How to Build a Crypto Derivatives Exchange: Essential Features and Steps

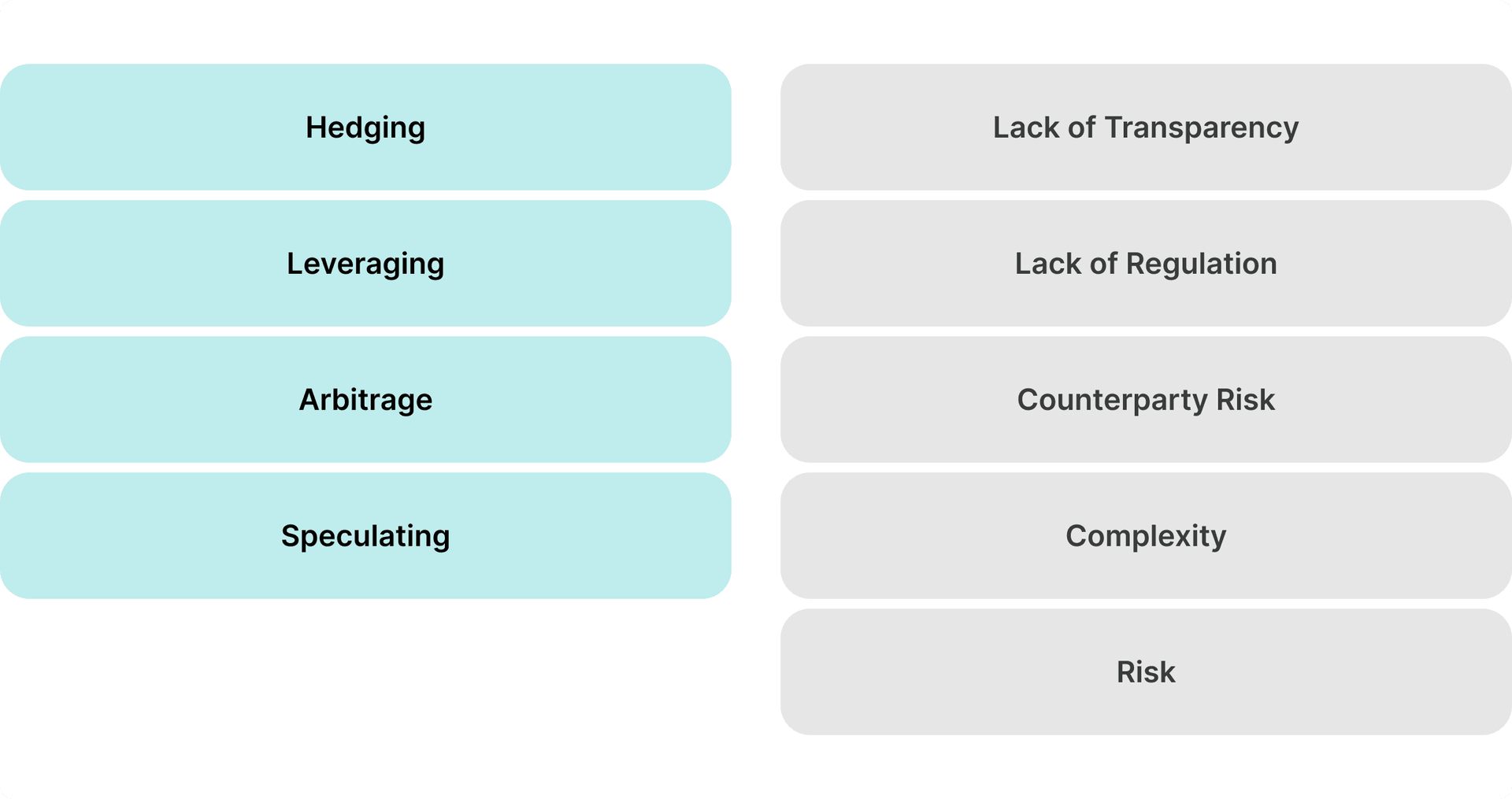

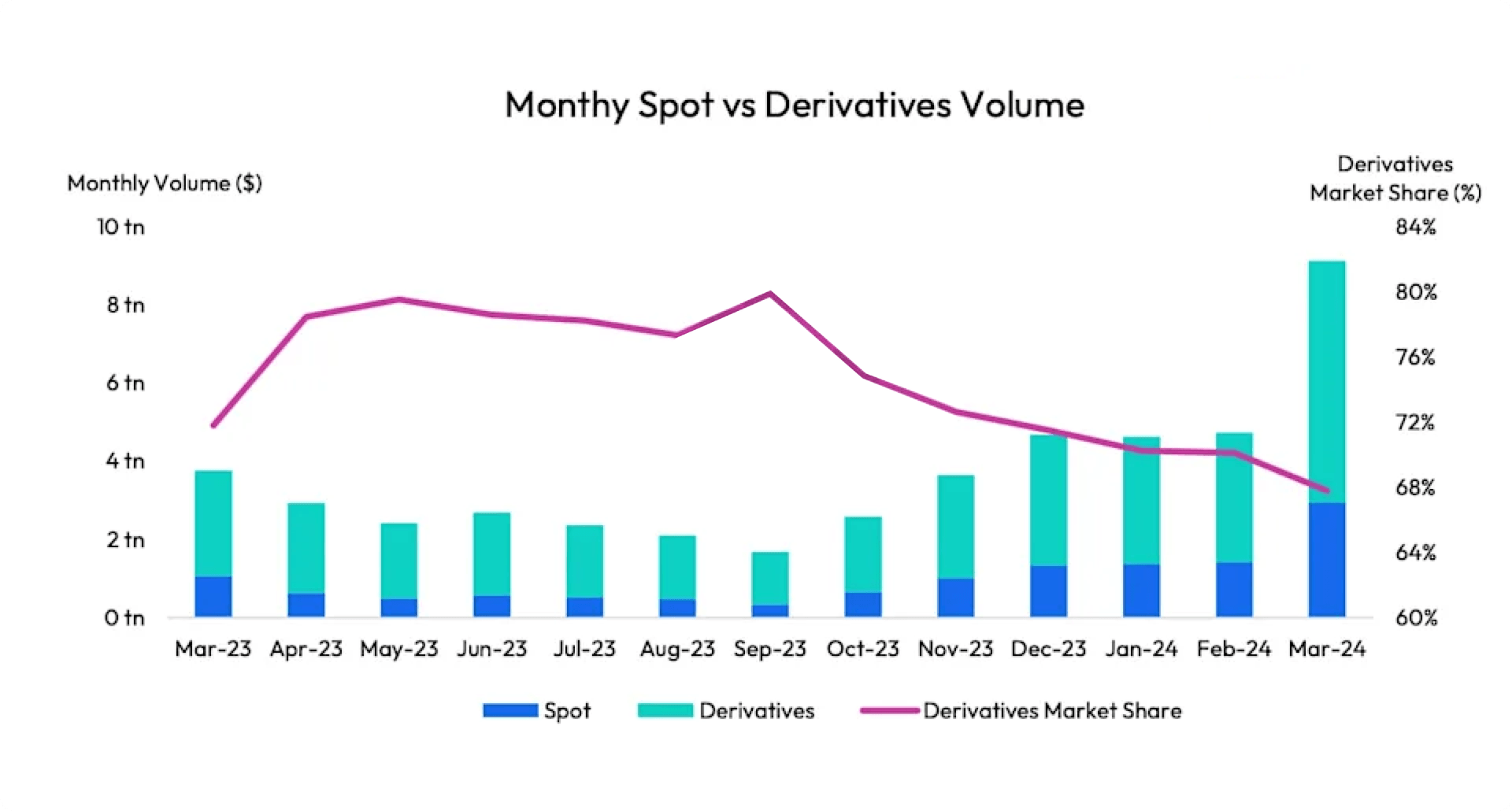

Derivatives exchanges have become the backbone of modern crypto asset trading, bridging the gap between blockchain-based assets and traditional financial institutions. These instruments enable traders to hedge market volatility, speculate on future price movements, and execute complex strategies without holding the underlying assets, driving crypto trading volumes.

