Forex Brokerage Software: How to Choose The Right One

The brokerage service industry has expanded massively, and you can find various solutions serving similar purposes. Therefore, you must set your objectives and expectations before acquiring the right Forex brokerage software to connect financial markets, facilitate trader’s experience, and allow you to do more with one management system.

This article will explain the objectives of the Forex brokerage software, the basic functions you must look for and how to integrate the best system.

Key Takeaways

- The trading software is the intermediary between investors and brokers, facilitating electronic charting, analytics and trading.

- You can develop an Forex brokerage software using in-house developers or outsource it to external development teams.

- White label Forex trading software saves you time and money, allowing you to enter the market and offer your services quickly.

Forex Brokerage Software: Your Firm’s Core

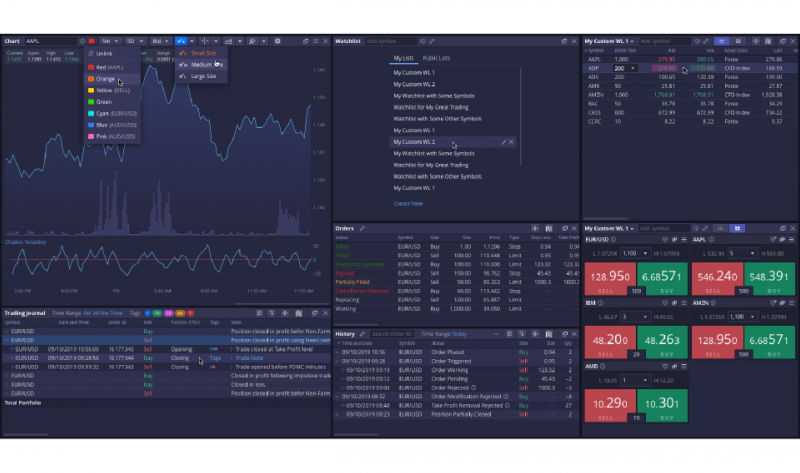

Brokerage software is the point of interaction between you and your clients. It is the dashboard your traders see and use to explore trading market prices, execute orders, backtest a Forex trading strategy and explore opportunities to grow their wealth.

The software for Forex brokers is the connection hub with third-party services, including payment processing gateways, liquidity providers, and financial reporting. Additionally, you can integrate more features, such as copy trading and automated Forex trading software, to expand the usage of your platform and attract more traders.

Therefore, it is crucial to find a suitable Forex brokerage platform provider that meets your financial and operational needs.

Download the free PDF guide covering the key decisions, common mistakes, and real costs of starting a brokerage.

Are Trading Software and Platforms The Same Thing?

When searching for brokerage solutions, you often encounter trading “software” and “platform” interchangeably. Both terms are synonymous in reference to the technological solution between brokers and users.

The platform is a broader build that includes price charts, market newsfeeds, payment options, management systems, etc. However, the trading software powers the graphical charts and order execution engine that make trades happen. In a nutshell, it is what the user sees inside the “trader’s room”.

Can You Develop Your Forex Brokerage Software?

There are various ways to own brokerage software, depending on your technical expertise, time, and capital. The most cost-efficient approach is to acquire a white label brokerage solution involving ready-to-use platforms that you can get, rebrand, and customise to your preferences.

Other ways include outsourcing, which saves money but might compromise your control and time-to-market based on the contractor’s geo-location and workload.

Alternatively, you can create your platform from scratch using in-house software development to program your trading software entirely. This is usually a prolonged process, but it gives you unlimited creativity, freedom and control over the features and functions you want to add.

