How to Place Trades on MT5: A Detailed Guide

Navigating the complexities of financial markets can be daunting, but with the right tools and knowledge, mastering the art of trading becomes significantly more accessible. MetaTrader 5 (MT5), considered the most popular platform for Forex and crypto traders today, stands out as a multifaceted tool, offering advanced trading capabilities for novice and experienced users.

Understanding how to place trades on MT5 is fundamental for executing basic transactions and employing sophisticated trading strategies.

Key Takeaways

- MetaTrader 5 offers a wide selection of technical indicators, advanced order types, one-click trading and robots.

- Traders can practise trading safely on MT5 by opening a demo account.

- The platform allows copy trading through its Trading Signals feature.

Why Use MetaTrader 5?

MetaTrader 5 offers a range of enhancements and extended capabilities compared to its predecessor. With MT5, you benefit from more built-in technical indicators and graphical objects, enhancing your analytical capabilities.

The platform supports a comprehensive array of order types, including advanced options like buy stop limit and sell stop limit, which are not available in MetaTrader 4 (MT4). As a result, entry and exit strategies can be controlled more precisely.

The platform’s inclusion of an economic calendar and a more sophisticated order management system makes it easier to manage trades efficiently. MT5 also supports trading across a wider range of financial markets, including stocks, Forex, and commodities, making it a versatile choice for diversifying trading activities.

Moreover, MT5’s multi-threaded strategy tester and optimised code execution support more sophisticated trading algorithms and can handle larger volumes of data, which is ideal for advanced traders and institutional investors. The platform’s ability to perform simultaneous multi-currency pair-back testing significantly speeds up the evaluation of various trading approaches.

Differences from MT4

While MT4 remains a popular choice for many, particularly for Forex traders, MetaTrader 5 has been designed to meet the broader needs of the market with its ability to trade futures on MT5 and different asset classes, as well as comply with regulatory requirements like the US’s no hedging rule. Users can even trade crypto on MT5 in the form of CFDs if a broker allows it.

MT5 uses MQL5, which supports object-oriented programming and offers more built-in functions and libraries, allowing for the development of more complex and sophisticated trading tools.

Unlike MT4, MT5 does not support hedging for US traders and does not allow backward compatibility with programmes written for MT4. Due to the advanced interface and additional functionalities, traders moving from MT4 to MT5 may experience a learning curve. However, these features contribute to MT5’s capability to provide enhanced performance, better efficiency, and a more robust framework for handling the demands of modern trading environments.

The extended functionalities and advanced features of MT5 cater to a wide range of trading activities and strategies, making it a superior platform for traders looking to leverage technological advancements for improved trading outcomes.

How to Start Safely?

One of the best ways to get familiar with MT5 and its features is by using a demo account. This allows traders to practise and test their strategies with virtual funds without risking real money. A demo account also provides access to the full range of features and functionalities of MT5, allowing traders to explore all its capabilities before committing to a live account.

How to Trade on MT5 Demo Account?