As institutional interest in digital assets grows and regulations become more sophisticated, derivatives exchanges now require reliable platforms, complete compliance readiness, and operational resilience.

This guide will walk you through everything you need to build a high-performance crypto derivatives exchange, from essential features and underlying technologies to development roadmap and cost considerations.

Key Takeaways

- Crypto derivatives are financial instruments that mirror the price of underlying cryptocurrencies.

- Building a crypto derivatives platform requires strong architecture, including a rapid matching engine, risk controls, and reliable liquidity.

- Digital asset derivatives are more accessible because they do not require asset ownership and can be combined with hedging strategies.

- Derivatives platforms can earn from trading commissions, margin fees, subscriptions, withdrawals, contract fees, and staking services.

What Are Crypto Derivatives?

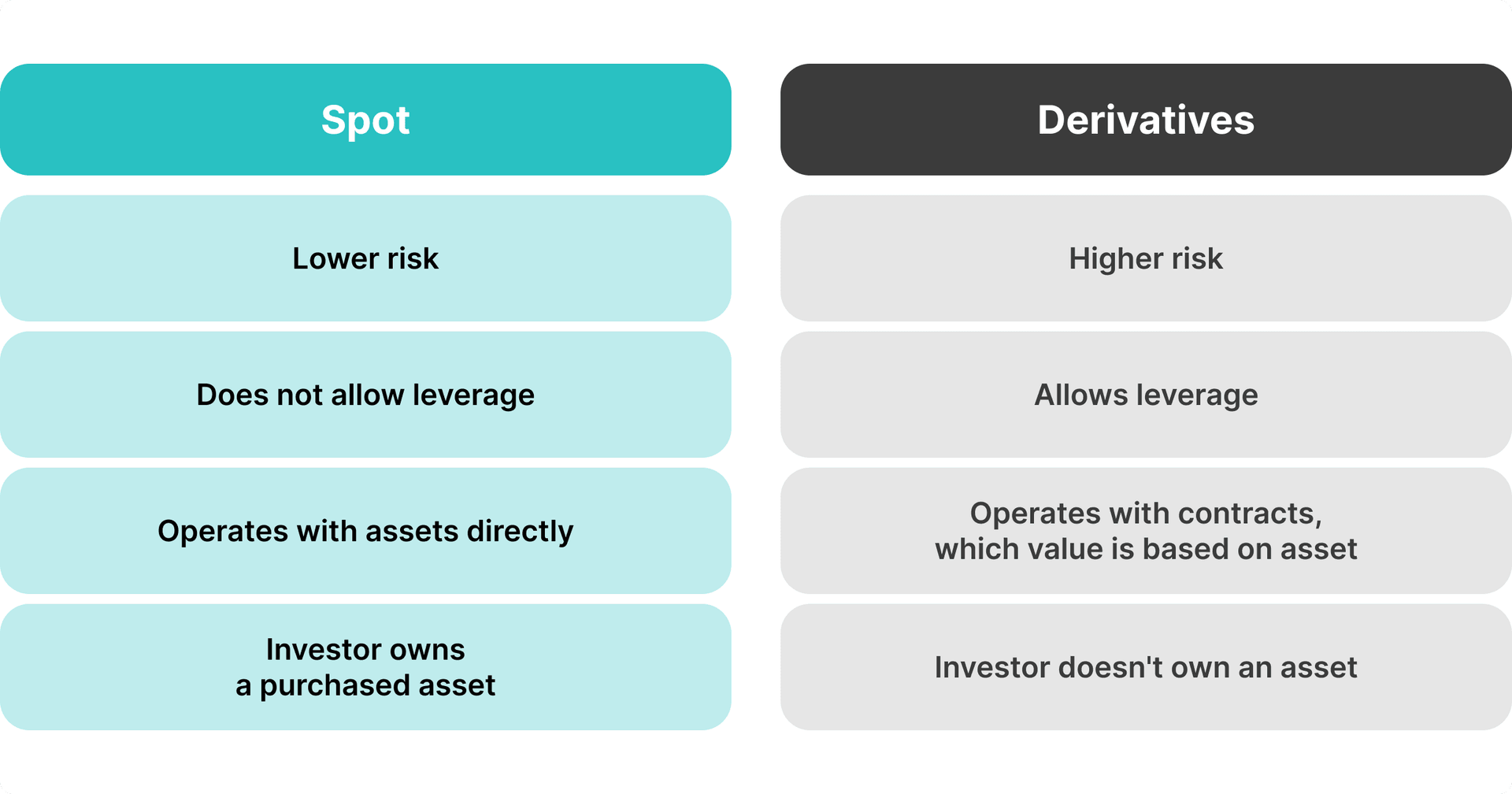

Crypto derivatives are financial contracts whose value derives from underlying cryptocurrencies, enabling traders to hedge risk, speculate on price movements, and execute sophisticated strategies without owning the asset. They can be traded as futures, options, or swaps, with various liquidity characteristics, market depth, and risk profiles.

Derivatives exchanges enable retail and institutional investors to access leveraged positions while managing exposure, offering more opportunities to earn from a highly volatile market. They combine innovative technology with compliance standards, making them critical in modern digital finance.

By offering a broad range of crypto derivatives through a robust platform, you can attract more traders to execute advanced strategies and top liquidity providers to ensure market depth and precise pricing. These platforms represent the intersection of technology, financial innovation, and regulation.

Build on a Proven Derivatives Trading Infrastructure

Power your derivatives platform with B2BROKER's institutional-grade tech stack — including ultra-fast matching engines, advanced risk management, and deep multi-asset liquidity. Accelerate development, reduce latency, and achieve full compliance from day one.

The Types of Crypto Derivative Products

Digital asset derivatives come as futures contracts, options contracts, perpetual swaps, or exotic derivatives. Each type has its own features, earning model, and risks. Let’s review these crypto products:

