Crypto Prime Brokerage – Is It a Safe Place for Crypto Investors?

The recent Bitcoin boom and crypto market bull run presented outstanding opportunities to make money and increase one’s holdings of digital assets. Cryptocurrency brokerage firms were on their all-time high activity ratios, with liquidity beyond the roof.

However, this liquidity rush and the following demand withdrawals left some traces on retail brokers and investors who couldn’t keep up with the market as significant players and exchanges claimed the most considerable profits and shares.

How do you instil stability and longevity in your investment portfolio? Crypto prime brokerage is the answer. In short, digital asset PBs assist you in financial planning beyond the mere execution of a trade order. What is the definition of a crypto prime brokerage? Let’s find out.

Key Takeaways

- Crypto prime brokerage is a business model that offers trading order execution, securities lending, custodial services and financial optimisation to large financial firms and investment banks.

- Cryptocurrency prime brokerages differ from executing brokers, who focus on taking trading orders and processing them at the lowest spread ranges and price slippage.

- Crypto PBs respond perfectly to the increasing crypto adoption rates by traditional financial institutions and investors.

Understanding Crypto Prime Brokerage

Let’s start with the prime broker definition. These financial service providers offer holistic monetary assistance, including processing trading orders in the open market, cash management, margin financing, and invoice settlement.

Such services are typically offered by banks and investment firms to conglomerate financial corporations and institutional investors.

Cryptocurrency prime brokerage refers to offering comprehensive digital asset management, ranging from opening crypto market positions, coin custodial services and DeFi asset optimisation.

Crypto prime brokerage solutions are demanded mainly by large financial institutions that engage in crypto trading and transact and store a large number of virtual coins. These corporations rely on a third-party service provider to manage wallets, DeFi/fiat assets, blockchain security, and other decentralised ecosystem functions.

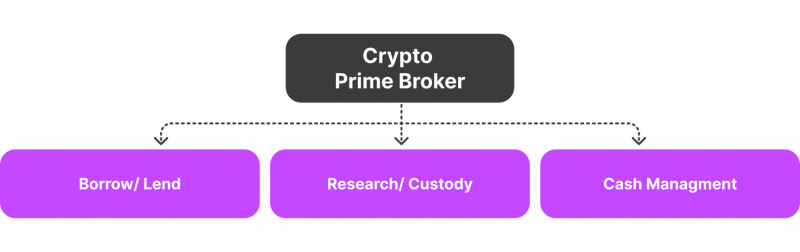

Crypto Prime Brokerage Services

Crypto prime brokerage platforms differentiate themselves from conventional (executing) brokers in the range of services they provide. Digital asset PBs extend their offerings to the following functionalities.

Trading Order Execution

A crypto prime broker’s first and foremost function is to execute trade orders placed by investors. As such, they play the role of executing brokers, receiving market position requests from investors and matching them with suitable securities.

In most cases, crypto investors who trade with Bitcoin use their USD money to open a long position in BTC, profiting whenever the coin’s price increases.

Custodial Services

Cybersecurity is the priority when dealing with digital and blockchain-based assets. Therefore, crypto prime brokers offer custodial services, storing the investor’s capital in safe online or offline storage.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Offline custody (cold wallets) entails using paper or hardware USB wallets to protect the user’s data from the Internet. On the other hand, online custodial wallets require storing cryptocurrencies over the Internet on decentralised or centralised servers.

Some examples of custodial crypto wallets include famous exchanges like Binance, Kraken and Coinbase.

Risk Planning

Investing in cryptocurrencies entails considerable risks because coins can change their prices quite unexpectedly. For example, Bitcoin is one of the most speculative digital assets, and its price can change dramatically after institutional activities and experts’ opinions.

Therefore, cryptocurrency prime brokerage uses its vast market knowledge to offer financial consultancy and strategic planning, assess investment opportunities, and set action plans for every market fluctuation.

Legal Compliance

The legal landscape for cryptocurrencies changes widely between locations and jurisdictions. Therefore, it is important to be aware of the applicable laws before investing and storing digital assets.

As such, crypto prime brokerage services assist investors in ensuring full legal compliance and legitimacy. Otherwise, local regulators can impose hefty fines.

Liquidity

Last but not least is crypto liquidity, which varies drastically throughout market cycles, speculations and traders’ sentiment.

Cryptocurrency prime brokerage acts as middlemen between investors and marketplaces. This prime brokerage agreement includes connecting with various liquidity pools and funding sources to offer reliable market access.

Thus, when an investor puts in a trading order, the PB will reroute the request across various liquidity sources and order books to find a matching order and settle the position as soon as possible.

