Portfolio Asset Allocation – How to Maximise Your Returns?

Succeeding in the trading industry requires advanced analytics, experience and knowledge. The combination of these skills can birth a highly profitable trader. Investors, regardless of their expertise, must carefully analyse and plan their trading portfolio.

The competition in the financial market is becoming highly intense, with more assets becoming available and lowered entry barriers. This means more participants share the market revenue, necessitating crafting the best portfolio asset allocation method that ensures longevity and profitability.

Looking for ideas to optimise your investments and trading style? Let’s review how to create a successful portfolio that brings income, balanced risk and potential growth.

Key Takeaways

- Portfolio asset allocation refers to distributing an investor’s capital over several securities to achieve balanced returns.

- Most asset allocation strategies focus on income, balance, or growth, depending on the investor’s age, time and risk tolerance.

- There is no one-size-fits-all approach to investment allocation. A trader must decide based on investing strategy and financial goals.

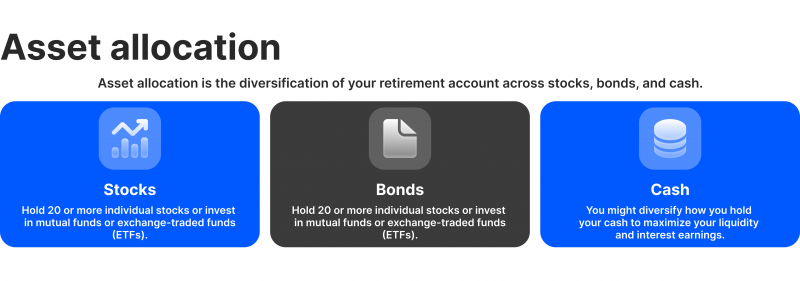

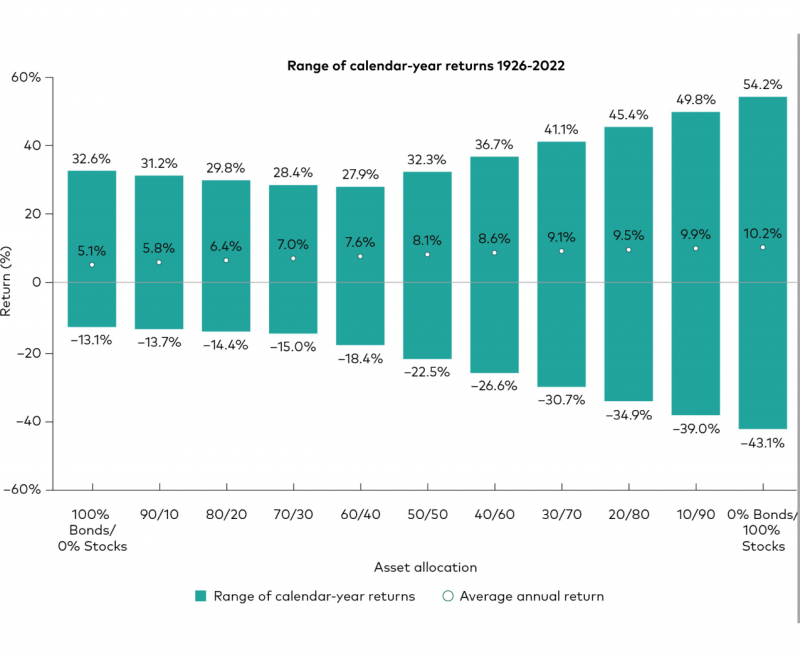

- Most allocation methods include stocks, bonds and money markets, whereas stocks bring the highest returns at high risks, while bonds and cash investments bring balanced returns.

What is Asset Allocation?

Portfolio asset allocation refers to the distribution of an investment basket in a controlled and thoughtful manner to help the trader reach their financial goals.

This means allocating tradeable securities and asset classes in a certain way that increases the investor’s profitability and sustainability, taking into account the risk tolerance, age and market conditions.

Investors must continuously track their investment portfolio and update it according to market volatility, changing risk levels and realised returns.

For example, a trader might allocate 75% to the stock market, 10% money market and 15% to bonds. Is this a successful investment portfolio asset allocation? It depends on the asset choice, duration and financial target.

Why is Portfolio Asset Allocation Important?

This approach resonates with the old saying, “Do not put all your eggs in one basket”, because the financial market is highly dynamic. One declining market usually means that another asset class is thriving.

For example, a declining US Dollar performance is usually associated with a growing gold, as investors shift their investments in the money market to a more stable asset, such as gold.

Portfolio asset allocation is also vital to hedge against risky market positions. For example, investing in currencies can bring higher returns than bonds. However, the Forex market is highly volatile, while bonds yield moderate returns with better stability.

