provide access to trading a variety of digital assets and, therefore, have the same popularity among traders and investors as Forex trading, which also creates the need to use professional CRM to organise the user space.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Converters

Converters are special services that help to carry out the process of converting one currency to another. These services have gained popularity due to the development of Forex trading, as it became necessary to quickly determine what value a certain amount of one currency has in relation to another.

Back office software driven FX businesses can greatly optimise operations and client relations.

Payment Service Providers (PSPs)

To understand why payment service providers are also frequent users of Forex back office software, it is necessary to remember that every Forex broker, as well as any crypto exchange, is all about money that users deposit, withdraw or exchange using specialised services that help to conduct transactions instantly and conveniently.

As an integral part of any business related to making money in the markets, whether Forex or crypto, PSPs also use the FX back office system to serve their clients.

There are two types of infrastructure designed to interact with clients. The front office is the part that directly interacts with users, and the back office is the technical part of the platform with which users do not interact.

Structure of Forex Back Office Software

FX back office is a complex ecosystem of useful tools that give you full control over all elements of the process of registration, storage, accounting, modification, and deletion of user data as well as all comprehensive information regarding users’ trading activity. This solution has a complex structure and includes the following components:

User Interface

The first and main component of Forex back office software is the user interface, which is the repository of many functions available within the Forex CRM platform. It is an indispensable assistant in matters of interaction between the company and clients.

- Advanced Trading UI — An advanced user interface that gives you the freedom to trade with an additional set of tools for managing user profiles and customising them.

- Money Storage & Conversion — A special place where users can store their funds, regardless of their type, both in Forex trading and when working in the crypto market.

- Adaptive User Layout — An adaptive configuration of user layout parameters that allows you to adjust the size, shape, and other parameters for any type of device and screen.

- Trading History & Analytics — This section includes a list of functional tools for trading activity analytics, as well as the ability to view the history of all trading activities in a certain time period.

- 2FA Security — An additional layer of protection that guarantees complete security of both personal and trading data. As a rule, it can be a password, secret phrase, or digital combination in the Google Authenticator service.

- Transaction Monitoring — An area designed to monitor all transactions carried out as part of the trading of various financial assets.

- Mobile App — The ability to create a mobile application with a completely individual interface and visual settings with additional security settings and financial transactions.

External Integrations

This section is a combination of various flexible settings for connecting third-party services and applications. Here, it’s necessary to highlight the possibility of connecting payment services for conducting deposit and withdrawal operations between the broker and users, SMS informing services about bringing financial transactions to the market, and different systems for customer relationship management.

Other systems that can be connected to the Forex back office include various trading platforms, “KYC” service providers, rate providers, and various marketing services that help set up an advertising campaign.

Admin Area

The admin area is the most essential component in the structure since it controls, organises, and structures comprehensive information about customer activity, including trade data, its type, duration, etc.

This area allows the view of detailed statistics and reports on various criteria and parameters. Plus, this area of Forex back office software gives you access to the KYC constructor to adjust the parameters for regulatory compliance and registration constructor settings to create individual ways of registering.

Moreover, there is an opportunity to use an anti-fraud system to reduce the risk of money laundering, a notification system for various events, and examples of email templates.

Key Features of Forex Back Office Software

Forex back office software has an extended range of various useful functions that allow you to configure numerous parameters related to clients flexibly, their verification, reporting, etc. Let’s consider the key functions that can be found in the FX back office solution below.

IB Room Affiliate Module

The IB module allows you to create a system of referral connections or an affiliate network. Each trader can become a partner and connect other partners to the network to trade and receive commissions from the spread difference.

This module allows you to upload all the necessary information that is somehow related to the affiliate program, keep records on the number of partners, and also access the data of the partners themselves to analyse their activities.

KYC Module

KYC (Know Your Customer) is a mandatory procedure for identifying counterparties for financial institutions (banks, stock exchanges, bookmakers, etc.). It includes selection procedures (criteria for who can become a client) and identification (passport data, biometric data), as well as transaction tracking and analysis.

Anti-Fraud System

The anti-fraud system allows you to conduct a comprehensive assessment of the behaviour of each individual user and identify suspicious activity that does not correspond to the cluster of his behaviour. This includes cases when the trading activity of traders undergoes serious changes and becomes completely different from what it was originally.

In this case, the system recognises the activity as suspicious and reports it to the control centre for further verification. Since the Forex market is very popular, there are many scammers trying to swindle money with various frauds, so this feature is a necessary element.

What is the Forex Back Office Software Cost?

This issue is as complex as the back office software in Forex itself. The price of this solution can vary significantly depending on the provider of these solutions.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

On average, the back office solution can cost around $1000-1500 per month as part of the Forex CRM system and, at the same time, have all the necessary functions, tools and services to fully monitor all the important components of the trading activity of traders, as well as their personal information.

Since such solutions are quite expensive, before making a choice, you need to decide on the selection criteria. Moreover, as mentioned above, many Forex CRM systems already have back office functionality on board, so purchasing the CRM platform itself can be a more profitable option than just buying a Forex Back office.

One way or another, the use of a wide range of analytical tools for organisational purposes, primarily aimed at obtaining a detailed report on the status of user accounts and their trading activities, will help bring the Forex business to a new level and help expand the already existing customer base.

One of the market-leading back office software examples is B2CORE.

Conclusion

To conclude, Forex back office software allows you to systematise and organise all the necessary information that comes from the stage of registering user accounts and ending with trading on the market.

Being an important element of many Forex CRM systems, the back office provides a great advantage for brokers who have a large client base and wish to manage it effectively.