From Multiple LPs to Single PoPs: How to Choose a Perfect Liquidity Partner

The global expansion of money markets has introduced numerous opportunities for small and medium-sized businesses. Gone are the days of commercial banks and massive conglomerates monopolising the forex, crypto and other currency sectors. Any business can carve out a respectable market share in this global industry with modern digital tools and online capabilities.

However, creating a brokerage agency still requires massive effort, as the currency field has never been more fiercely competitive. Obtaining direct access to constant and reliable liquidity can go a long way toward securing your place as a strong retail broker. This article will discuss the various sources of liquidity and which option might be the best for your specific business model.

Key Takeaways

- For brokers, finding a liquidity partner is crucial, allowing them to provide fair market quotes for currency pairs and tight spread margins.

- Liquidity partnerships can be initiated with tier-1 LPs, prime brokers, market makers, Prime of Prime providers and regular LPs.

- Selecting a correct LP partner depends on your scope of operations, budgetary capabilities and business aspirations.

- PoPs are by far the most optimal option for mid-sized brokerages, as they provide fractional tier-1 services at an affordable price.

How Liquidity Works in Crypto and Forex

Retail brokers must look for ways to acquire liquidity when entering the money markets, whether for forex, crypto or any other type of currency. Liquidity sources allow brokers to obtain direct market access to large fund pools and order books of central exchange platforms or other significant players in the money markets.

As a result, brokers can serve retail traders consistently, providing tight spread margins, expanding their currency offerings and matching competitive prices on the market.

Obtaining liquidity sources is not just a favourable tactic to penetrate money markets but a necessity for any newcomer business in the field. Without accessing liquidity, brokerage startups will have to develop their own order books, accumulate liquidity pools and obtain massive borrowings from financial institutions.

All of the challenges mentioned above can be achieved with a considerable initial investment. But in most cases, regular brokerage startups won’t be able to attract big-ticket investors. So, obtaining institutional liquidity from prime brokers, Prime of Prime companies, and related organisations might be the most dominant strategy.

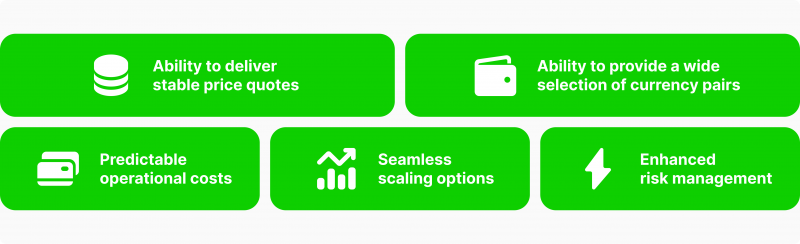

Benefits of Acquiring a Constant Source of Liquidity

As analysed above, liquidity sources allow aspiring brokerages to access the primary market they choose: cryptocurrencies, foreign exchange, or other related sectors. However, acquiring a consistent and dependable source of liquidity is not just a simple tool for gaining global access but a mechanism that empowers brokerage businesses on many levels. Let’s explore.

Price Stability and Risk Management

Money markets are known for their fluctuations and volatility. The breakneck speed of the global economy, politics and commerce creates a hectic environment that constantly affects monetary assets unpredictably. For brokers, exchange rates and currency pairing quotes change almost continuously, and a price quote from two minutes ago could already be outdated.

So, creating a brokerage platform with access to the latest price quotes and can effectively execute trades with these numbers is imperative. Otherwise, clients will simply switch to more competitive platforms. Proper liquidity partners will prevent this from happening and provide you with continuously updated order books through liquidity channels.

The importance of liquidity management is also tightly connected with risk management responsibilities. Most startup brokerages have razor-thin profit margins, which will be further reduced if you can’t match the competitive spread margins of your local money sector.

Without affordable and reliable liquidity sources, your brokerage will have to reduce profits to satisfy client needs and eventually fail to meet expectations. Naturally, reduced profit margins could lead to bankruptcy, further emphasising the need for dependable liquidity providers.

Predictable Long-Term Costs

As outlined above, acquiring a liquidity partner allows you to access order books and liquidity pools. This service is indefinite and mostly charges monthly fees.

As a result, brokerages can build predictable operating budgets for the whole year, incorporating liquidity expenses from the get-go. This will help startups avoid dodgy credit relationships with institutional lenders that often increase effective interest rates due to market fluctuations.

Ability to Grow Without Roadblocks

Every brokerage business that enters the money markets has a long-term plan to grow out of its local confines and join global market participants. However, the growth process might often be bumpy and challenging if you don’t make plans for it early.