Investment Portfolio Asset Classes

Currencies, stocks and bonds are classic financial instruments that investors use to create a balanced investment portfolio.

The cash, or money market, is a short-term investment that offers moderate returns for beginner investors. They work similarly to saving accounts, where a user deposits funds in a money market account according to a predetermined minimum amount. The capital is invested in treasury and commercial bills for one year and 270 days, respectively.

Bonds are securities issued by governments or established financial organisations used to control the institutional cash flow. These bonds have fixed interest revenues, where the trader earns payments as stated in the bond contract. Therefore, these assets are not subject to market fluctuations but can bring insignificant gains.

Stocks, or equities, are more profitable in the long term. The growth rate of these investments depends on the industry and whether the stock pays dividends. Experts advise holding stocks for approximately five years to realise noticeable gains. These assets usually comprise the majority of an investor’s portfolio because they yield higher profits.

Subclasses You Must Know About

The aforementioned asset classes have sub-categories that experienced traders use to fine-tune their portfolios. These include:

- Small-cap stocks: Companies with a market capitalisation of less than $2 billion. These shares have relatively low liquidity, which makes them riskier, but they have a higher growth rate.

- Medium-cap stocks: Companies with market capitalisation between $2 billion and $10 billion. These bring a moderate risk-profitability balance.

- High-cap stocks: Companies with market capitalisation over $10 billion. These blue-chip stocks offer low growth rates but are highly liquid and stable.

- International securities: These are stocks and securities issued by foreign entities and listed on foreign exchange markets.

- Fixed-income securities: Government and corporate bonds that offer fixed interest payments periodically, besides paying the principal back at the maturity date. These securities offer low volatility, low risk and stable income.

- Emerging markets: These are assets issued by entities in developing countries. Emerging markets offer high potential returns but are highly risky due to their economic uncertainty.

- Money market: These are short-term investments that work similarly to traditional banks’ saving accounts. However, they offer improved interest rates in the short term.

- Real estate investment trusts: REITs are pools of real estate and mortgage investments that offer flexible returns.

Three Asset Allocation Models

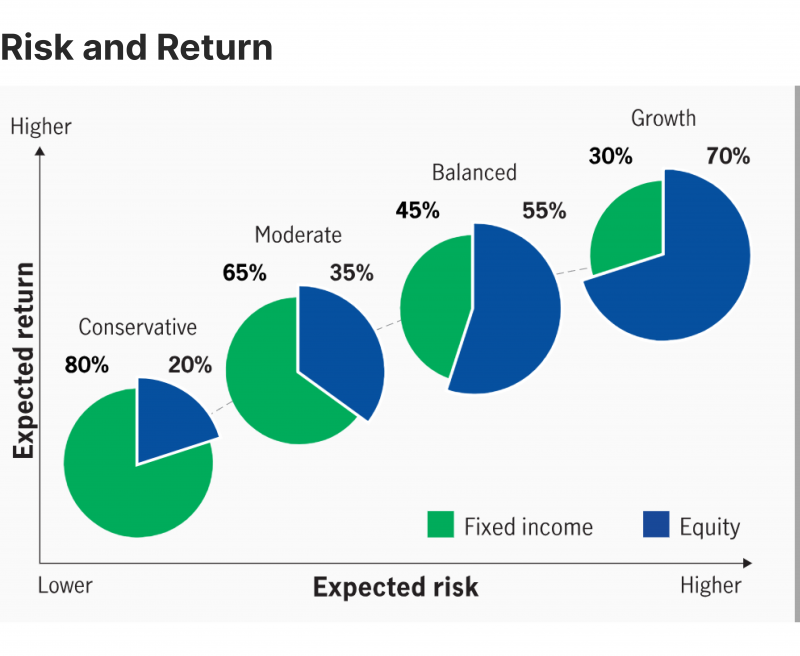

The portfolio allocation strategies rely on three basic concepts. These are income, balance, and growth. Investors manipulate the proportions in asset allocation to create the best strategy that suits their objectives.

Income Portfolio

This approach focuses on maximising revenues. Investors use dividend-paying equities and coupon-yielding bonds. Dividends are payments that shareholders receive as part of the company’s profits. Shareholder’s dividends are issued monthly, quarterly, or semiannually per share.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Coupon-yielding bonds are treasuries that pay holders fixed amounts monthly or quarterly until maturity. These assets suit investors who want to increase their profitability in a short time.

Balance Portfolio

As the name suggests, the balanced asset allocation combines bonds and stocks to minimise volatility and focus on stability. Investors in this category focus on long-term gains regardless of short-term price fluctuations and have a long-range investment horizon.

This portfolio strategy suits investors working on their retirement plans and wants to have sufficient capital for many years.