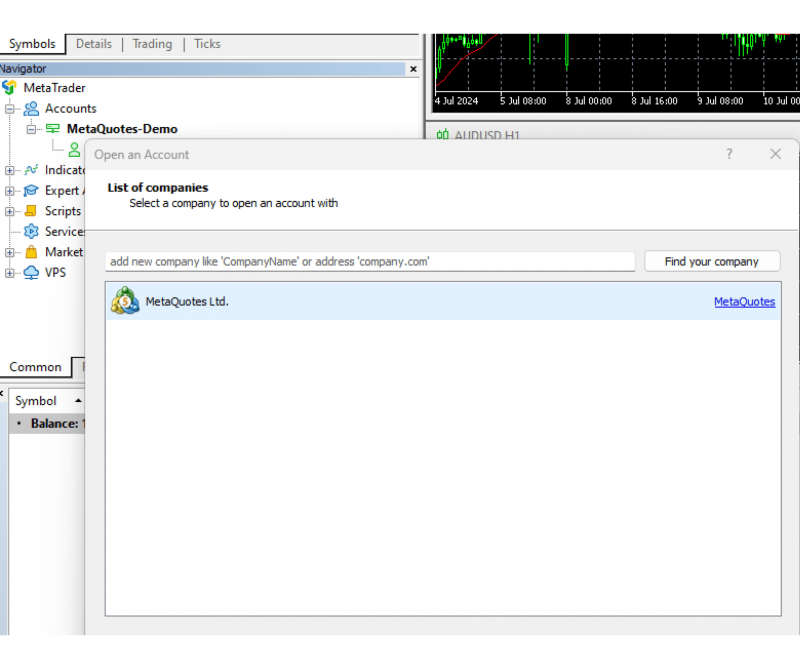

Opening such an account is fairly easy with the MetaTrader platform. To do that, go to the Navigator menu, right-click on the Accounts and select Open an Account.

From here, choose the Demo option and fill in the required details. Once you’ve completed this process, you will receive login credentials to access your demo account, which can then be used on both desktop and mobile versions of MT5.

Using a demo account allows traders to test out different strategies, familiarise themselves with the platform’s features and functions, and gain confidence before transitioning to live trading. It also allows for comparison with other trading platforms, helping traders make informed decisions about their preferred platform.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Step-by-Step Trade Placement

So, how do you actually place trades on MT5? Follow these simple steps to get started:

Selecting a Trading Instrument

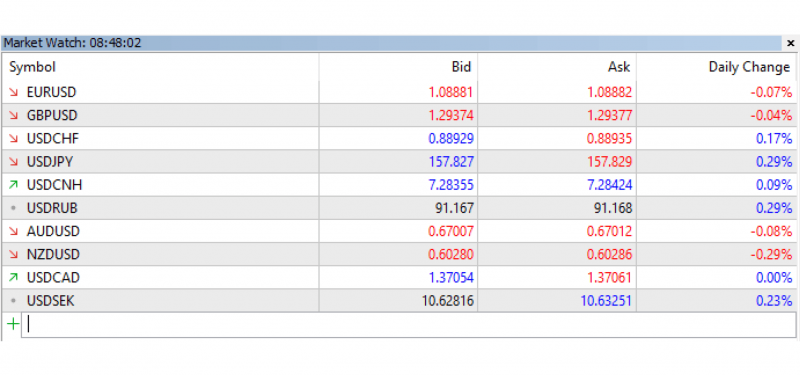

To begin trading on MT5, you first need to select the financial instrument you wish to trade, which can be done by navigating to the ‘Market Watch’ window.

This section is placed in the top-left corner of the trading terminal by default. If you don’t have this window, you can click on ‘View’ and activate it or use the shortcut CTRL+M to bring up the Market Watch. From there, you can add your own trading instruments or choose from those available.

To place the instrument chart on your screen, simply click and drag your chosen asset or a specific stock onto the trading screen. You can trade different asset classes on the platform, and you can even learn how to trade gold on MT5.

Opening the Order Window

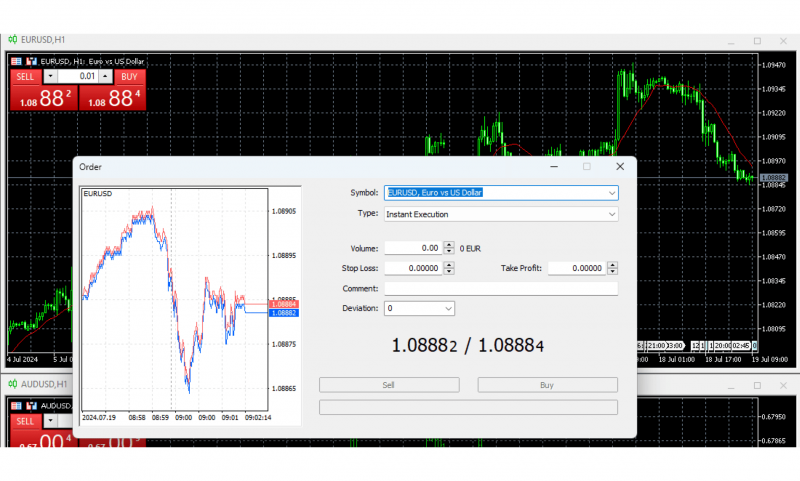

After selecting your desired instrument, the next step is to open the order window to initiate a trade. You can open a new order by clicking the ‘New Order’ button on the toolbar or by right-clicking the selected instrument in the Market Watch window and choosing ‘New Order’. Alternatively, you can press the F9 key, which automatically inserts the selected symbol into the order window based on your platform settings.