A quality liquidity provider will always meet your scaling demands by accommodating your increased trading volume and giving you access to larger fund pools without delays. Providing such seamless scaling options will help you smooth out a chaotic transition to a global market without compromising your existing client base or their respective investment strategy.

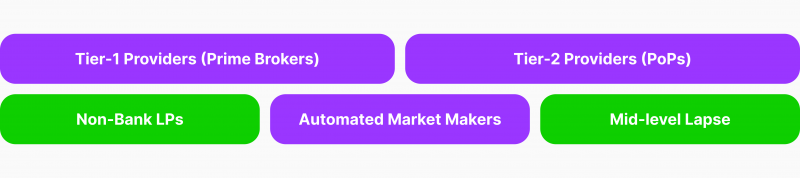

Different Types of Liquidity Partners

Since liquidity has become a lifeblood of money markets, the liquidity provider niche has grown considerably, branching out to different LP variations that provide unique services. While there are numerous iterations of LPs, this article will discuss two fundamental groups that dominate the market for brokerage businesses.

Tier-1 Liquidity Providers (LPs)

The first group of LPs comprises the most influential and resourceful organisations across the money markets – tier-1 trading firms and financial institutions. These massive entities are often involved in several monetary sectors, including commercial banking, investment banking, money lending, etc.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Examples of such institutions are some of the most prominent financial players worldwide – JP Morgan Chase, Citi Bank, Deutsche Bank, Wells Fargo and Bank of America.

Due to their massive scale, nearly limitless resources and highly competent workforce, tier-1 liquidity providers are firmly at the top of the liquidity market. They provide comprehensive financial and advisory services, including research, consultation, asset management, risk mitigation and much more.

However, there is a single fundamental downside to tier-1 LPs – their excessively high price tag. Tier-1 LPs charge at least 6-figure fees each month for their most basic package, which naturally eliminates most brokerage startups from receiving their services. So, what’s the alternative? Let’s explore.

Regular LPs

Regular liquidity providers are very different from tier-1 LPs, who focus exclusively on delivering liquidity sources to their clients. Their services are limited to trade execution and access to order books. Some brokers provide basic analytics tools like live data feeds and price charts. But generally, their scope is quite limited.

Regular LPs are also constrained in selecting currency pairing options, as they don’t have long-standing relationships with tier-1 organisations. Instead, regular LPs are connected to mid-sized liquidity pools with basic currency exchange options. As a brokerage business, providing a wide selection of currency pairings is essential, enabling clients to execute diverse trading strategies.

Without a wide array of currency options, your brokerage business will not be able to satisfy institutional traders and most retail traders, leaving you with a reasonably limited target audience. So, the only option to maintain diversity with LP partnerships is to acquire several partners.

Dealing with different liquidity providers simultaneously can become complex, time-consuming and inefficient due to incompatible tech providers, multi-tasking challenges, inconsistent rates and other complications.

In addition, the fees of multiple LPs could stack up to produce a massive monthly expense for your brokerage startup, defeating the entire purpose of partnering with affordable providers.

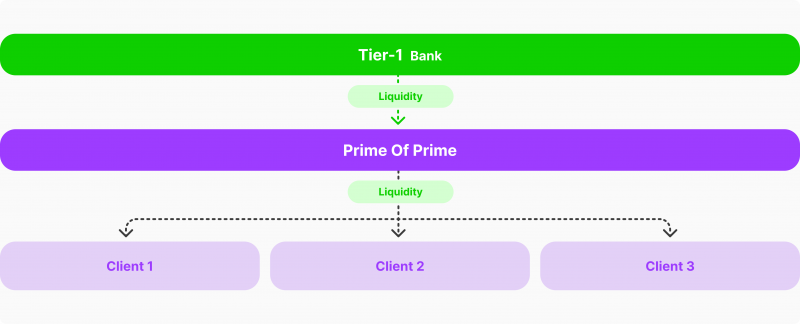

Tier-2 Liquidity Providers (PoPs)

In response to the downsides of the previous two types of liquidity providers, the LP market has produced a new variation on the established formula. Tier-2 firms, commonly known as Prime of Prime liquidity providers, are companies that combine the best of both worlds.