Main Functions of a Forex Broker Software Program

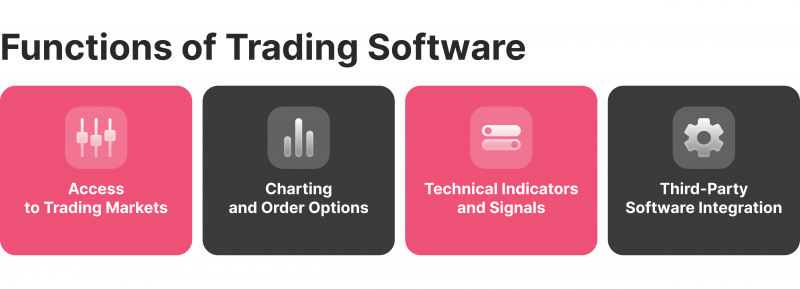

Regardless of the approach you choose to secure your Forex brokerage technology, there are essential functions that you must have and investors require to improve their trading experience.

Access to Trading Markets

The main function of the Forex brokerage software is to provide access to financial markets, namely stocks, bonds, commodities, cryptocurrencies, Forex, ETFs and more. Traders use the trading software to view financial instruments, check prices, analyse charts, and place buy or sale orders.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

The execution engine’s capacity dictates how quickly the order is fulfilled, and assets are transferred to the investor’s account. You may also add automated trading software to enable investors to streamline their trading decisions.

As a broker, you must find a Forex technology provider that offers access to deep market liquidity with a vast number of participants and assets, optimising execution speed and minimising spread and slippage.

Charting and Order Options

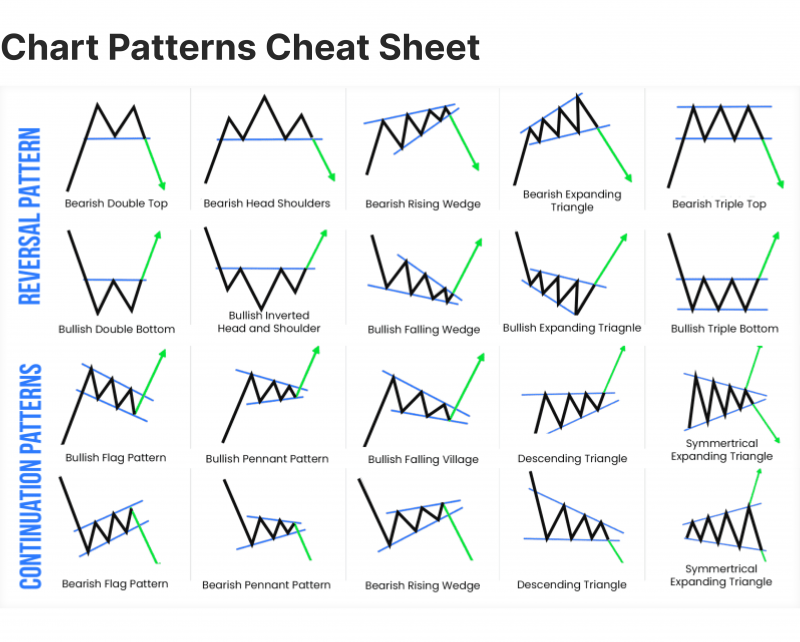

Charts are your clients’ tools to display and analyse market trends, conduct price estimations, and execute orders. Investors prefer a Forex broker with the best charting software and timely price updates using Candlestick, baseline, or line-break charts.

You can offer a mix of free and subscription-based charts, providing adequate analytical tools while exploring diverse revenue streams.

Additionally, investors choose FX brokerage platforms that offer risk-limitation tools, such as stop-loss, trailing stop and limit orders. These execution models allow investors to control market risks, where they can dictate the minimum losses they are willing to bear and the maximum profits they want to secure using take-profit orders.

Technical Indicators and Signals

Trading indicators are technical tools that assist traders in understanding market conditions, identifying trends and drawing price projections. Some indicators are more difficult than others, depending on the code complexity, functionality, and market conditions.

Basic indicators like moving averages, exponential smoothing, DMA lines, RSI index and market sentiment are usually available at most trading platforms.

You can offer a combination of built-in and premium indicators in your platform to attract more investors and allow investors to develop custom signals to boost user engagement.