- Futures Contracts: Agreements to buy or sell an asset at a predetermined price and date, often used for hedging or speculation.

- Perpetual Swaps: Similar to futures contracts but without a fixed expiration date, allowing continuous leveraged trading.

- Options Contracts: Grants the right, but not the obligation, to buy or sell assets at a given price within a defined period for more flexibility.

- Exotic Derivatives: Specialized contracts with customized pairings and payoff structures, allowing sophisticated traders to manage complex risks.

What Is A Crypto Derivatives Exchange?

Derivative exchanges are gaining popularity due to high-stakes bets on cryptos, offering various benefits, such as high throughput rates and enhanced order types.

Exchanges for virtual currency derivatives hold a crucial position within the digital currency market, where traders can interact with financial markets connected to digital coins.

By using these platforms, users can wager on fluctuations in crypto prices without physically holding the digital currency.

How Such Exchanges Work

Crypto derivatives trading involves speculating on the future price of a digital currency. Regardless of market price, this finance contract allows investors to profit by purchasing at a lower price and selling at a higher price.

Derivatives trading platforms offer flexibility and access to new markets, making them attractive to exchange owners and investors.

A trader opens an account on a derivative exchange and undergoes KYC and AML verification for platform safety. Then, users deposit cryptos to place an order to buy derivative contracts, specifying the order parameters such as type, price, and size.

Next, users can select the crypto that should be a base asset for derivative trading. Finally, the exchange executes the order, and after the order is fulfilled, it is possible to withdraw the crypto or convert it into the desired asset available on the platform.

How Crypto Derivative Platforms Get Their Profit?

Brokers operating on a crypto derivatives platform can earn from different models. Here are some options for profiting from digital currency derivatives trading.

- Trading fees: Collected from makers and takers on each derivatives trade, forming the core revenue source.

- Margin trading fees: Fees for borrowed capital, leveraged positions, and overnight funding.