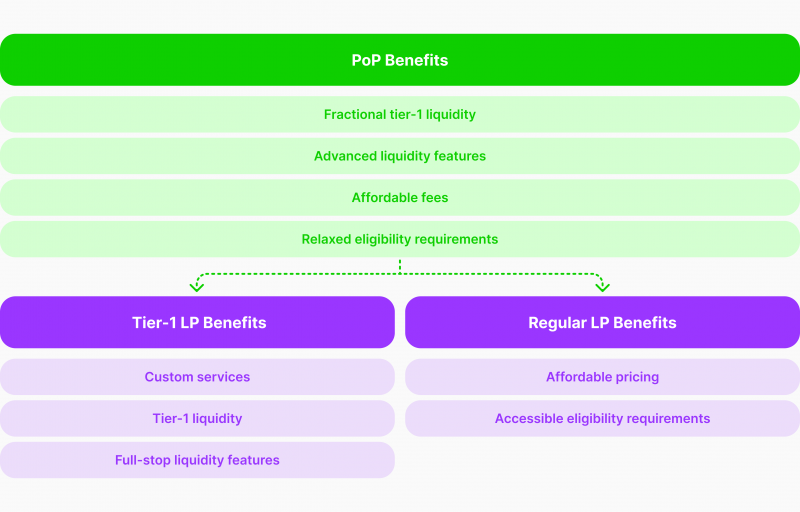

PoPs combine the expansive currency pairing selection and bespoke services of tier-1 firms with the affordability and accessible eligibility requirements of regular LPs.

PoPs achieve this optimal formula by partnering with prime broker organisations like commercial banks, tier-1 LPs, market makers, non-bank liquidity providers, and an FX prime brokerage. Each of these organisations has access to primary market liquidity, continuously providing relevant currency pairings, asset classes and live price updates. PoPs have a mutually beneficial relationship with prime brokers, obtaining their wealth of resources in exchange for monthly royalties.

What Is Prime of Prime? Your Easy Guide to PoP Liquidity Providers

Join B2BROKER CEO Arthur Azizov and CDO John Murillo as they unpack the concept of Prime of Prime liquidity providers. In this informative video, they clear up any confusion about choosing to work with a single PoP institution versus multiple liquidity providers, such as Tier-1 banks and non-bank entities. They also highlight the risks of relying on a single provider and share tips on how to promote risk diversification and improve capital efficiency.

The Affordability of PoPs

But how do PoPs decrease expenses despite offering virtually the same services as tier-1 companies? They segregate the acquired tier-1 resources to fit the needs of small and mid-sized brokerage agencies.

Suppose a tier-1 company charges a monthly $100,000 fee for a single client. The PoP agency will divide this service into ten smaller parts and distribute it to ten small or mid-sized agencies, charging only a $15,000 monthly rate for each.

As a result, smaller brokerages receive all the potential benefits they would get from tier-1 LPs but for a fraction of the costs. On the other hand, tier-1 companies receive virtually the same royalties without actually delegating their workforce to the task.

So, the PoP model creates an optimal combination for everyone involved in return for a profit markup that isn’t damaging to smaller agencies.

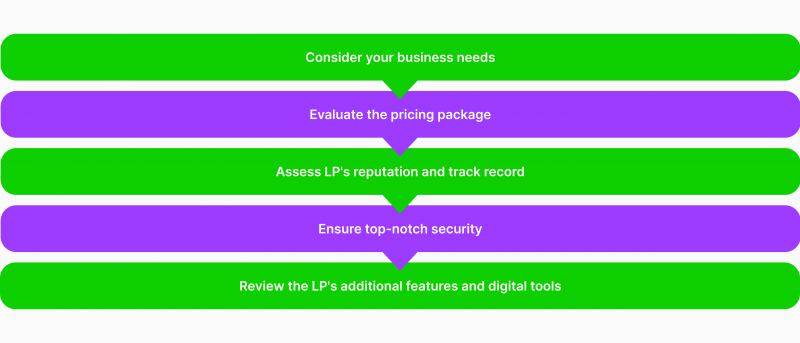

Things to Consider When Choosing a Liquidity Partner

As outlined above, there are many variables involved in choosing a suitable liquidity partner. Selecting a proper option will determine your long-term success and the ability to scale without considerable limitations. Below, we analyse the core factors you should take into account when making the final choice.

Your Own Scale of Operations

Each brokerage startup has distinct goals and aspirations in mind. Some agencies strive to provide a boutique service for a niche audience, accumulating a target client base of limited but loyal customers. Conversely, other agencies try to provide freedom of choice for retail traders by offering a variety of currency pairs and other complementary services.

