Starting an Online Brokerage Business: Licensing, Regulation, and Technology

As online trading becomes more accessible, more traders, businessmen, fintech enthusiasts, and average workers looking for a secondary income are entering this space.

For you, this means a larger money pool to capitalize on and earn your market share. However, how do you get around the tricky regulatory requirements and how can your start be distinguished among giant market players who have been doing it for years?

This is exactly what we will cover in this guide. Starting an online brokerage business today can be lucrative and complex, requiring careful planning and an approach to avoid jurisdictional chokeholds and instill trust among traders. We will walk you through every step of the process—from licensing and regulation to technology and operations.

Key Takeaways

- Launching an online brokerage combines high growth potential with strict legal and operational requirements.

- Licensing and regulatory compliance are key to building credibility and accessing liquidity providers, banks, and payment systems.

- CRM, execution engines, and liquidity aggregation algorithms are the tech backbone of your trading platform.

- Choosing the right jurisdiction, technology partners, and compliance frameworks determines long-term success.

Understanding Online Brokers

Online brokers are intermediaries that connect individuals and institutional traders with financial markets and investment venues. They provide digital access to instruments such as Forex, CFDs, ETFs, commodities, and cryptocurrencies, and the platform executes buy or sell orders on the end user’s behalf.

They process traders’ positions using intricate technologies, including matching engines, liquidity-provider channels, order-routing algorithms, and execution models. Modern brokerages go beyond simple order processing; they offer advanced analytics, market insights, educational resources, and automated risk management tools.

So, if you want to build a well-performing online brokerage platform, you need to ensure all these functionalities are in your ecosystem.

Unlike traditional brokers, online platforms leverage global connectivity and access to serve across various jurisdictions with minimal friction, ensuring operational efficiency, quick execution, and optimal customer experience.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Different Types of Online Trading Brokerages