Third-Party Software Integration

Popular brokerage platforms come with integration points to facilitate the work of additional features and services. Using API keys and backend integrations, you can add multiple payment gateways, secure liquidity sources, integrate auto trading software and provide technical support through live chat and e-mails.

Moreover, you can integrate investment solutions that elevate the trader’s experience, such as copy trading solutions, PAMM and MAM portfolio management, spot crypto exchanges, and add prop trading software.

Therefore, it is important to inspect the Forex brokerage technology and ensure it accommodates your scaling needs for current and future plans.

Top Forex Brokerage Software Providers

When searching for trading software in Forex, you are most likely to encounter MetaQuotes (MetaTrader 4/5) and Spotware (cTrader) as the leading trading technology developers.

MetaTrader 4 was the first fully digitalised web trading platform that allowed users to interact with the Forex market and place orders on hundreds of currency pairs. The platform expanded to stocks, ETFs, commodities and other asset classes.

MetaTrader 5 followed the development of trading practices, building on the MT4 system and integrating copy trading, managed portfolios, social trading, and algorithmic trading. Most brokerage firms offer a MetaTrader Forex platform, as most Forex traders are familiar with its interfaces, dashboards and functionalities.

cTrader arrived later in the market, building on the success of MetaTrader software and improving the processing speed, integration points, algorithmic trading capabilities and B2B offerings.

cTrader software offers better customisation for FX brokers, allowing businesses to personalise the trading experience while trading Forex, improving automated trading engines, and making the interface more customer-centred.

Joining established names in the industry, B2BROKER’s B2TRADER platform is tailored to serve brokers with multi-asset and multi-market needs. It enables trading across a diverse range of assets and markets, including Forex, CFDs, and crypto spot markets, while providing centralised account management suitable for traders at any skill level. B2TRADER can handle up to 3,000 financial instruments and is capable of processing as many as 3,000 requests per second, with swift execution speeds that start at just 1 millisecond.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

The platform also offers a mobile app that facilitates trading and account management on the move, compatible with iOS, Android, and custom APK files. Additionally, B2TRADER integrates smoothly with major liquidity hubs like OneZero, PrimeXM, and B2CONNECT, further boosted by B2BROKER’s own innovative solutions. This makes B2TRADER a robust and scalable choice for brokers looking to expand their offerings and enhance their operational efficiencies.

Acquiring Forex Broker Software: White Label vs Custom Development

Custom-developing a trading system gives you ultimate control over your operations, costs, software functionality, and designs. However, it requires more time to find and hire experienced developers willing to commit to a prolonged working process, which costs more wages, hardware, and maintenance.

Moreover, you might miss on time-sensitive market opportunities. For example, if the crypto market is expected to boom in the coming weeks, there is not enough time to build, promote and launch your platform.

On the other hand, pre-built turnkey solutions are more attainable, shortening your market entry time and lowering your costs. Forex trading software platforms like MT4 and cTrader provide white label licenses to technology providers who offer you the FX trading solution.

When acquiring a white label Forex broker solution, make sure you check the following:

- The license – Many providers do not have a legitimate permit and offer subpar trading platforms that can damage your brand.

- The reputation – Getting FX brokerage software from a reputable developer can boost your brand recognition and attract investors.

- The costs – Ensure the white label Forex broker cost meets your expectations or offer custom plans that suit your budget.

- The tech stack – Inspect the technological build of the software and ensure it allows you to integrate additional services or choose features your clients need without engaging in prolonged development processes.

Final Remarks

Launching a financial trading service business requires finding a Forex brokerage software and platform developer to provide the technology that connects your clients with trading markets. You can create a system yourself with internal development teams or outsource building the software to external teams.

However, white label brokerage solutions allow you to short-cut your entry into the market and save costs from developing the software from scratch. Make sure you carefully check the provider’s offering, including available instruments, charting and analysis tools, technical aspects and further integration possibilities.