- Subscription fees: Fees for premium analytics tools, advanced charting tools, or institutional accounts.

- Deposit & withdrawal fees: Commissions from asset transfers, depending on blockchain and network load.

- Options & futures contract fees: Additional charges for contract settlement, exercise, or expiration handling.

- Staking & lending fees: Revenue from interest-bearing services and lending liquidity to traders.

- API access fees: Monetized access for institutional clients, algorithmic traders, and Introducing Brokers.

- Advertisement fees: Earnings from paid ad placements, token promotions, and partner integrations in the platform ecosystem.

Learn how crypto exchanges make money through trading fees, staking, and more. Discover revenue models of top exchanges like Binance and Coinbase.

10.11.24

Essential Features for a Cryptocurrency Derivatives Platform

Technical reliance is a key factor in the derivatives exchange development process. Every component—from the matching engine to wallet security—must be precisely engineered and frequently optimized to ensure accuracy, regulatory resilience, and user trust.

Here are the main elements you need to integrate into your infrastructure:

Security, Compliance, and Custody Infrastructure

User protection and regulatory compliance are the notion of a trustworthy derivatives exchange, and traders now expect secure fund custody, multi-signature controls, and seamless onboarding.

Therefore, you must ensure hot and cold wallet utilization, streamlined KYC/AML verifications, encrypted storage, and multi-currency transaction whitelisting.

You can also instill trust in your systems by providing proof-of-reserves, insurance funds, and transparent reporting, ensuring transparency with long-term clients as your platform thrives and the trading activity grows.

Matching Engine and Order Processing

The trading engine is the operational core of your derivatives platform. It must be fine-tuned to support ultra-low latency, accurate execution, and high throughput. These capabilities, along with sub-millisecond order matching, ensure tight spreads, smooth liquidity sourcing, and efficient settlement.

You must also safeguard your system using fault-tolerant architecture and automated failover protocols to prevent downtime or deteriorated performance during peak activity, ensuring stable scaling and a reliable trading experience.

Liquidity and Market Connectivity

Liquidity depth is critical for market efficiency and user satisfaction; it impacts how accurate your quoting is and how prices move during high-volume orders. Establish reliable connections with external liquidity providers, internal liquidity pools, and institutional market makers to ensure uninterrupted execution and flow.

Ensure robust API connectivity to support cross-exchange trading, reduce spreads, and minimize slippage, providing users with a satisfactory experience and ensuring optimal filling rates.

Deep, Reliable Liquidity Across 10 Major Asset Classes

FX, Crypto, Commodities, Indices & More from One Single Margin Account

Tight Spreads and Ultra-Low Latency Execution

Seamless API Integration with Your Trading Platform

Risk Management and Market Protection

Advanced risk management tools are essential to protect that platform from systematic failures and safeguard the users from market shocks. These modules include real-time portfolio margining, automated liquidation procedures, circuit breakers, insurance funds, and Auto-Deleveraging (ADL) mechanisms.

These systems work together to stabilize markets during periods of extreme price volatility, prevent cascading failures, and protect leveraged positions.

Clearing, Settlement, and Collateral Management

Clearing and settlement ensure trades are completed accurately, verifying matched order details against obligations and risk, while settlement is the final stage where assets and payments are exchanged. These systems manage leveraged positions, margin calls, and real-time profit and loss calculations.

The automated collateral management system offers ongoing risk monitoring and secure fund segregation, ensuring that crypto exchanges and traders remain safe and operational.

Product Diversity and Trading Options

Offering a wide range of derivative instruments encourages greater user engagement and platform adoption. Supporting futures, perpetual swaps, and options contracts with flexible leverage settings allows both professional and institutional traders to implement varied strategies.

Product diversity not only attracts a broader user base but also creates multiple revenue streams for the exchange, enhancing its long-term profitability.

API Access and Mobile Trading

Open API infrastructure supports algorithmic trading and institutional integration, enabling automated strategies and higher trading volumes. At the same time, responsive mobile applications expand accessibility for retail traders and emerging markets, especially with the rising trends in mobile trading.