Setting Trade Parameters

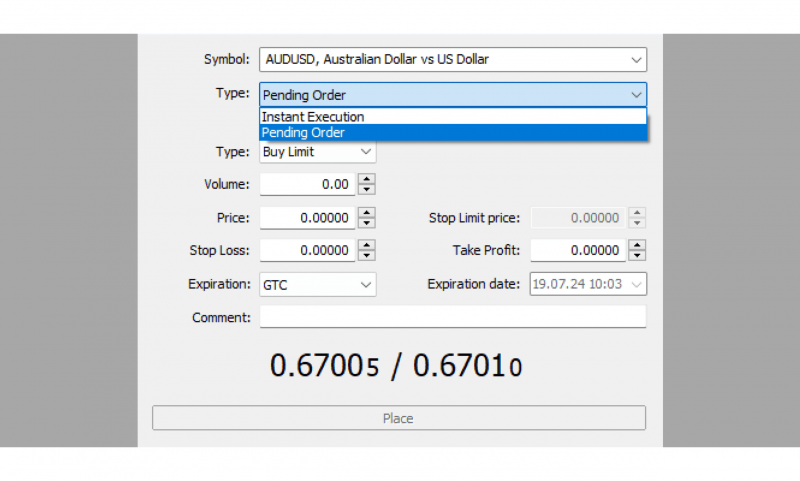

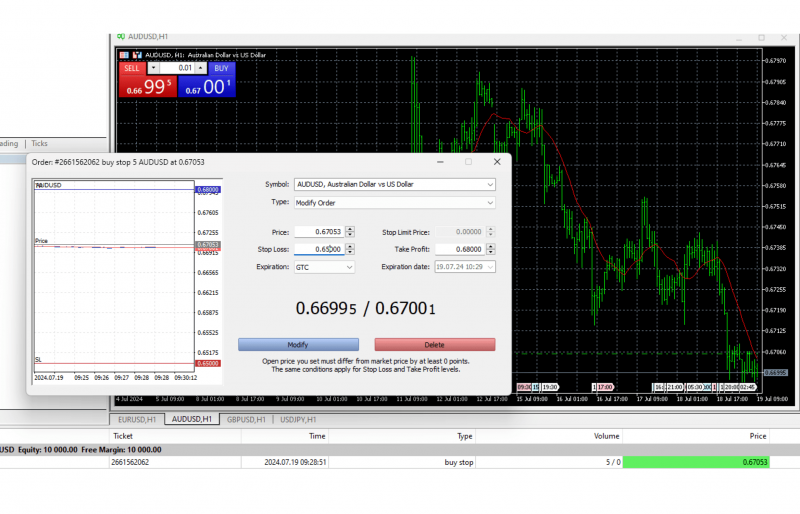

In the ‘New Order’ window, several trade parameters need to be set to tailor the trade to your strategies and risk management preferences. These parameters include selecting the trade volume or lot size, choosing the order type (such as market order, or ‘Instant Execution’, and Pending Order), and setting stop loss and take-profit levels if desired. You also have the option to specify additional parameters like order expiration and to review all details before confirming the trade.

To place pending orders directly from the chart, position your mouse cursor at the desired price level and execute the appropriate command from the chart context menu. This menu offers different order types based on the cursor’s position relative to the current price, ensuring you place the correct order type for your trading strategy.

For instance, if activated above the current price, options like ‘sell limit’ and ‘buy stop’ become available, while below the current price, you can select ‘buy limit’ or ‘sell stop’.

How to Close Trade on MT5?

