Essential Cryptocurrency Exchange Development Services and Providers

The modern crypto world has progressed dramatically from its challenges and market downturn in 2022. For the last year and a half, the blockchain field has experienced several bull runs and currently holds an impressive market capitalisation of $2.65 Trillion. With the upcoming Bitcoin halving and other exciting developments in the field, the industry growth of crypto might finally become sustainable in 2024.

In light of these promising circumstances surrounding the blockchain field, cryptocurrency exchanges have made the rounds as an excellent startup idea. The invention of white-label cryptocurrency exchange software has further popularised this prospect. Now, the development process of crypto exchanges is much more straightforward and less resource-intensive than ever before.

However, starting up a crypto exchange business is still not a trivial task, as there are many options to tackle this challenge and not every method is optimal. So, let’s explore the best software solutions you can employ while developing your crypto exchange solution.

Key Takeaways

- Crypto exchanges have become popular due to the recent growth of the crypto market.

- Crypto exchanges require white-label solutions, API integrations, payment processing tools, CRM suites and numerous other digital tools.

- Obtaining each solution requires careful consideration and analysis of features.

The Emerging Goldrush of Cryptocurrency Exchange Development

As of early 2024, the cryptocurrency market has showcased massive trading volumes, going up as high as $270 billion in a single 24-hour span. This metric is exponentially higher compared to last year’s figures. With crypto user numbers jumping by 34% and reaching 580 million, it is no longer a secret that the global audience has warmed up to crypto again.

The Competition is Still Unforgiving

As a result, developing an exchange platform has become one of the most dominant startup prospects in the cryptocurrency industry. Traders actively seek exchange solutions that provide reliability, security, tight spreads, and accessible UI. The market for exchanges has grown tremendously, but it’s still far from being saturated or monopolised by large corporations.

So, there is still room for a successful exchange business to make its mark in this thriving climate. However, the competition is fierce and subpar solutions will not cut. Aside from the values outlined above, your company must showcase strong regulatory compliance and safeguard user assets with the latest cybersecurity practices. However, entering this niche has undeniable benefits, especially considering the market’s immediate future.

Essential Services to Start a Crypto Exchange Company

Considering the exciting prospects presented above, developing a crypto exchange company has a lot of upside. This idea is incredibly profitable, considering you no longer must develop advanced in-house solutions to create a fully operational exchange platform. However, it is still essential to know the relevant pitfalls and challenges that you will inevitably face.

Each service and software you need must be evaluated carefully. Crypto exchange platforms that aim to be competitive need to develop robust security measures, advanced matching engine software, convenient UI and many other capabilities. Let’s explore.

Turnkey Crypto Exchange Service

Instead of building in-house software, a dominant strategy is to seek out a crypto exchange software development company. A proper cryptocurrency exchange development company will provide a white-label service that takes care of your technical needs on a core level. WL tools provide a pre-built matching engine, analytics tools, trading menus, pricing quotes, and every aspect of an average exchange platform.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

After that, it is up to you to personalise this platform and add all relevant extensions. In most cases, acquiring liquidity sources, payment processing tools, and other external tools will still be part of your duties. However, an excellent white-label crypto exchange development company might provide these tools as an extension of its services.

It is important to choose the WL cryptocurrency exchange platform carefully. You need to evaluate its features and compare its functionalities with the needs of your target audience. The most important aspects here are UI accessibility, live data feeds to keep the price charts up-to-date, and advanced trading mechanisms to satisfy the demands of professional traders.

Regulatory Compliance with Legal Consultation

Regulatory compliance is achieved through acquiring a proper crypto exchange license, depending on your jurisdiction and business aspirations. There are numerous types of crypto exchange licenses, and acquiring the right one might be more challenging than expected.

So, it is prudent to receive guidance from an experienced consultant on how to tackle the process of obtaining the exchange license. Seeking professional consultation in this matter will greatly reduce your resource requirements for receiving a proper exchange license, allowing you to accelerate the entire launch process considerably.

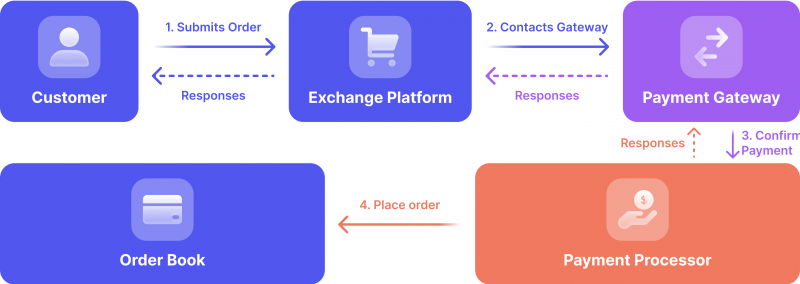

Payment Processing Service

As mentioned above, white-label crypto exchange development services might often include payment processing gateways, but they might be subpar in many cases. So, exploring external options and evaluating their processing speeds makes sense. Generally, payment processing should have a near-instant execution speed and the ability to seamlessly connect wallet accounts, both on the customer and business side.

