How to Start Binary Options Broker – Step-by-Step Guide

The possibilities in the trading world are endless. You can almost create any business that offers investment opportunities or income generation in the financial market context and make considerable money from it.

Binary options trading brokerage firms offer an easy way for trading enthusiasts to make money from speculating in the market. Many consider binary trading more direct than keeping an investment position and making buy/sell decisions.

The Binary options market has had many ups and downs but has become more regulated and streamlined. Investors and speculators are more interested in these trading options, meaning there is much money for grabs. Let’s discuss how you can become a binary options broker in more detail.

Key Takeaways

- Binary options are financial instruments where traders can win or lose their money by predicting the asset’s future price.

- Becoming a binary options broker can be lucrative because of the facilitated access and the increasing number of traders.

- Binary options are cash-or-nothing, asset-or-nothing, one-touch, no-touch, double one-touch/no-touch, and range binary options.

- Binary options brokerages earn money from commission fees, account services, premium subscriptions, and IBs.

How Binary Options Trading Works

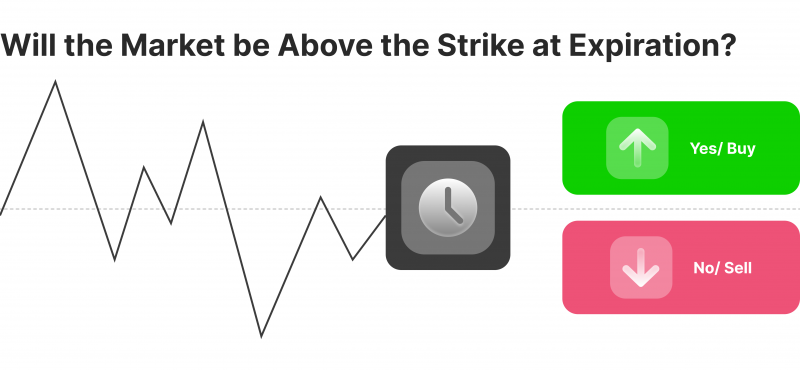

Binary options trading is a type of investment in which traders speculate on the underlying asset’s potential price. The binary options broker sets the strike price, and participants “bet” whether the market price will go above or below that level.

This type of investment needs less maintenance than regular trading markets, which require looking at charts, executing orders, and analysing the overall market and other factors. In contrast, binary options entail putting money on potential predictions and waiting for the expiration date to determine whether the investment is a winner or a loser.

The brokerage platform determines the time frame for each binary option contract, which can range from a few minutes to weeks. Traders must optimise their binary options trading strategy to determine trend movements and potential price direction.

The drawback of trading with binary options is that incorrect predictions lead to total investment loss. On the other hand, if a trader gets the prediction right, they receive a percentage defined by the binary options broker or a fractional investment in the underlying asset.

Binary options are strictly regulated now due to increased scam activities and illegal operators offering illegitimate services without genuine payouts.

Binary options originally started in the 1970s when the Commodity Futures Trading Commission was founded. However, in 2008, the Chicago Board Options Exchange (CBOE) made it officially available for exchanges.

Starting a Binary Options Brokerage

Becoming a binary options broker allows you to capitalise on the increasing number of participants who want to make income from the financial market without the hassle of a regular brokerage account.

Launching binary options brokerage requires a comprehensive knowledge of trading markets and a solid infrastructure to offer the most demanded assets at competitive rates and returns.

However, you must ensure full legal compliance, a good reputation, and personalised services to boost investor confidence and build customer trust. Creating a customer-oriented business model and acquiring relevant permits is crucial in light of an increasing number of illegal brokers.

Types of Binary Options

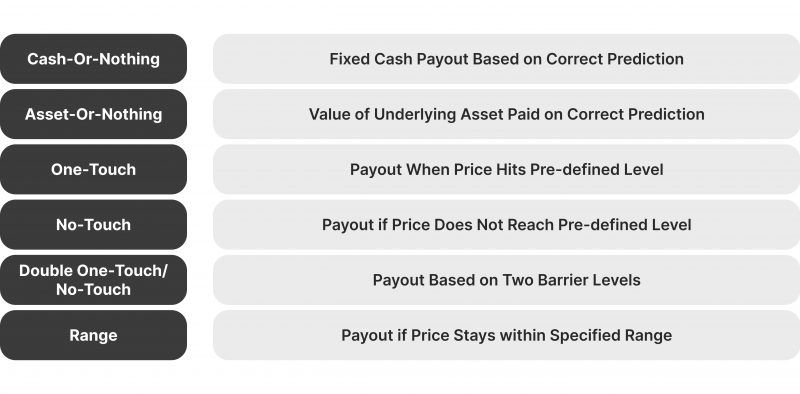

Most binary options brokers offer two types of principal contracts: asset-or-nothing and cash-or-nothing. Others extend the list to one-touch, no-touch, double one-touch/no-touch, and range binary options. Let’s explain how they work.