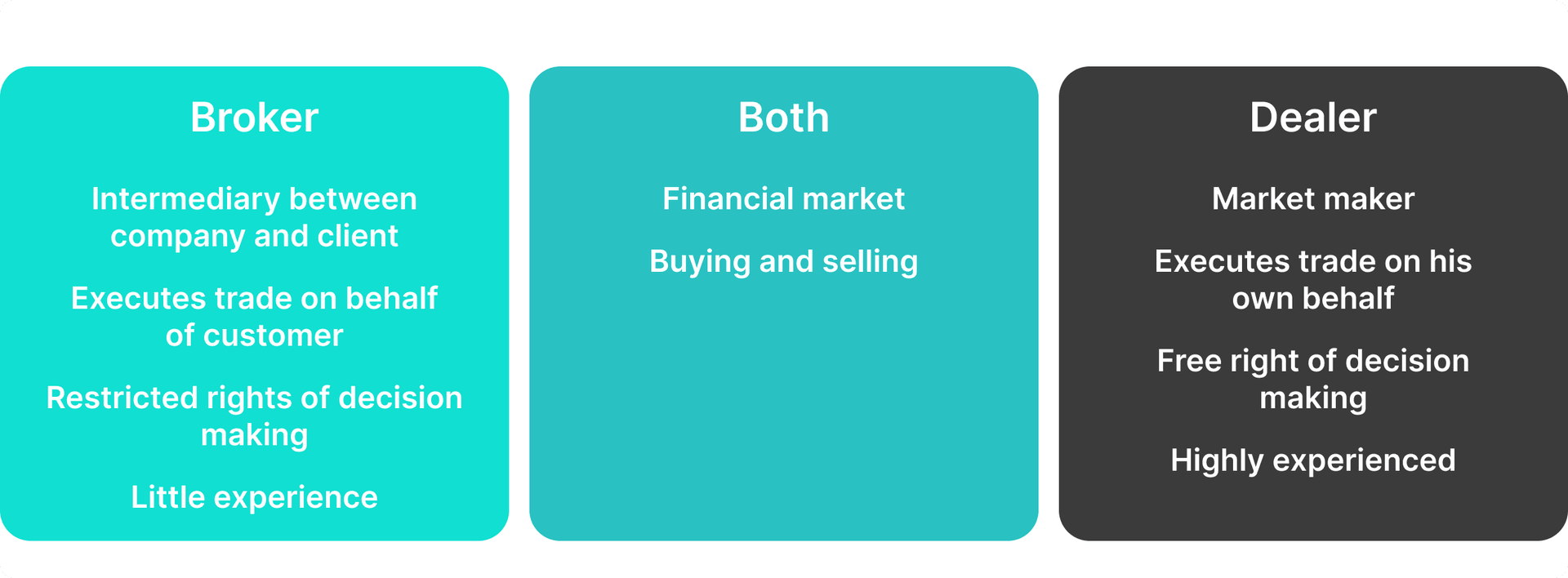

Before establishing your online brokerage, you must differentiate between the two main business models and select the one that suits your ambitions, objectives, and target market. There are two principal types of online platforms: Brokers and Broker-Dealers.

Online Broker Agency

In this model, your primary responsibility is to manage deals on your client’s behalf. Simply put, you will act as a direct intermediary for your customers on various financial markets and complete their requests. In this case, you do not have official ownership or obligation of the client’s investment portfolios and, therefore, play the role of a middleman.

However, this does not mean your responsibilities will be limited and carefree. Online brokers must ensure top-notch security, provide user-friendly interfaces, offer low trading fees, and execute trades without slippage.

As such, the online broker agency model is highly challenging, but the high trading volume potential and increasing client demand make this service lucrative.

Online Broker-Dealer Agency

In this model, you will execute trades on your customers’ behalf and on your own account. In this case, you can keep all the proceeds to yourself instead of just profiting from the commissions.

Most broker-dealer firms start out as simple brokers and enter this stage of their business once they accumulate enough capital to trade on their own terms. Broker-dealers are often massive entities that span numerous countries and possess significant resources.

This model is highly profitable, giving brokers more freedom and control over their business. However, it is also a highly risky and capital-intensive activity, not advisable for newcomer broker firms.

What Licenses Are Required to Start an Online Brokerage Business?

Licensing is the primary legal foundation for every brokerage business, especially when dealing with financial operations worldwide. A regulatory license establishes operational legitimacy and builds client confidence.

Having a license supports partnerships that enable key financial services, such as liquidity providers, payment gateways, crypto wallets, and banks. Operating without proper jurisdictional support limits your access to financial infrastructure and exposes your company to significant legal and reputational risks.

Types of Brokerage Licenses

It is essential to obtain the right license that fits your business model:

- Broker-Dealer Licenses: Crucial for firms trading securities or acting as market makers, regulated by bodies such as the SEC or FINRA in the US and the FCA in the UK.

- Forex Dealers or Money Services Licenses: Required for foreign exchange brokers handling client deposits and processing leveraged instruments.

- Investment Firm Authorizations: Common in Europe and other jurisdictions to ensure legal portfolio management of CFDs or multi-asset products.

