How to Choose a Liquidity Bridge for Your Brokerage

Market liquidity has become a core pillar of modern trading, facilitating the growth of brokerages, exchanges and other trading outlets across the globe. The modern investment landscape is brimming with diverse choices, including forex, crypto, stocks and many other tradable assets, giving retail traders a lot of flexibility to invest on their own terms.

The current investment field provides more choices than ever before, offering diverse currency and asset classes to customers and allowing investors to create multi-asset portfolios. As an up-and-coming brokerage platform, you must meet this high standard of diversity, high-speed execution and efficiency. To achieve this goal, you must select the right liquidity bridge provider that meets your distinct needs.

Key Takeaways

- Liquidity bridges are connective technologies that link your brokerage with various liquidity channels.

- Good liquidity bridges let you offer tighter spreads, optimal prices and fast execution.

- To select a perfect liquidity bridge, you should consider pricing, reputability, technology, security and many other factors.

First Things First: What is a Liquidity Bridge?

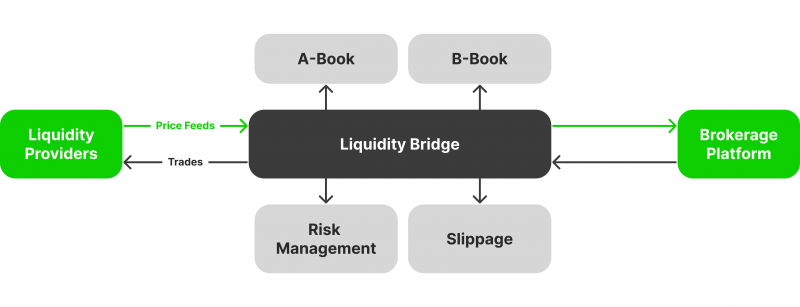

Liquidity bridges, as the name suggests, are connective protocols between the various liquidity pools of different asset classes and brokerage platforms. In the case of crypto, liquidity bridges can connect trading platforms to liquidity pools that aggregate crypto funds from investors, DeFi protocols, market makers and large exchange order books.

In the forex market, liquidity bridges can link your trading platform with multiple liquidity providers, like commercial banks, electronic communication networks (ECNs), larger forex brokers, or other financial institution entities. All of these companies include liquidity pools containing a diverse set of currency pairings with competitive pricing that will flow directly to your trading infrastructure.

Regardless of the asset class, liquidity bridges aggregate tradable assets from various sources, delivering the best possible price for brokerages and allowing them to process client requests efficiently.

When a client requests to purchase, sell or exchange a specific asset, liquidity bridges connect your brokerage platform to liquidity pools, searching for any matching orders and finding the most suitable option. As a result, your clients receive the most optimal deal on the market.

Advantages of Acquiring a Liquidity Bridge for Brokers

Liquidity bridges aren’t just essential tools for connecting your brokerage platform to a wider liquidity pool. The best liquidity bridges can enhance your trading operations on many levels, giving you an edge over your competition in terms of variety, risk mitigation and elevated flexibility to manage your brokerage platform.

Diverse Liquidity and Risk Mitigation

Liquidity bridges provide market depth to your brokerage platform, equipping you with optimal spreads on asset pairings and competitive price offerings for your clients. Moreover, liquidity bridges minimise the market manipulation risks that you may face in the case of a single liquidity provider. If the liquidity bridge includes a smart order routing system, then you can automatically route client orders to the best possible matches within available liquidity pools.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Increased Flexibility and Enhanced Efficiency

With diverse choices provided by liquidity bridges, your brokerage can set its own execution terms and workflow, no longer being dependent on a single order execution source. Some liquidity bridges also provide alerts if they detect price manipulation on financial markets, letting you eliminate unreliable liquidity channels.

Moreover, centralised access to all liquidity channels simplifies your liquidity management duties, letting you raise efficiency across the board. As a result, your brokerage will meet even the strictest client expectations related to tight spread margins, optimal prices and fast execution.

Liquidity bridges have a rare ability to connect centralised and decentralised liquidity pools, creating a greater balance across crypto markets and potentially stabilising crypto prices.

How to Select a Proper Liquidity Bridge for Your Brokerage Needs

To identify a suitable liquidity bridge for your trading environment, you must conduct due diligence when searching for liquidity bridge providers. With numerous choices on the market, the selection for liquidity bridges has never been more diverse. However, the elevated selection of choices also means saturation and the absence of clear-cut leaders in the field. So, to make a correct selection, you must consider the following aspects.

