Top 10 CFD Trading Strategies for Consistent Profits

Contracts for Difference, or CFDs for short, are gaining more and more attention among retail traders. Its ability to cover a wide range of asset classes such as shares, currencies, commodities, indices, and even crypto offers traders endless opportunities for profits. In fact, according to Finder’s data, there has been a 137% increase in Google searches for “CFD trading” between 2012 and 2022.

However, the high risk associated with CFDs requires traders to develop solid strategies to trade profitably. This article will discuss the top 10 CFD trading strategies and tips to help you achieve consistent results in 2024 and beyond.

Key Takeaways

- A robust trading strategy can help individuals achieve consistent profits, manage risks, and identify profitable market entry/exit points.

- Different strategies, such as day trading, position trading, and scaling, cater to different market scenarios and trading preferences.

- The right risk management contributes to long-term trading success.

Why Traders Should Have a Strategy

A trading strategy refers to a set of rules and guidelines that a trader follows when deciding whether to buy, sell or hold CFD positions. A well-defined and tested plan helps traders to:

- Stick to their plan instead of making impulsive decisions based on emotions or market noise.

- Minimise risks and manage losses effectively.

- Stay disciplined with your trading approach.

- Identify profit-making points for entry and exit.

Without a proper strategy, CFD trading can be a recipe for disaster. Traders may fall victim to emotional decision-making, overtrading, or failing to cut losses at the right time, resulting in consistent losses.

Top 10 Strategies for CFDs

The trading industry has developed a wide range of strategies over the years, each with unique features suited to specific market situations and trading preferences. Here are some of the most sought-after strategies in the CFD sphere:

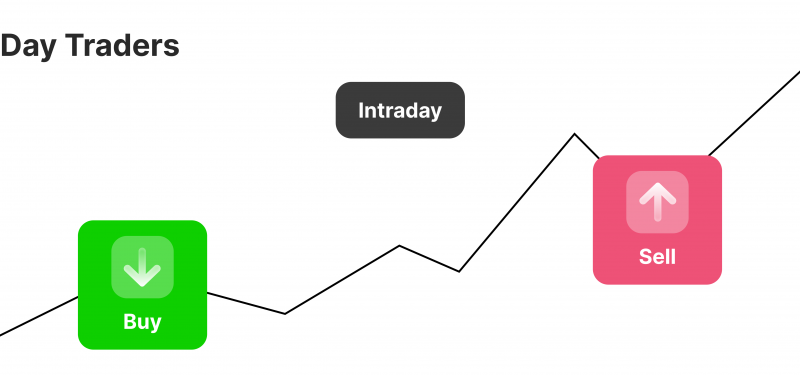

Day Trading

Day trading, as the name implies, involves opening and closing trades within a single day. Traders under this strategy monitor market movements closely to capture brief price swings and execute trades.

This method is suitable for traders who prefer fast-paced action in the markets and have the time to dedicate to it. However, it requires discipline and strict adherence to stop-losses, as holding positions overnight can cause significant losses in case of unexpected market events.

Position Trading

Position trading, or trend following, is a strategy where traders buy or sell assets and hold onto them for an extended period to make potential income from long-lasting trends in the financial markets. This approach requires patience and the ability to tolerate price swings, as the holding period can range from weeks to months and years.

Position traders focus on understanding the bigger trends instead of the rapid buying and selling characteristic of day trading. A position CFD trader can often generate higher returns than a day trader because of the compounding effect of their assets growing over time.

This strategy necessitates a comprehensive analysis of fundamental factors influencing the markets over extended periods, allowing traders to identify and ride the prevailing market trends.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

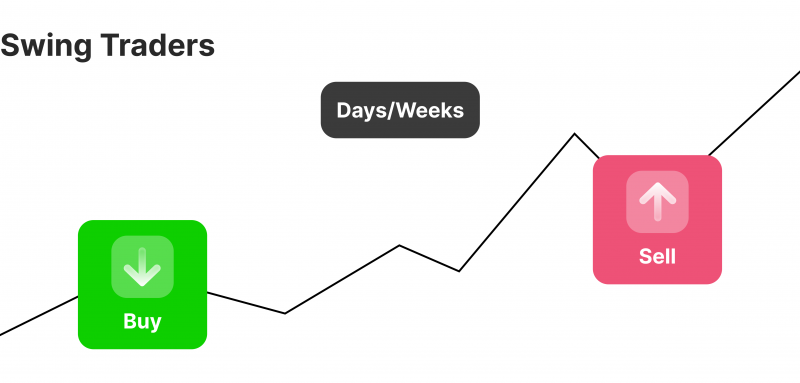

Swing Trading

In swing trading, positions are held for several days to weeks to capture medium-term price changes. The essence is to identify short-term swings in the market and capitalise on them. Swing traders use indicators such as moving averages, Bollinger Bands, Relative Strength Index (RSI), and other oscillators to determine entry and exit levels.