Jurisdictional Differences and Strategic Considerations

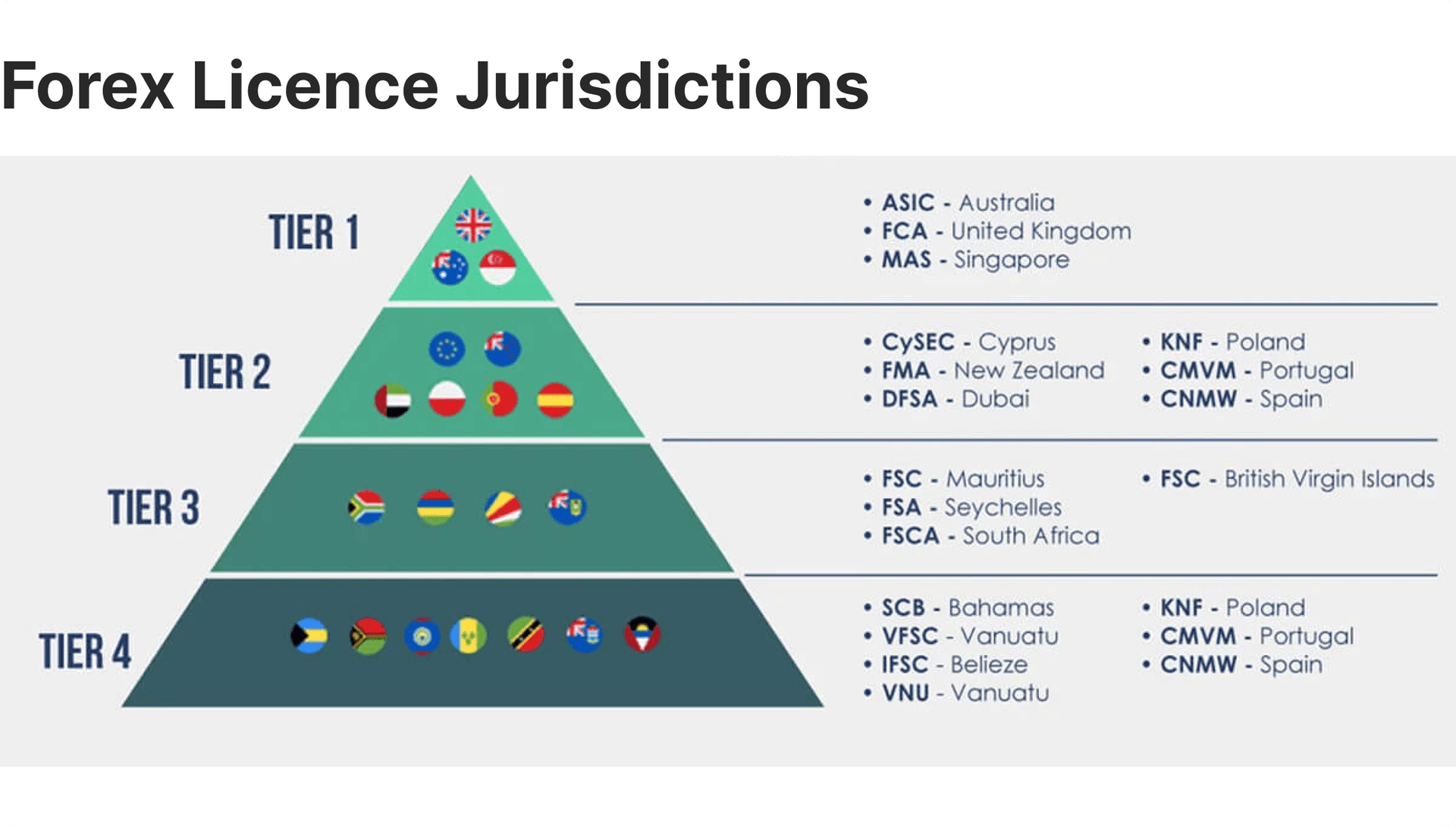

Licensing requirements vary significantly between jurisdictions.

- Established financial centres such as the UK, Cyprus, and Singapore offer strong reputational value but involve longer approval timelines and higher costs.

- Offshore jurisdictions like Mauritius or Seychelles provide faster, more flexible licensing but may offer limited market credibility in Tier-1 regions.

Many successful brokerages adopt a multi-licence structure — using one regulated entity for EU or UK clients and another offshore entity to serve emerging markets. This strategy balances regulatory prestige with business agility and global reach.

The Licensing Application Process

Getting a brokerage licence involves detailed planning and documentation. Here’s how you can start:

- Research legal frameworks and select a jurisdiction that aligns with your business model, budget, and target clients. Tier-1 regulators have higher capital and reporting requirements, while offshore jurisdictions offer lower costs and faster setups.

- Prepare compliance manuals and AML/KYC policies that demonstrate your readiness to adopt international anti-money laundering and client protection standards.

- Show proof of capital adequacy, which typically ranges from $50,000 to over $1 million, depending on license type and region.

- Submit the application and supporting documents to the regulator, undergo background checks, financial audits, and interviews to verify management integrity and financial strength.

Typical approval timelines in offshore jurisdictions range between three and six months, while heavily regulated regions take from nine to twelve months to issue the license.

You must also take legal and administrative costs into consideration, which can add from $20,000 to $250,000 to the total cost, excluding staffing and maintenance. Therefore, working with experienced legal and compliance consultants is the best way to navigate the specific requirements of each region and to prepare documents correctly, avoiding longer waiting times.

Regulatory Requirements for Starting an Online Brokerage Business

Beyond licensing, regulatory compliance defines the long-term credibility and stability of your brokerage. It governs how client funds are managed, how transactions are recorded, and how risks are monitored. These measures are not only regulatory checks, but also safeguards against fraud and operational malpractice.