These features ensure that users can monitor positions, execute trades, and stay informed on market conditions from anywhere, at any time.

User Experience and Accessibility

A seamless and intuitive user interface significantly impacts user navigation and trading experience—ultimately driving retention and monthly trading volume.

Features such as real-time charts, customizable dashboards, easy navigation, multilingual support, and mobile optimization create an inclusive experience, making your crypto derivatives platform appealing to novice and experienced traders.

You can also introduce demo trading and educational resources to further empower users, allowing them to familiarize themselves with platform functionality and gain confidence in their strategies before interacting with live markets.

All-In-One CRM & Back Office for Brokers and Exchanges

Fully Customisable Trader’s Room with Modular Features

Built-In IB Module, KYC, Payment Integrations, and Reporting Tools

Intuitive Interface that Boosts Client Engagement

Transparency and Fairness

Transparent operations are vital for maintaining credibility in a crowded market—a key competitive advantage. This includes clear fee disclosures, real-time market data, and consistent communication regarding platform and service updates.

Openness and transparency foster trust and differentiate legitimate exchanges from unregulated operators, ensuring that traders feel confident in the fairness and integrity of their trading environment.

Customer Support and Community Engagement

Effective support contributes to user satisfaction and long-term loyalty, assuring that clients receive prompt support where milliseconds matter for their executed orders. Offering 24/7 multilingual assistance, educational content, and responsive issue resolution helps build trust and strengthen the community.

You can expand on this by hosting webinars, engaging on social media, and actively gathering feedback to further promote organic growth and sustained user engagement.

Innovation and Ecosystem Integrations

Continuous innovation is essential for maintaining competitiveness. Tap on futuristic market trends by integrating with DeFi protocols, adopting hybrid CeFi–DeFi models, and offering seamless on-chain settlement options.

Expanding API capabilities and interoperability with third-party services allows the exchange to quickly respond to regulatory changes, emerging technologies, and new trading strategies.

How to Launch a Crypto Derivatives Exchange: Key Steps

Starting a cryptocurrency derivatives exchange business requires strategic planning, technical expertise, and an understanding of dynamic markets. The market moves quite unexpectedly, and user preferences shift frequently, so you must always follow regulations, trends, and price changes.

Here’s a step-by-step guide to entering the crypto derivatives market.

1. Market Research and Planning

Conducting thorough market research is essential to identify your target market, user preferences, service gaps, and trader demographics. It is also vital for competitor analysis, where you can assess existing services and offerings and identify what distinguishes your business.

This approach helps you define a unique value proposition that aligns with local laws, ensures technical readiness, and focuses on long-term operations.

2. Regulatory and Legal Compliance

Operating a crypto business comes with legal challenges because the regulations in this sphere change frequently. However, as frameworks become more streamlined and stable, derivatives exchanges must obtain proper licenses, implement KYC/AML modules, and comply with the relevant jurisdictional requirements.

Regulatory compliance is not only a checkbox—it builds investor confidence and mitigates the risks of operational shutdowns or legal fines.

3. Technology Stack and Architecture

The tech stack is the system and software backbone that supports your platform. Therefore, you must select a high-performance matching engine, smart routing algorithms, and a modular architecture that simplifies blockchain integration.

These technologies ensure seamless scalability, low-latency trading, and zero server downtime, encouraging growing trading volumes.

Power your Brokerage with Next-Gen Multi-Asset & Multi-Market Trading

Advanced Engine Processing 3,000 Requests Per Second

Supports FX, Crypto Spot, CFDs, Perpetual Futures, and More in One Platform

Scalable Architecture Built for High-Volume Trading

4. Liquidity and Strategic Partnerships

Invest in partnerships with top liquidity providers, prime brokers, market makers, and crypto liquidity pools to ensure deep order books and reliable cross-exchange connectivity.

These strategic alliances boost your brand’s reputation and attract institutional investors to your platform.