Swing trading allows more flexibility than position trading as it involves maintaining positions for a shorter period with bigger fluctuations in price than day trading. However, it requires traders to understand how markets react to events and data releases that can disrupt the momentum of their trades. Despite that, swing trading remains one of today’s markets’ most profitable CFD trading strategies.

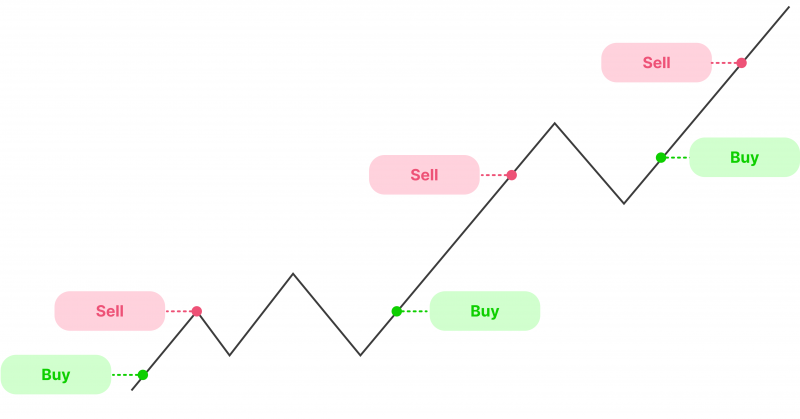

Scalping

CFD scalping is a distinctive strategy that focuses on making small yet consistent potential profits. Scalpers aim to execute numerous quick trades, buying and selling based on tiny price changes, to capture small earnings without taking on significant risks.

The key to successful scalping is being swift and executing frequent trades to capitalise on the tiny price movements in the market. Scalpers monitor price charts and indicators, looking for opportunities to enter and exit positions rapidly, often within minutes or even seconds. This is why it has been deemed the best strategy for CFD trading.

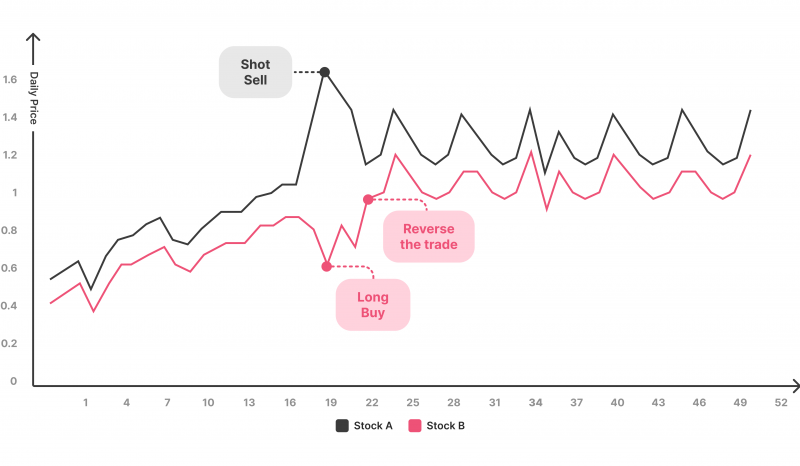

CFD Pairs Trading

Pairs trading involves taking advantage of the relative changes in value between two related assets. Traders who employ this strategy identify a pair of assets that have historically shown a strong correlation in their dynamics and then execute trades to capitalise on the divergence or convergence of these prices.

By entering a long position on one asset and a short position on the other, pair traders can potentially profit from the price differential between the two, taking advantage of opportunities even in uncertain market conditions.

According to statistics, only 18% of CFD traders remain profitable. To become a successful trader, you need in-depth knowledge of the financial market and a good risk management plan.