The Role of Regulation in Financial Markets

Regulation protects investors and preserves market integrity by ensuring fair trading practices and transparent operations. Compliant brokers gain trust from retail and institutional clients—directly translating into higher retention and market share.

Therefore, compliance is not just a legal box to tick — it is a competitive advantage that can drive new clients and traders to your platform.

Core Compliance Obligations

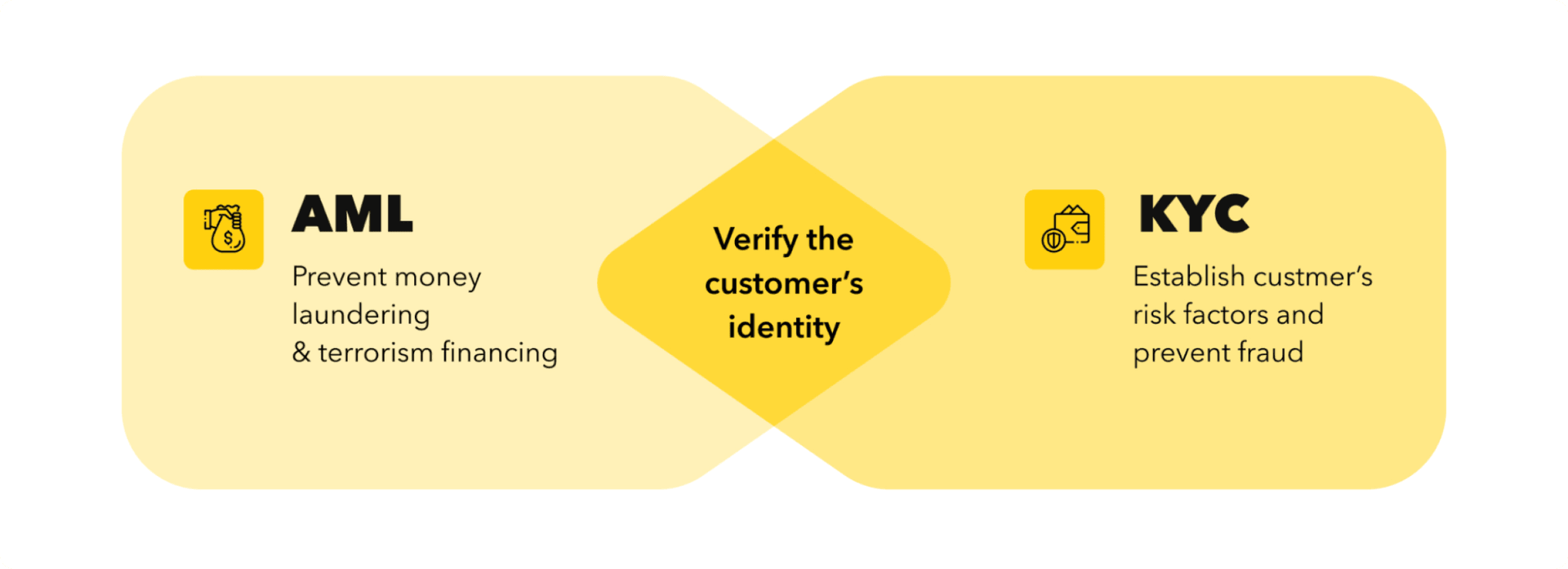

Every regulated brokerage must implement a robust compliance framework for KYC, AML, transaction monitoring, and reporting. Here’s how they work.

- KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures verify client identity and prevent illicit activity.

- Transaction and communication monitoring detect suspicious user behavior and financial activities.

- Regular reporting and trail auditing enable authorities to supervise capital, transactions, and internal audits.

Modern white label brokerage platforms come pre-built with integrated compliance automation that implements these frameworks and reduces manual input, ensuring utmost precision and transparency.

Capital Adequacy and Client Fund Protection

Financial regulatory bodies require brokers to provide and maintain sufficient capital reserves to cover liabilities and operational risks. As such, client deposits must be held in segregated accounts, separating end-users’ money from the company’s funds, as an additional security layer in the event the company goes bankrupt.

Additional measures include liquidity monitoring, regular audits, and transparent reporting to demonstrate financial soundness, boosting investor confidence and partnership legitimacy.