Growth Portfolio

This asset allocation strategy is for long-term investors. It focuses on blue-chip companies and stable stocks that can potentially grow largely over many years coming. These shares can possibly fluctuate widely in short-term dynamics, but the trader does not focus on current gains.

Traders follow this approach to fund a significant purchase in the future, such as a retirement house or an around-the-world trip. Investors are more likely to realise these gains in five years, at least.

Investors use online asset allocation platforms and software to streamline their investments and manage their funds more efficiently. Quicken is the oldest software (est. 1982), while others include ShareSight, Kubera, SigFig and MorningStar Investor.

Age-Based Portfolio Asset Allocation

The asset allocation by age implies planning the stock-bond combination based on the investor’s age and retirement plan. It finds the best percentage of each asset class in a way that maximises the profits from shares by the retirement age.

As a rule of thumb, a trader would subtract their current age from 100 to find the optimum equities allocation. A 35-year-old investor would allocate 65% of the portfolio for shares, including small-to-large cap shares and dividend-paying stocks.

The remaining 35% of the investment portfolio goes to bonds or between bonds and money markets.

Life-Cycle Portfolio Asset Allocation

The life-cycle portfolio allocation seems similar to the age-based strategy. However, it focuses on age, risk tolerance and financial goals.

Also known as the target-date asset allocation, it continuously adjusts the allocation percentages as the investor nears retirement. Eventually, this strategy lowers the risk factor and invests in more stable securities.

Investment corporations issue preset life-cycle allocation plans per retirement age. For example, the Vanguard 2030 fund targets people expecting to leave the labour market by 2030. This investment portfolio includes 63% stocks, 36% bonds, and 1% short-term reserves.

All Weather Portfolio Asset Allocation

The all-weather portfolio planning is an asset allocation strategy that works regardless of the market conditions. As such, a trader can maintain profitability during bull and bear markets despite occasional price actions.

This strategy was developed by the US investor and hedge fund manager Ray Dalio, who created a portfolio that works during market growth and recession.

This allocation approach provides an equal balance between most asset classes, comprising 30% US stocks, 40% long-term bonds, 15% intermediate-term bonds, 7.5% gold, and 7.5% commodities. Combining these securities can presumably offer stable gains over time.

Constant-Weighting Asset Allocation

The constant-weighting allocation requires the trader to update the portfolio’s proportional distribution between assets.

For example, if an investor’s capital is $10,000, and they allocated 90% for stocks and 10% for bonds. It means they invest $9,000 and $1,000 respectively.

A few months later, if the equities value drops to $8,500 and bonds rise to $1,500, the allocation is now 85% for shares and 15% for bonds. Therefore, the trader would buy more shares and sell treasuries to maintain the original balance of 90/10. Some investors prefer leaving a buffer of 5% to accommodate market dynamics, not to buy and sell for every 2% or 3% allocation change.

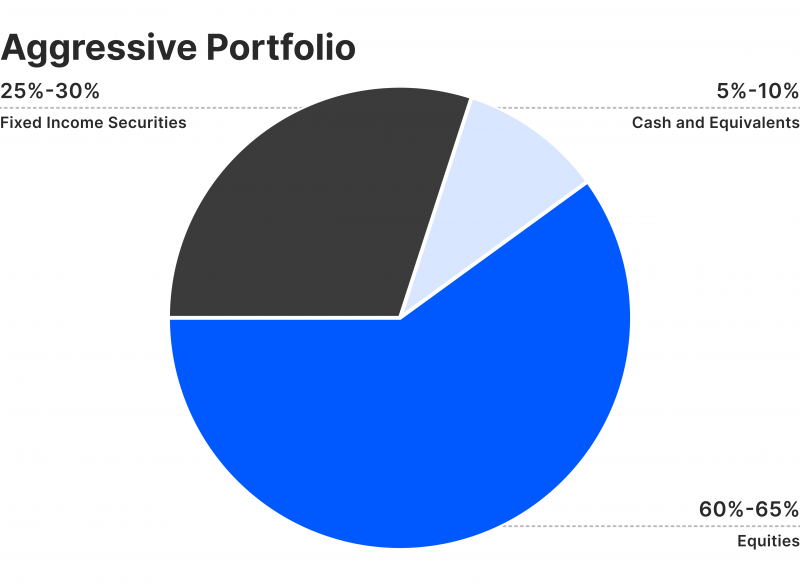

Aggressive Portfolio Allocation

The aggressive allocation is a growth-focused strategy that aims to capitalise on gains from blue-chip stocks in the long term.

A trader following an aggressive approach invests mostly in shares that generate significant and stable returns for upcoming years. This strategy also includes fixed-income securities, such as money market investments and government bonds.