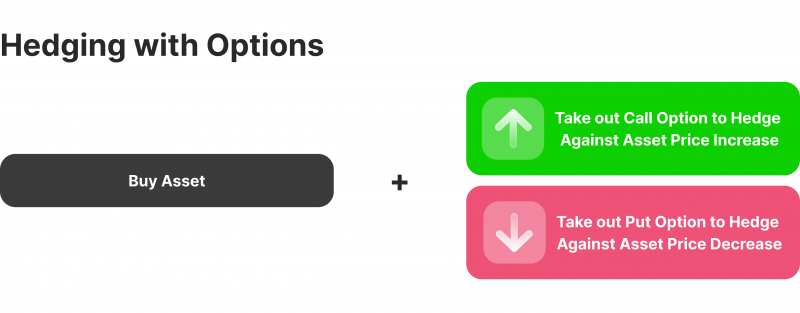

Hedging

CFD hedging is a technique that entails opening positions to protect losses in an existing position. Hedging can be used by traders who want to mitigate risk and protect their investments from sudden market volatility.

For example, if a trader holds a long position on a stock and worries about potential losses due to market volatility, they can open a short position on the same stock through CFDs. If the stock price decreases, the loss on the long position will be offset by the gains on the short position.

Hedging can involve using various types of instruments, such as forward contracts or options, to create a protective position that minimises the impact of unfavourable market conditions on the trader’s overall portfolio. They are best used in the currency market but can also be used as a crypto CFD trading strategy.

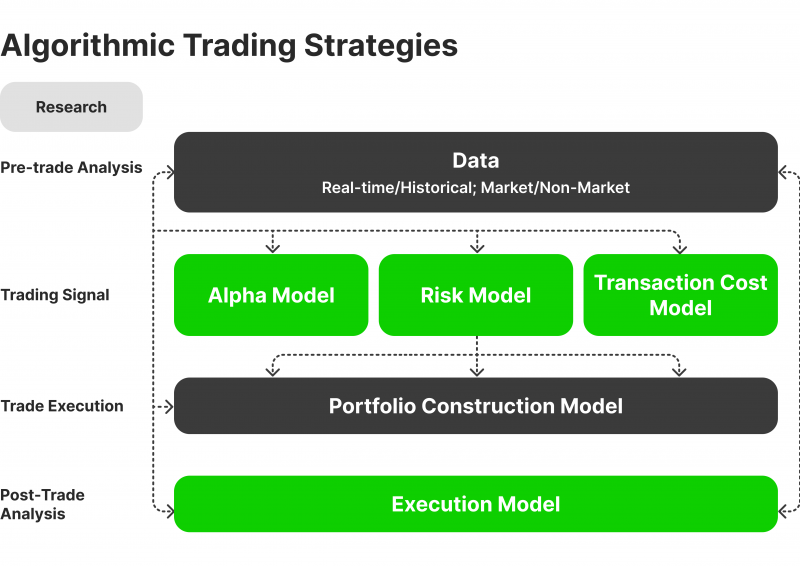

Algorithmic Trading

Algorithmic trading, or automated trading, involves computer algorithms to execute trades automatically based on predefined criteria. These criteria include technical indicators, price patterns, or news sentiment analysis.

Algorithmic traders develop sophisticated programs to make split-second decisions, enabling them to engage in high-frequency trading with minimal manual intervention. This strategy is prevalent in today’s CFD markets because of the speed and precision of said algorithms, making it one of the most successful CFD trading strategies.