Data Protection and Cybersecurity Standards

From user contact information to payment and banking details, brokerages handle sensitive client data and must comply with international data protection standards. Frameworks like the GDPR in Europe require encryption, access controls, and transparency in data storage.

Some of the best practices in cybersecurity include intrusion detection, multi-factor authentication, and disaster recovery systems to ensure business resilience and data integrity.

Ongoing Supervision and Reporting

Regulatory compliance is not a one-time pass—but a continuous endeavor that requires periodic filings, staff training, and internal reviews. You need to conduct regular internal audits and risk assessments to maintain operational legitimacy and integrity.

Therefore, appointing a qualified compliance officer ensures ongoing adherence to evolving laws and transparency expectations, especially with regulators and key stakeholders.

Cross-Border Licensing and Passporting Strategies

For brokers expanding internationally, cross-border licensing offers efficiency. Under EU passporting, firms authorized in one European Economic Area (EEA) state can operate across other states with minimal additional approvals.

This framework supports rapid scaling, streamlined compliance, and lower administrative overhead when onboarding new staff members, traders, and investors. Similar recognition agreements exist in other regions, helping brokers enter new markets without redundant licensing processes.

How Much Money Do I Need to Start a Brokerage Firm?

Adequate capitalization determines whether a brokerage can meet regulatory thresholds, operate smoothly, and withstand market volatility. Here’s a typical finding plan:

- Regulatory minimums: Capital required to meet license conditions.

- Operational budgets: Staff, technology, and office expenses.

- Marketing funds: For client acquisition and brand awareness.

- Contingency reserves: For delayed revenue or unforeseen losses.

Brokerage startup can cost from $250,000 to over $1 million, depending on jurisdiction and business model. Higher-tier broker-dealers require larger reserves, whereas smaller forex or CFD brokers may begin with moderate capital.

Your business plan should typically span 18 to 24 months of expenses to ensure operational stability before profitability. Reliable liquidity management is essential to maintaining credibility and investor confidence.