- Cash-or-nothing offers a fixed reward determined by the broker if the prediction is correct. Otherwise, they lose their investment.

- Asset-or-nothing offers the value of the subject security if the prediction is correct. Otherwise, the trader loses the investment.

- One-touch binary options deliver the determined payout when the asset reaches the strike price at any point before expiration.

- No-touch binary options offer payouts if the asset never reaches the strike price before the expiration date.

- The double one-touch/no-touch puts two touch/no-touch levels that must be reached/not reached to deliver the payout.

- Range binary options are achieved if the asset stays within the determined price range until the principal contract expires.

What Assets a Binary Options Broker Offers

Typically, a broker for binary options can offer any financial instrument to wager on and speculate on their future performance. However, there are selected assets that most brokerage firms offer. These include:

- Forex: EUR/USD and GBP/USD are famous currency pairs in binary options due to their massive trading volume.

- Stocks: Blue-chip companies like Amazon, Apple and Google are well-known binary options, given their volume and growth.

- Indices: S&P 500, Nikkei 225, and FTSE 100 are common binary options because they significantly influence the stock market.

- Commodities: Crude oil, gas, gold and silver are reliable binary options given their popularity and significant growth over the years.

- Cryptocurrencies: The increasing popularity of virtual coins makes them inevitable binary options, especially Bitcoin.

How Binary Options Brokerages Make Money

Similar to other financial brokerage businesses, a binary options broker makes money by charging percentages and fees for every transaction. They can also earn income by losing investors’ funds and offering various services.

Commissions

Binary options brokerage firms earn money from traders’ transactions, including deposits and withdrawals. They also get their cut from winning and losing binary trades placed by users, which can be fixed amounts or proportional payments.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Brokers can also charge commissions on other trading activities, such as executing market orders. These percentages can start from 10% on small trades and even lower rates on high-volume market positions.

Account Management

Brokers can offer various account types, such as VIP accounts, which have lower commission fees but require annual or monthly payments. Related fees include dormant accounts, yearly account maintenance, and margin account fees.

Premium Subscriptions

Binary options trading brokers may offer a subscription model in which the trader receives advanced analytics, a technical toolkit, and charting options. These may include financial advisors or binary option signals to improve the user’s chances.

Affiliate Partnerships

Running affiliate programs can help convert more customers into the binary options trading platform. Although brokers must pay a percentage to their affiliates, they receive qualified leads at almost zero marketing efforts.

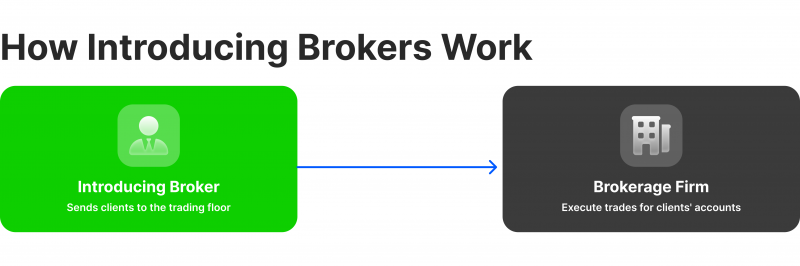

Introducing Brokers

IB is a renowned affiliate program in which an entity or a trader introduces qualified investors to a binary options brokerage. Most IBs build relations with multimillionaires who execute huge-volume trades, offering significant returns for the binary options broker.

This practice is crucial for startups and new brokerage firms who want to land as many investors and wealthy users as possible.

Step-by-step: Create Your Own Binary Options Brokerage

Launching a binary options brokerage firm can be challenging because you must prepare for extensive compliance paperwork. However, once you build a solid user base, the business can be highly lucrative with the increasing number of market participants. Here’s how you can start.

Plan Your Costs

Your business budget depends on your platform’s size and target market. You can open a binary options brokerage with an investment of $500,000 to $2,000,000 if you want to establish a binary options brokerage from scratch. Some jurisdictions might require minimum operational capital, depending on your location.