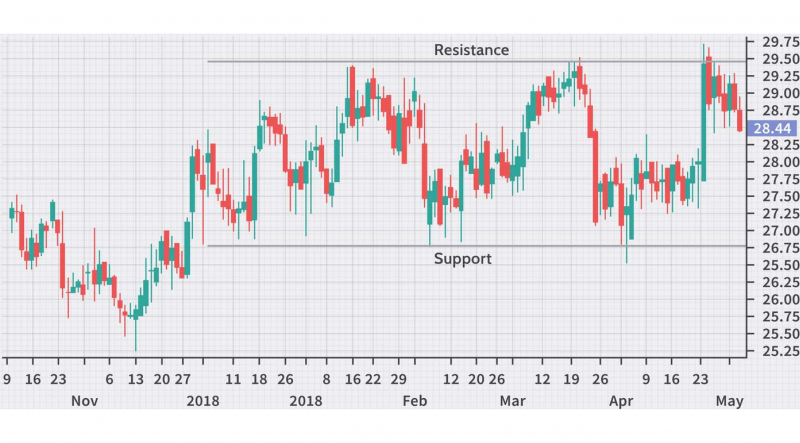

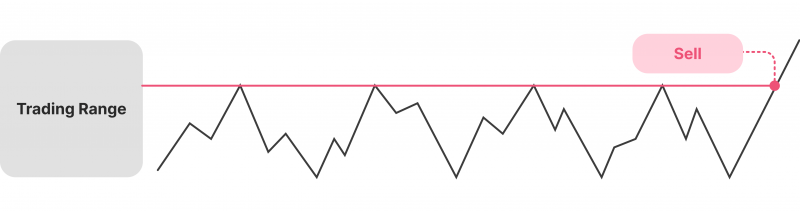

Range Trading

Range trading aims to profit from currency pairs that move within specific price ranges. Traders using this strategy pinpoint support and resistance zones, placing buy orders near the support level and sell orders near the resistance level.

By capitalising on the oscillating market movements within these boundaries, range traders can potentially achieve consistent profits. However, there is always a chance that the price may break out of the predetermined range, so be ready to adjust to market situations.

Breakout Trading

Breakout trading involves identifying and capitalising on significant price movements that breach key support or resistance levels. When a breakout occurs, traders enter positions toward the breakout, anticipating further momentum and potential price appreciation or depreciation.

Breakout traders watch the market for signs of impending breakouts, using technical analysis tools and indicators to pinpoint potential entry and exit points. This strategy can be particularly profitable during increased market volatility.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

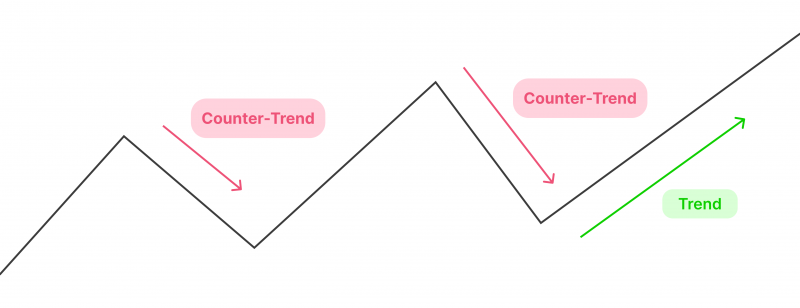

Counter-Trend Trading

A counter-trend strategy involves going against the prevailing market sentiment. Traders who employ this approach aim to profit from potential reversals by identifying overbought or oversold conditions in the market.

When a currency pair has been in a prolonged trend, either bullish or bearish, counter-trend traders may enter positions in the opposite direction, anticipating a reversal in the trend. This strategy requires a keen eye for market dynamics and the ability to identify potential signals of trend exhaustion, such as divergences in technical indicators.

Implement Risk Management to Avoid Losses

In the fluctuating sphere of CFD trading, regardless of the strategy you opt for, the key to sustained success lies in efficient risk management. The integration of solid risk-prevention measures is vital to safeguard your finances.

Some key risk management practices include:

- Start with a Small Account: Begin with a modest trading account size to limit potential losses, especially as a newcomer to forex or Bitcoin CFD trading.

- Diversify Your Investments: Dispense your capital among diverse currency pairs and asset classes to mitigate the blow of singular losses.

- Utilise Stop-Loss Orders: Utilising stop-loss orders will allow you to automatically terminate your positions and confine your downside risk when the market turns unfavourable for your trades.

- Maintain Disciplined Position Sizing: Confirm that the proportion of your trades is in harmony with your risk acceptance level and comprehensive trading plan.

- Stay Informed and Adaptable: Continuously educate yourself about market developments, economic indicators, and changes in industry regulations.

Closing Thoughts

Bear in mind that the secret to maximising your benefit from CFD trading lies in your capacity to adjust, acquire knowledge, and maintain a disciplined approach. Experiment with various strategies and enhance your emotional resilience.

Nonetheless, remember that inherent risks accompany CFD trading. Integrate risk management in your trading plan, and never forget that persistence and patience are essential for securing long-term profits in the ever-changing landscape of CFD trading.