5. Security Architecture and Risk Controls

Implement multi-layered security measures to combat the rising threats in the crypto world. These include complex encryption algorithms, secure access management, powerful DDoS protection, and periodic code audits.

This practice ensures platform integrity and keeps you up to date with the latest developments in blockchain and cybersecurity.

6. UI/UX and User Experience Development

Design an intuitive interface with real-time analytics, responsive performance, and clear workflows for managing leveraged positions. It is also crucial to provide a frictionless onboarding and depositing journey to minimize the drop rate and boost the user experience.

Strong UI/UX practices improve user acquisition, boost retention, reduce support inquiries, and enhance the overall trading efficiency.

7. Testing and Quality Assurance

Perform comprehensive functional, integration, and stress testing to ensure system reliability under varying market conditions. Beta testing with selected users helps identify bugs, configure trading performance, and validate security protocols.

Then, collect user feedback early to refine platform features, enhance overall stability, and optimize user experience before full-scale deployment.

8. Launch and Post-Deployment Monitoring

Begin with a soft launch to manage risk, gradually scaling operations as stability is confirmed. Then, continuously monitor system performance, latency, liquidity depth, and trade execution quality.

Real-time analytics and proactive issue resolution maintain smooth operations, ensuring reliability, compliance, and user trust as trading volumes and market participation expand.

9. Marketing and Growth Strategy

Following launch, prioritize user acquisition through community engagement, influencer collaborations, and educational content. Amplify visibility and market reach through strategic partnerships with liquidity providers, brokers, and fintech firms.

Consistent brand messaging, data-driven campaigns, and incentive programmes strengthen reputation, attract institutional clients, and foster sustained growth in a competitive landscape.

Benefits of Crypto Derivatives Exchange Development Solution

Crypto derivatives have substantially grown over the years, peaking at $4 trillion in 2021 before settling to $1.3 trillion in 2023. Getting a ready-to-use derivatives exchange solution means earning your share from this massive market much faster and without significant development costs.

Here’s what you can expect from the best crypto derivatives exchange solutions:

- High Market Demand: Growing interest in crypto derivatives from retail and institutional traders.

- Risk Mitigation: Advanced tools for hedging and managing market exposure.

- Access for Financial Institutions: Compliant infrastructure that supports institutional-grade trading.

- Expanded User Base: Professional trading platforms attract retail and institutional participants.

- Automation & Efficiency: Streamlined operations reduce manual intervention and human error.

- Revenue Opportunities: Multiple monetization channels, including commissions, subscriptions, and staking fees.

- Global Reach: Serving international traders with 24/7 platform operations and a support desk.

- Innovation Gateway: Integration with futuristic DeFi systems and emerging technologies to foster new product development.

Build Your Crypto Exchange with B2BROKER

Launch a powerful crypto exchange platform using pre-built solutions, deep liquidity integrations, fiat/digital payment gateways, and regulatory expertise with B2BROKER.

Avoid lengthy setup deployments and hefty development costs. Reduce your time-to-market and seize current opportunities with affordable fintech solutions that scale with you.

Build Your Crypto Derivatives Exchange with B2BR

Accelerate your market entry with our Derivatives Exchange Turnkey Solution, combining matching engines, deep liquidity, compliance support, and 24/7 technical service in one unified ecosystem.

FAQs about Crypto Derivatives

- What types of crypto derivatives can be traded?

Different types include futures contracts, perpetual swaps, options contracts, and exotic derivatives.

- What are the advantages of building a digital derivatives exchange platform?

There are many advantages to using such platforms, including diverse income generation channels, attracting experienced traders, contributing to market efficiency, competing effectively, and introducing innovative products.

- What is crypto derivatives regulation?

The US Commodity Futures Trading Commission (CFTC) continues to approve digital money derivatives and other assets through the “self-certification” method.

- Why invest in crypto derivatives exchange development?

Developing a derivatives exchange in cryptocurrencies provides exposure to high-demand markets, diversified revenue streams, and the opportunity to offer advanced trading tools while leveraging secure, compliant infrastructure.