The MT5 platform offers real-time access to global news and an economic calendar for monitoring market trends as a dedicated feature.

Utilising MT5’s Advanced Features

As mentioned previously, MT5 offers advanced features and functionalities that can significantly enhance your trading experience. Some of these include:

One-Click Trading

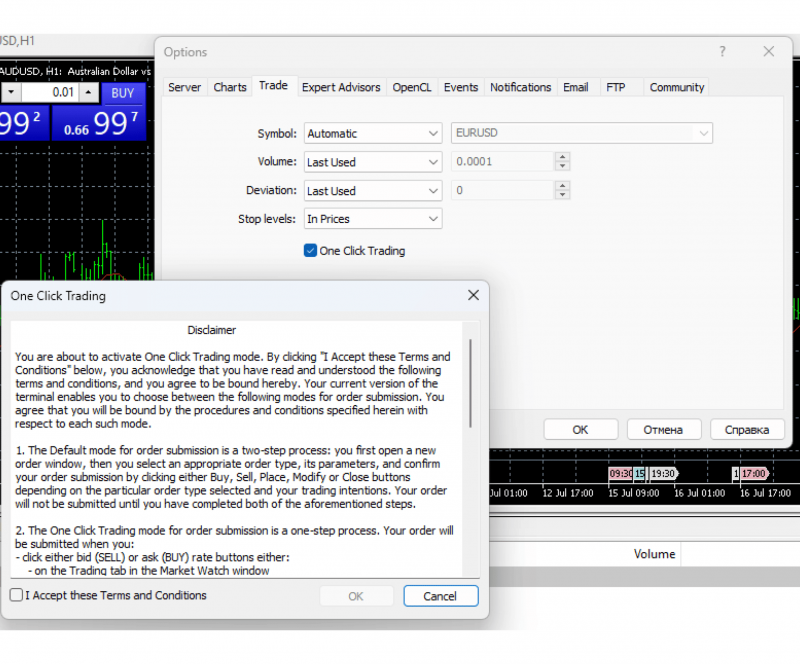

One-Click Trading on MT5 enhances your trading speed and efficiency, allowing you to execute trades with a single click without additional confirmation dialogues. It can be useful for strategies such as day trading and scalping, where speed is of the essence.

To activate One-Click Trading, navigate to Tools, select Options, and then the Trade tab. Once enabled, you can instantly place buy or sell orders directly from the chart window or the Market Watch.

Market Depth

The Market Depth feature on MT5 displays real-time bids and asks for a financial instrument, providing a detailed view of market liquidity. This tool is invaluable for assessing how large orders would influence the market price, particularly in liquid markets like Forex.

The Depth of Market (DOM) window allows you to place trades directly, either through market execution or by setting pending orders at your desired price levels. For securities traded on exchanges, it reflects actual prices and volumes, while for OTC instruments, it shows broker quotes, which can vary.

To activate this window, simply choose an instrument and click ALT+B. Alternatively, you can navigate to Charts on the top menu and choose the DOM from here.