Pricing and Compatibility

Since liquidity bridges deliver your primary source of liquidity, it is crucial to have maximum compatibility with their tech stack. Integrating liquidity bridge APIs into your existing ecosystem should be easy, error-free and compatible with your digital workflow.

Pricing is arguably even more important, as liquidity bridges can range from affordable solutions to unreasonably pricey ones. It is crucial to select a liquidity bridge that accommodates your needs without excessive costs. It is also essential to double-check that your liquidity services will not contain any hidden fees or accumulated costs in the long run. Otherwise, your bottom lines might be nudged in a negative direction after acquiring a liquidity bridge.

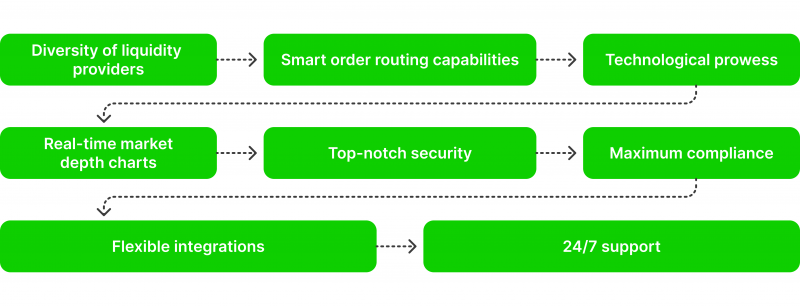

Liquidity Providers and Smart Order Routing

Access to a diverse pool of liquidity providers is critical, ensuring competitive spreads and execution for clients across various currency pairs and crypto assets. If your liquidity bridge can’t provide diverse channels, you might face the risks of market manipulation and uneven spread margins.

Smart order routing is also advised. This advanced system analyses real-time market data, intelligently routing orders to the LP, offering the most favourable terms. Smart order routing systems also work as robust risk management protocols, ensuring that your platform doesn’t experience any market exposure risks and that all your client orders are satisfied without any complications. The MT4 liquidity bridge and MT5 liquidity bridge both employ smart order routing systems in all of their operations, setting great examples of SOR integration.

Technical Prowess and Real-Time Data

Since liquidity providers act as the fuel to your operations, it is absolutely vital to ensure that liquidity bridges have almost no downtime. Any technical errors in this department could lead to unsatisfied customers and unrealised profits. Fast liquidity distribution is crucial for your success, which can only be achieved with low latency, allowing you to serve customers with minimal delay.

Scalability is another sizeable concern. As your brokerage grows, your liquidity bridge should be able to accommodate an increased amount of users and their requests without delays or complications. Liquidity bridges should also provide real-time market depth data, allowing you to understand the spreads, price quotes, and other relevant information from the market and enhancing your control over the liquidity distribution.

Security and Compliance

Liquidity bridges must be as secure as technically possible. Otherwise, your brokerage might suffer heavy losses from security breaches. So, ensure that your liquidity bridge strictly follows all the best security practices and complies with laws and regulations. Features like KYC, encryption, access controls, and penetration testing practices are essential in ensuring optimal security.

However, it is not enough to only evaluate the current capabilities of a liquidity bridge provider. It is prudent to search their history and find out if their track record doesn’t contain any questionable failures related to security or reputability.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Integration and System Support

Whether you accommodate forex trading, deal in cryptocurrencies, or sell financial instruments, it is crucial to have cutting-edge integration capabilities. Integration with various tools, APIs and systems ensures your platform can grow without roadblocks or technical delays, allowing you to scale limitlessly.

Lastly, you must ensure that liquidity bridge providers provide ample support for your technical difficulties. API technology can often be buggy and unresponsive, even with the best technology providers on the market. So, the best thing you can do is employ responsive providers and handle your problems within minutes. MT4 liquidity provider is an excellent example, serving B2B clients thoroughly and providing all the required critical support.

Final Thoughts – Adopting a Liquidity API Bridge

Adopting liquidity bridges is a no-brainer for a brokerage platform, regardless of your niche, size and unique circumstances. In today’s environment, liquidity bridges are optimal solutions that simplify liquidity distribution.

By acquiring a proper bridge, you can forget the liquidity problems. As a result, your spreads will be tighter, your asset price quotes will be optimal, and your clients will no longer experience trouble with executing orders. From crypto and forex markets to stocks and other commodities, liquidity bridges can make your brokerage operations significantly more efficient and, consequently, much more profitable!