Building a technological infrastructure is costly and lengthy because developing an interactive and fast-executing platform can take up to 12 months. The technological development cost can start from $100,000, depending on how comprehensive your services are and the services you offer.

Instead, you can hire white label development services to integrate a ready-to-use system, which you can re-brand and fine-tune to meet your business objectives.

If your jurisdiction requires it, you might also have to pay compliance fees. These costs include application fees, regular auditing, and legal consulting.

Other miscellaneous costs include office equipment, fixtures, cloud hosting, cybersecurity, wages, and, most importantly, marketing your brokerage platform.

Find a Reliable Partner

Look for a technology partner to power your binary option software with fast execution, top-notch user privacy, secure protocols, and a personalised customer experience. You can use turnkey solution binary options providers to connect your platform with a suitable trading system.

You must consider the provider’s legitimacy, compliance and reliability to offer 24/7 services to your customers. Ensure a solid liquidity stream and supply of binary trading assets to avoid slippage and offer smooth withdrawal processes.

After integrating the tech provider into your platform, keep monitoring the API connections and network performance to avoid unexpected outages.

Ensure Legal Compliance

Acquaint yourself with the legal environment and frameworks. The requirements differ between jurisdictions, and you must obtain a brokerage license to offer legal financial services.

Typical procedures include preparing the license application and involving your operational capital, budget, experience, and infrastructure. You might also need to submit the organisational chart and undergo background checks for top-level personnel.

Some jurisdictions might require a complete business plan to check your profitability model and protect investors’ rights. You will also need to demonstrate full compliance with anti-money laundering and KYC procedures, whether internal or using third-party KYC providers.

The application process might take 3 to 12 months, and you must stay current with the developing financial regulations.

Build Your Business Model

Develop your core business operations, including how you will make money, how the user onboarding process will go, and your risk-mitigation strategies. Usually, the best binary options brokers offer contracts across Forex, stocks, indices, commodities and cryptos to attract investors from different industries and experiences.

Focus on the new user onboarding process. It is important to make this procedure intuitive, interactive and simple to avoid confusion and minimise your traders’ time-to-start.

Most importantly, set up a contingency plan to prepare for unexpected events, like dramatic market shifts, liquidity interruptions and other risks.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Generate Traffic

Craft your marketing strategy and how you will attract customers to your platform. This process requires creating sales funnels, e-mail marketing, social media engagement, SEO optimisation, monetary incentives, referral networks and other promotional programs that encourage investors to register on your platform.

Work on strategies to maintain customer retention, such as loyalty programs, weekly raffles, and other bonuses for existing traders.

Ensure Top-Notch Security

Building a robust system is essential for binary options trading platforms, where investors deposit and store their investment budgets and earnings. Therefore, integrate top-notch security protocols and firewalls to combat hacks and cyber attacks.

Use segregated accounts to store traders’ funds off the internet and use sophisticated cybersecurity tools to scan for malware and vulnerabilities and resolve them promptly.

Offer crypto deposits to promote user privacy and minimise the chance of leaking user information and financial data online. Implementing top security practices is crucial to boost user retention, where investors’ funds are safe and secure.

Conclusion

Binary options are financial instruments that allow investors to earn money by predicting the future price changes of certain assets. Binary options brokers set a strike price for a given security, and traders must decide whether the asset’s value will be above or below that level.

Trading with binary options has become strictly regulated. Therefore, starting a binary options brokerage entails thorough legal compliance and licensing that spur investor confidence and attract more investors to your business.

Operating a binary options business can be lucrative because there are many ways to generate income from commissions, account management, affiliate programs, premium technical analysis and the increasing number of market participants.

FAQ

How to launch a binary options platform?

Familiarise yourself with the legal environment in your country and acquire the required licenses to offer brokerage services. Find a technology partner to build your platform and integrate trading software. Then, start generating traffic and launch your platform.

Is binary trading legal in the US?

Yes. Although binary options brokerage firms are strictly regulated and must be offered by a registered exchange with the SEC.

Is binary options trading suitable for beginners?

It is relatively easy to trade binary options because investors only need to choose one of two alternatives, whether above or below the strike price.

What are the risks of binary options trading?

Binary options are risky because, unlike traditional trading, investors can potentially lose their capital if their predictions are wrong, whereas, in financial markets, traders lose a fraction of their equity.