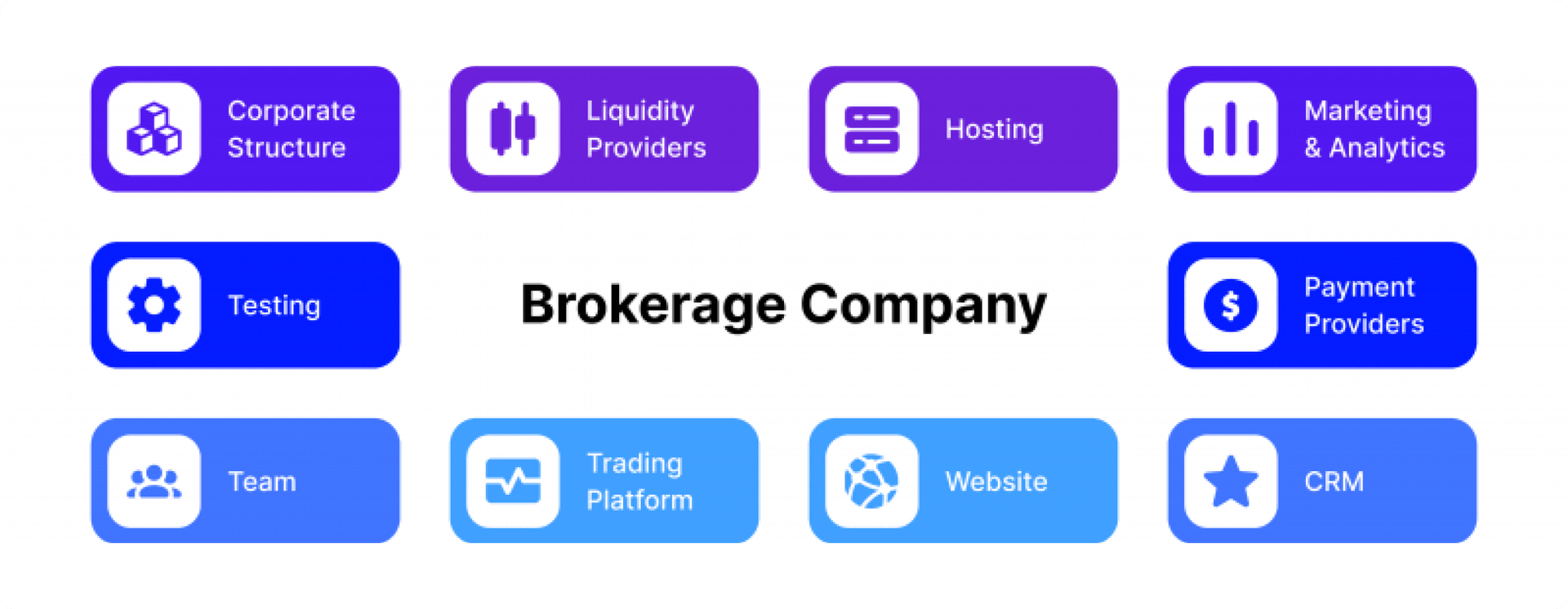

Securing the Right Technology Stack: Platforms, Liquidity, and CRM

Technology is the operational backbone of every brokerage. Platform reliability, liquidity access, and CRM integration directly influence trading experience, trading volume, and business scalability. Here are the main tech elements your ecosystem must ensure.

Trading Platform Essentials

A modern trading platform aligns the user experience across desktop, web, and mobile devices, enhancing trading accessibility and convenience. You also need powerful API connectivity with liquidity providers and trading venues to ensure real-time price feeds and low-latency execution, which are key to attracting top-tier traders and institutional investors.

Advanced charting and order types are essential for your trading platform, with customizable interfaces and branding elements that boost the user experience.

Performance metrics such as sub-second execution and 99.9% uptime are non-negotiable. Turnkey brokerage solutions allow you to adapt features as your platform expands into new asset classes or markets.

Start your Forex Brokerage in Weeks, not Months

All Technology, Liquidity & Payment Integrations Included

White-Label cTrader/B2TRADER with Full Back Office Support

Compliance-Ready Setup with Ongoing Technical Support

Liquidity Aggregation and Risk Tools

Liquidity defines trade quality and client satisfaction. Top-tier brokers integrate multiple liquidity providers, using smart order routing to secure optimal pricing and execution speed.

Real-time exposure monitoring, margin control, and negative balance protection tools protect both clients and the firm from unexpected volatility. You must also integrate advanced risk management systems to automate hedging and help maintain profitability under diverse market conditions.

Deep, Reliable Liquidity Across 10 Major Asset Classes

FX, Crypto, Commodities, Indices & More from One Single Margin Account

Tight Spreads and Ultra-Low Latency Execution

Seamless API Integration with Your Trading Platform

CRM and Client Onboarding

A centralized CRM system connects compliance, sales, and support operations. Most advanced back office software supports automated KYC/AML checks, document management, and communication tracking, which accelerate onboarding while reducing errors.

For global operations, multilingual dashboards, localized offerings, and automated workflows improve efficiency and client satisfaction.

All-In-One CRM & Back Office for Brokers and Exchanges

Fully Customisable Trader’s Room with Modular Features

Built-In IB Module, KYC, Payment Integrations, and Reporting Tools

Intuitive Interface that Boosts Client Engagement

How to Start an Online Trading Brokerage Step by Step

Launching an online brokerage business requires strategy planning, regulatory compliance, and tech precision. Whether you are offering Forex, crypto, CFDs, or multi-asset trading, each stage must be carefully executed to ensure smooth operations and long-term success.

Here’s a step-by-step guide on starting your online brokerage firm:

Step #1: Develop a Comprehensive Business Plan

Every successful brokerage platform begins with a well-structured strategy. Define your mission, target audience, asset offerings, and revenue streams. This plan is key for license issuers as well as for stakeholders if you are seeking fundraising opportunities.

Include detailed financial forecasts, operational cost estimates, and a clear roadmap for technology acquisition and staffing to estimate your costs better.

Step #2: Choose and Analyze Your Target Market

Identify and understand your ideal target audience, whether retail clients, institutional investors, introducing brokers (IBs), or a mix of them.

Conduct in-depth research on market demographics, trading habits, language preferences, regional regulations, and existing service gaps.

Then, tailor your asset range, trading products, and marketing approach accordingly, taking into consideration what is allowed to trade, what currencies are supported, and whether international transactions are permitted in that country.