Automated Trading

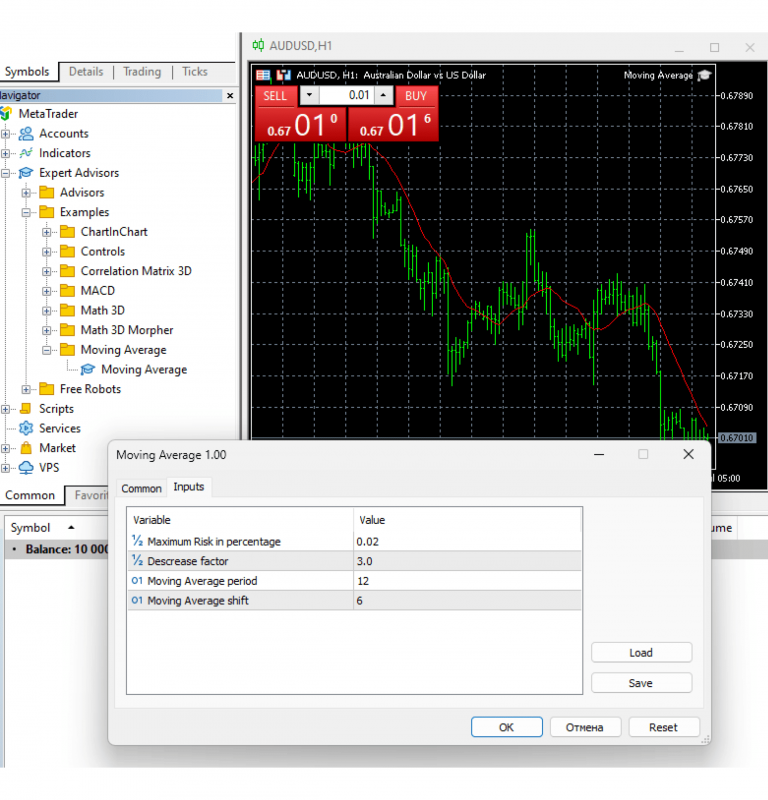

Automated Trading on MT5, facilitated by robots, allows for round-the-clock trading without manual intervention. The integrated development environment, MQL5 IDE, supports the creation, testing, and execution of market strategies.

Even if you lack programming skills, you can access a vast array of ready-made robots and indicators from the MetaTrader Market or the MQL5 community. These tools can automatically execute trades based on predefined criteria, ensuring you never miss a profitable opportunity.

There are two types of automated applications available on MT5:

- Trading robots, also known as Expert Advisors, are programs designed to perform trading operations automatically. They can be attached to a chart and programmed to execute trades based on predefined criteria without the need for manual intervention.

- On the other hand, indicators are tools used for price analysis and identifying patterns in price changes. They can be used directly in trading robots to form a complete automated trading system or utilised independently by traders for manual strategies.

Regardless of whether you are using a Forex or stock trading robot or an indicator, the process for running them on MT5 remains the same. To start a robot, simply attach it to a chart by double-clicking on it in the Navigator window or dragging and dropping it onto a chart. This will bring up the Expert Advisor Properties window, where you can adjust settings and click “OK” to start the program.

Monitoring and Adjusting Trades

After placing a trade on MT5, it is essential to monitor and adjust it as needed to optimise your trading outcomes:

Tracking Performance

To effectively monitor and adjust trades on MetaTrader 5, tracking your trading performance is crucial. Utilising platforms like Fxmerge, you can connect your MT5 accounts and access comprehensive statistics that are automatically downloaded from your retail investor accounts.

Through this integration, your trading results can be analysed in just a few minutes due to the user-friendly data presentation. Additionally, the accessibility of this data on various devices, including smartphones and tablets, ensures that you can review your Forex trading results anytime, optimising your investment strategy and time management.

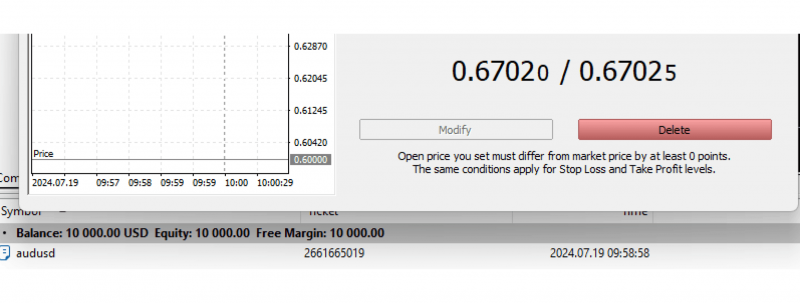

Adjusting Stop Loss and Take Profit

Adjusting your stop losses and take profits can significantly impact your trading results. You can modify orders directly on the chart by right-clicking on the existing order, selecting ‘Modify’, and then adjusting to your new targets. This feature not only enhances the flexibility of order management but also aids in swiftly and efficiently implementing strategic decisions.