Before searching for a liquidity partner, it is crucial to understand your own business model and long-term aspirations since this will drastically simplify the selection process. Many LPs, including PoPs and regular LPs, have specialised services that fit different sectors. So, before committing to any single partner, determine your needs and requirements.

The current brokerage market is booming thanks to the increased influx of retail traders across the globe. So, opening up a brokerage company promises to be a dominant strategy for startups in early 2024.

Pricing and Reputability

Running a successful brokerage is all about developing healthy profit margins to increase the scope of operations gradually. Your monthly liquidity expenses should be optimal to achieve this goal, helping you scale without budgetary constraints. The pricing package provided by LPs plays a crucial role in setting up manageable monthly expenses and formulating long-term plans with profit margins.

Many LPs have complicated pricing schedules, with numerous hidden fees which are not apparent initially. So, it is crucial to understand the entire fee scheme to avoid unpleasant surprises down the road.

Moreover, the reputation of the LP is paramount, as unreliable and shady companies could swiftly lead to bankruptcy. It is essential to check LP’s licenses, history with clients, and compliance track record.

With current online channels, conducting background checks and identifying weak spots in a liquidity provider’s reputation has become much more manageable. Remember, choosing a liquidity partner is a long-term commitment and should assessed appropriately.

Security and Cutting-Edge Technology

Finally, you should consider an LP’s technical capabilities regarding security and the digital tools they offer. Security plays a unique role in liquidity partnerships, as LP channels have a constant money flow through digital means.

So, it is imperative for LPs to employ state-of-the-art security solutions, protecting the clients’ resources and their own reserves. It’s also crucial to update security solutions regularly, catching up with the latest malicious techniques and malware.

Aside from cybersecurity, a top liquidity provider should be able to deliver complementary digital tools, including white-label solutions, analytics tools, live data feed APIs and other helpful mechanisms. As a result, your brokerage agency can avoid developing in-house solutions and bloating your business expenses.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Why PoPs are the Optimal Choice for Small and Mid-sized Agencies

Judging from the critical factors stated above, mid-sized businesses would benefit the most from partnering with Prime of Prime LPs. Before the PoP providers entered the market, mid-sized brokerages were stuck in the no man’s land equivalent of liquidity. Tier-1 providers are simply too expensive, and regular LPs can’t satisfy the increasingly complex demands of competitive brokerages.

With PoPs, brokerage asset managers can access multi-asset liquidity channels that are not limited to narrow currency pairing selections. PoPs can also broaden your operational horizons with indices, energy assets and precious metals.

Moreover, PoPs provide complex trading mechanisms for brokerages, including CFDs, margin trading options and other popular techniques. As a result, PoPs will allow smaller and medium brokerages to increase their service roster, offer more trading options and create a top-notch trading platform from scratch.

PoPs are uniquely positioned to provide such benefits with an affordable price tag, letting brokerage firms level the playing field during their initial business launch phase and continue supporting their growing needs.

PoPs are also more reputable on average since they must meet stricter partnership requirements of tier-1 liquidity firms. As a result, they must maintain a flawless track record and acquire numerous licenses, which makes PoPs a more reliable partnership option by default.

Broker’s Dilemma: Single PoP or Several LPs?

Watch B2BROKER CEO Arthur Azizov and CDO John Murillo discuss the pros and cons of working with multiple LPs versus a single Prime of Prime (PoP) liquidity provider.

Final Remarks

Selecting a dependable and trustworthy liquidity partner is a significant milestone for brokerage companies. Making the right choice here is paramount for brokerages, especially the up-and-coming startups that want to create a strong first impression on their target audience.

Aside from certain exceptions, PoPs might be your best option in this context, providing cumulative benefits that can’t be found with other types of LP partners.

With their affordable pricing, tier-1 liquidity channels, complementary digital solutions and razor-sharp spreads, PoPs will help you get a strong start in the highly competitive brokerage niche.

FAQ

Why is liquidity essential for brokerage businesses?

Liquidity partnerships are imperative for brokerage businesses, letting them provide reliable spread margins and a wide selection of currency options and dependably serve their clients in the long term.

What are the different types of liquidity partners?

There are generous choices in the LP market, including tier-1 prime brokers, market makers, Prime of Prime liquidity providers and smaller, more basic LP firms.

What is the best option for medium-sized and smaller brokerages?

Currently, the Prime of Prime LPs is the most optimal choice for up-and-coming and medium-sized brokerage firms. PoPs provide access to tier-1 liquidity and numerous complementary digital tools and accommodate the scaling needs of brokerages. These services are available at optimal prices, allowing smaller companies to maintain healthy profit margins.