Step #3: Assess and Mitigate Key Risks

A sound risk management framework protects your brokerage from financial and operational threats, especially if the market goes sideways or profits are delayed.

Identify potential vulnerabilities, such as liquidity gaps, server downtime, cyber threats, and regulatory non-compliance. Moreover, implement internal controls, maintain adequate capital reserves, and invest in cybersecurity systems to minimize unauthorized access and breaches.

Some jurisdictions will require you to establish insurance coverage, clear escalation procedures, and data recovery protocols to ensure business continuity and protect investors’ rights in any market condition.

Step #4: Secure Licensing, Liquidity, and Capital

Select a jurisdiction that aligns with your business model—Tier-1 regulators (FCA, CySEC, ASIC) offer prestige and credibility, while offshore jurisdictions (Seychelles, Belize) provide flexibility and lower entry barriers.

Prepare to meet capital adequacy requirements, which can range from $50,000 to over $1 million depending on the license type, scope of service, and business location.

Also, for deeper market access, accurate pricing, and stable execution, you must partner with Tier-1 liquidity providers or aggregators, which are critical to maintaining trust and offering competitive spreads.

Step #5: Build and Integrate Your Trading Platform

Your trading platform is the face of your business. Choose a platform that supports multi-asset trading, automation, and real-time risk monitoring, while offering an intuitive user experience and navigation.

You can build a proprietary system from scratch or use a white label platform solution to launch your brokerage faster and more efficiently.

Other integrations needed for your platform include CRM, liquidity bridges, payment gateways, crypto wallets, and customer support systems, creating a single operational ecosystem.

Power your Brokerage with Next-Gen Multi-Asset & Multi-Market Trading

Advanced Engine Processing 3,000 Requests Per Second

Supports FX, Crypto Spot, CFDs, Perpetual Futures, and More in One Platform

Scalable Architecture Built for High-Volume Trading

Step #6: Set Up Core Operational Infrastructure

Implement systems for reporting flow, trading accounts, and client onboarding, supported by automated KYC/AML verification tools.

Your operational setup must meet both regulatory standards and client expectations for speed, security, and compliance. Therefore, you must secure banking and PSP relationships to enable global deposits and withdrawals across fiat and crypto.

Step #7: Hire and Train Licensed Professionals

Compliance can be complex, especially amid evolving regulations for cryptocurrencies and digital assets. Therefore, you must hire licensed compliance officers and risk managers to ensure a better flow.

You also need qualified designers, IT engineers, and multilingual support staff, with regular training on regulatory changes, data protection laws, and customer communication to ensure consistency and reliability.

Strong internal culture and expertise directly influence your brokerage’s reputation and client satisfaction.

Step #8: Prepare for a Strategic Launch

Develop a cohesive brand and marketing strategy, incorporating SEO, content marketing, affiliate networks, and social campaigns to build visibility.

Before going live, conduct a comprehensive system audit to test trading stability, latency, and failover protocols. Run pilot programs with select clients to gather feedback on performance and usability.

You must also ensure all promotional materials comply with local advertising laws — A well-executed launch backed by compliance and performance creates strong early momentum and long-term credibility.

Key Marketing Strategies to Grow Your Brokerage Firm

Marketing drives visibility, client acquisition, and profitability, especially with the increasing number of brokers and existing key financial institutions.

Use SEO (Search Engine Optimization), marketing campaigns, paid advertisements, and educational webinars to attract qualified leads. You can also launch affiliate and IB programs to expand your reach and build connections with professionals.

Another way to incentivize trading and encourage deposits is through partnerships, referral networks, and promotions that reward traders for their activity, leading to higher trading volume and potential profits.

Transform Your Brokerage Vision into Reality with B2BROKER

Building a brokerage requires balancing compliance, technology, and client engagement. With B2BROKER’s turnkey solutions, you will access everything your brokerage needs, from liquidity aggregation and CRM systems to copy trading and white label platforms, from day one.

This approach enables you to launch a world-class brokerage platform within weeks — fully scalable, customizable to your branding needs, and accustomed to market challenges.

Our roadmap is simple: Company formation and licensing, setup integration and customization, and platform launch and early performance tracking.

Start your journey today — Launch with B2BROKER now!

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.