Partially Closing Positions

Partially closing trades, also known as scaling out, is a strategic approach used by traders to secure profits or mitigate losses as market conditions evolve. By setting multiple targets, you can gradually reduce your position, locking in profits while potentially capturing further gains with the remaining position.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

For instance, you might decide to close a percentage of your position at each predefined target, using a trailing stop to safeguard any accrued profits while leaving room for additional gains. This tactic secures earnings and provides flexibility in handling trades according to market dynamics.

How to Copy Trade on MT5?

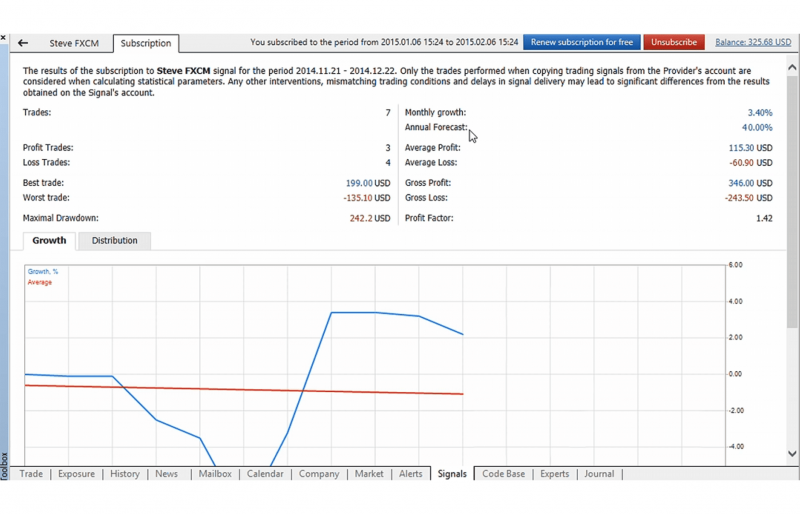

The feature, known as Trading Signals, allows MT5 users to subscribe to signals from experienced traders and automatically copy their orders on their own account. By connecting with professionals, you can learn their strategies and potentially achieve the same success without manually monitoring and adjusting your own trades.

Here’s how to copy trade on MT5:

Log in to the MQL5 account.

To access the Signals, make sure you are logged in to your MQL5 community account. Without this account, you won’t be able to access the Signals feature.

Select the Signals tab and browse through available signal providers.

In the Navigator window, click on the Signals tab to see a list of signal providers. Review their performance statistics and trading strategies before selecting one that aligns with your trading style and preferences.

Subscribe to a chosen signal provider by completing the subscription process.

Once you select a suitable signal provider, click Subscribe to begin the subscription process. This will require an active MT5 trading account, a valid MQL5.com account, and sufficient funds on the MQL5 account with an added bank card/e-wallet for payment.

Conclusion

From the initial steps of selecting an instrument and placing orders to leveraging more advanced features like One-Click Trading and Expert Advisors, MT5 has proven itself as a comprehensive tool for contemporary trading demands.

By integrating sophisticated trading techniques and continuously evaluating performance through platforms like Fxmerge, traders are better positioned to navigate the complexities of the financial markets with confidence and precision.

FAQ

How to view trades on MT5 PC?

If you’re using a PC, go to the “Toolbox” window at the bottom of the screen and click on the “History” tab. You will see a list of all your closed trades linked to your trading account there. In case you can’t see the terminal, you can press “Ctrl + T” or navigate to the “View” menu and select “Toolbox”.

How to clear trade history on MT5?

There is no direct solution for clearing your trade history on MT5. However, you can create a new account and transfer your funds to start with a clean slate.

Why can't I place a trade on MT5?

If the ‘New Order’ button is greyed out and inactive on your MT5 terminal, it’s likely because the minimum first-time deposit has not been processed on your trading account. Once this deposit is processed, the New Order button will be activated, allowing you to begin trading.

Why are my trades being rejected on MT5?

If you encounter issues with your trades being rejected on MT5, it could be due to several reasons. One common cause is a poor internet connection or technical glitches that disrupt the connection between your device and the trading host. To resolve this, try restarting your MT console and ensuring a stable internet connection.