This strategy’s aggressiveness varies between moderately aggressive and very aggressive. An increased market aggressiveness entails 80-100% stock allocation, while a moderate approach limits the stock investments to 60-70%.

Tactical Portfolio Asset Allocation

Tactical asset allocation means identifying market momentum and exceptional opportunities and making timely decisions to maximise gains using short-term and long-term investments.

In this approach, a trader would run a long-term-focused portfolio consisting of stocks and bonds. However, when sudden opportunities arise, such as sharp increases in pharmaceutical stocks or significant declines in automotive. The trader quickly purchases these stocks to capitalise on gain opportunities before reverting to the long-term strategy.

This approach requires careful analysis and advanced market knowledge to make timely and accurate decisions.

Dynamic Portfolio Asset Allocation

This approach requires market assessment and decision-making based on current updates. Unlike other strategies that include a target allocation and constant changes to maintain proportional investment, dynamic asset allocation requires coping with growing and declining markets.

For example, if the tech stocks are declining, the trader would switch from long to short positions to gain from decreasing market values. Simultaneously, a trader would buy increasing stocks. The investor would repeat this dynamic asset shifting to maximise their gains.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Insured Investment Asset Allocation

The insured asset allocation strategy creates a risk-free base with alternative securities that maximise the investor’s returns. This approach establishes a minimum return level that traders must always maintain.

As long as the threshold is achieved, the investor can seek opportunities in mixed-risk assets and markets, utilising market analysis, risk assessment and financial consulting. If the portfolio’s value drops below the base level, the investor buys more low-risk securities, such as bonds and T-bills, to reach the minimum level.

This approach is suitable for long-term investors and those who want to take calculated risks while attaining a comfortable level of returns.

Integrated Asset Allocation Method

The integrated asset allocation model factors the market potential gains and trader’s risk tolerance. This way, the trader invests in securities that maximise their profits while taking age and risk into account.

For example, investors nearing retirement take fewer risks and invest less in stocks regardless of their return projections. This method integrates the investor’s risk appetite to make market judgements.

This method works against strategic asset allocation, for instance, which focuses on shifting investments according to market changes to chase gains because it may carry potential risks.

Plan Your Asset Allocation and Portfolio Construction

Investors, beginners and professionals use portfolio asset allocation tools to manage their capital and ensure returns that align with their goals. Otherwise, randomly investing without a structure can expose the trader to significant risks, especially during unexpected market events.

Here’s how you can build your investment portfolio.

- Determine your objectives: Set your financial goals. Whether you want to achieve a comfortable retirement, own a property, buy a car or go for a vacation. Defining your goals helps you find the best asset allocation model that maximises your gains timely.

- Identify your risk tolerance: Understand the types of risks that exist and how much you can tolerate with each investment. This varies according to your goal, age and allocation model.

- Select your investment time horizon: 5, 10, or 20-year investments have different approaches. Therefore, it is important to determine how quickly you want to achieve these goals.

- Analyse your asset allocation: Research and analyse each market and asset class before investing. Find the right balance between bonds, equities and cash investments in your portfolio.

- Choose your investments: After finding the right portfolio allocation percentages. Determine the financial instruments you want to invest in. Ensure you understand how each market moves.

- Oversee and update your portfolio: Use a Backtest portfolio asset allocation tool beforehand to assess the expected returns and validate your strategy. Launch your investment portfolio and regularly rebalance your assets to maintain your returns.

Conclusion

The portfolio asset allocation strategy dictates how investors distribute their capital proportionally between tradeable securities. Financial instruments have different risk levels, rates of return, and longevity, which investors manipulate to balance their investing portfolio in a way that maximises their profits and maintains balance.

There are various approaches to organising the investor’s funds. Most of those concentrate on generating more income, achieving balance or focusing on long-term profitability.

FAQ

Which asset allocation strategy is the best?

There is no golden rule when it comes to asset allocation. It depends on the investor’s age, risk tolerance, capital and time horizon. If you want to accept risk and achieve high returns, the aggressive portfolio allocation suits you, while insured asset allocation is safer for risk-averse investors.

How can I allocate investment assets by age?

The rule of thumb says that you should invest a percentage in stocks that equals 100 minus your age. If you are 40 years old, you can allocate 60% of your portfolio to stocks and the remaining for bonds or bonds and money markets.

How does the 70-30 investment strategy work?

The 70/30 distribution means investing 70% in stocks as high-income generators and 30% in fixed-return securities, such as bonds and T-bills.

How do I plan my portfolio asset allocation?

First, you must determine your financial goal and risk tolerance. Then, identify how long you want to invest, whether for 5, 10 or 15 years. Finally, research the market to find the best-performing assets and keep updating your investments.