Crypto Prime Brokerage Market Landscape

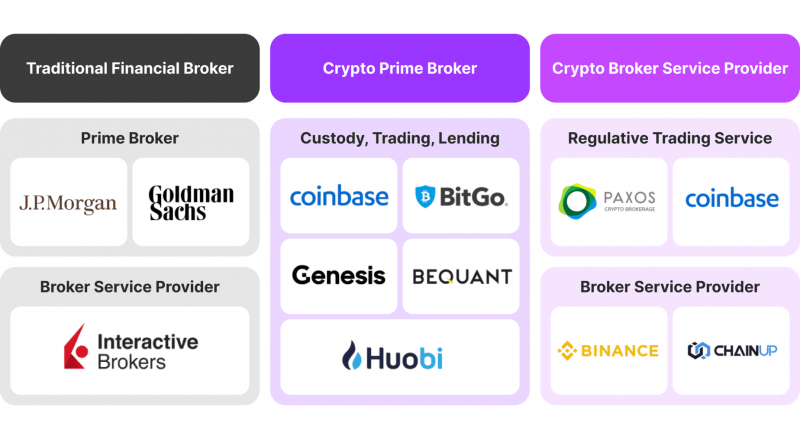

The rise in crypto prime brokerage has grown exponentially in the last couple of years as investors and hedge funds have changed their position towards digital assets and blockchain-based currencies.

A study conducted by Fidelity in 2022 showed that 60% of institutional investors have invested in crypto assets, with Bitcoin being the most critical coin, amounting to 25% of these investments.

However, these growing trends were coupled with the fear of high volatility, liquidity fragmentation and market instability. Therefore, financial institutions and hedge fund startups needed a one-stop-shop solution that could solve the liquidity, execution and clearing functions.

Here’s where crypto prime brokerage firms come into play, offering end-to-end services that boost confidence among investors.

Crypto Prime Brokerage vs Broker

Despite the similarities between the roles of an executing broker and cryptocurrency prime brokerage, there are some notable differences regarding the target market. A crypto prime brokerage optimises a company’s asset usage, settles transactions, manages accounts, and sources liquidity.

On the other hand, executing brokers are only tasked with finding a counterpart security or trader for every requested market order and settling it at the best market conditions. This includes offering the tightest big-ask spread and securing low price slippage.

Crypto prime brokerage services usually target multi-million investment firms that deal with many accounts and look to hire a specialised operator with bundled financial services. However, execute-only brokers serve retail traders and users who want to invest in the market at the best rates possible.

It is also worth noting that a cryptocurrency prime brokerage usually charges premium prices for their services, which may be fixed amounts, while a retail broker usually charges spread fees and other handling commissions.

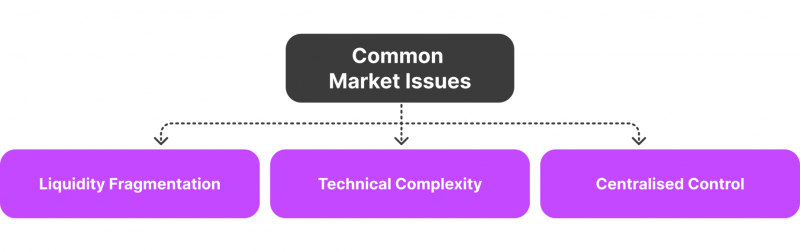

Current Crypto Prime Brokerage Issues

Despite the arrival of many crypto prime brokers, the number is still incomparable to traditional financial institutions that prefer sticking to conventional securities in more mature markets. Paralally, the digital asset trading market still needs to tackle a few issues to become more appealing to more institutional investors and hedge funds.

Liquidity Consolidation

Liquidity plays a significant role in market stabilisation, but it is still inadequate in the decentralised economy compared to traditional financial markets. Crypto liquidity is fragmented across various venues, and securing a reliable liquidity source can be tiresome.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Therefore, working with a prime broker account offers institutional players deep liquidity reach in one place.

Technical Complexity

Decentralised finance came with new terminologies and concepts that traditional investors find challenging to implement and follow.

In addition, many believe that blockchain technology, crypto wallets, smart contracts, and automated execution engines are still preliminary and must be fine-tuned and polished before we see mass adoption.

Centralised Tendencies

Most traditional-to-crypto transformations today still follow the centralised route in terms of governance, risk planning, and asset optimisation, which can put cryptocurrencies at risk of failure in a similar way to how traditional banks have failed over the years.

This puts more pressure on global prime brokers to come up with new ways to increase the digital asset investment utility and avoid repeating the same mistakes.

Conclusion

Crypto prime brokerage is a new haven for institutional investors, as this offering can save them time and effort in sourcing liquidity, storing crypto assets and overcoming technical difficulties.

Cryptocurrency prime brokerage bundle services to hedge funds and large investment companies that exceed the sole function of processing market orders. Crypto PBs can manage corporate account payables/receivables, optimise financial indicators, and participate in strategic planning, in addition to executing trading positions.