Cryptocurrency exchange platforms with the highest processing speeds are generally more favourable since most crypto strategies are very time-sensitive and must be carried out in hours or minutes. So, employing a flexible and high-speed payment processor will help you advance a crypto exchange business.

Choosing between centralised vs decentralised crypto exchange models is a hot discussion topic. However, recent trends have showcased that a hybrid crypto exchange development company might be the best solution for your exchange needs.

Liquidity and other API Extensions

API extensions are crucial in establishing a high-performance exchange platform. Your crypto exchange platform development company might provide some APIs, including links to live data feeds and liquidity channels, but in most cases, you will have to purchase these services separately.

The most critical API tool will be your liquidity source, funding your exchange platform with actual liquidity to exchange assets. You must find a crypto exchange liquidity provider that supplies diverse currency pairings and tokens. Otherwise, your exchange offerings might be too scarce to develop a substantial audience.

Moreover, checking whether your liquidity API connects appropriately to the crypto exchange platform development service is essential. If technical troubles cause delays, your entire service might become lacklustre and unable to accommodate your customers’ time-sensitive needs.

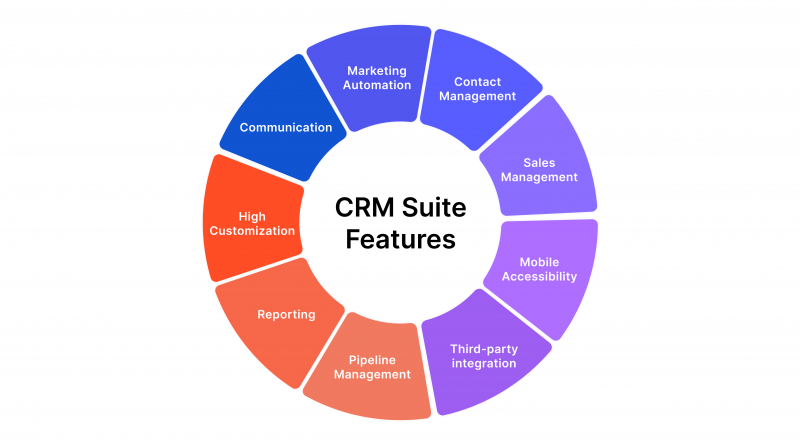

CRM Suite Service

Client Relationship Management (CRM) tools used to be overlooked by mid-sized exchange companies due to their ambiguous value proposition. In the current landscape, CRMs have become invaluable.

Robust Security Measures

Your average crypto exchange platform development company will give you some security tools and protocols, but in most cases, that won’t be enough to ensure maximum security. You need to employ tools like two-factor authentication, encryption, KYC, and KYT procedures to keep your customers secure within your company’s digital premises.

KYC procedures often include anti-money laundering protocols and counter-terrorist financing measures. Both of these practices are essential for the crypto field, as blockchain transactions are inherently plagued with questionable counterparties and chances of malicious activities.

Out of these tools, your crypto exchange development company might help you with 2FA and password encryption, but KYC and KYT protocols need to be acquired separately and implemented rigorously within your organisation.

Customer Support Portals

Last but certainly not least, you must develop swift, responsive, and thorough customer support portals that effectively resolve client issues on the spot. Your support portal should be convenient and present varied connectivity options, including chatbots, live support chats, video calls, and tickets.

Moreover, the various integrations of AI can help you develop a robust support system. Some issues are typical and can be resolved by bots and automated systems, allowing you to dedicate your support staff to more pressing concerns.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

How B2BROKER Combines All of the Above

As a global liquidity provider, B2BROKER has accumulated an impressive ecosystem of tools, services and features to accommodate practically every need of cryptocurrency exchange startups. From pre-made turnkey solutions and payment processing services to liquidity channels and diverse asset class selection, B2BROKER seamlessly takes care of your exchange platform needs.

Moreover, B2BROKER offers a variety of advanced instruments, like CFDs and ETFs, to elevate your competitiveness in the modern trading environment further. Also, B2BROKER has numerous social trading mechanisms, including copy trading, PAMM, and MAM modules, that are ready to be integrated into your exchange infrastructure.

The entire roster of offerings is combined with a cutting-edge CRM suite that allows businesses to monitor, analyse and manage their company’s performance in real-time. So, with B2Broker’s comprehensive ecosystem of solutions, you won’t have to look for all the services mentioned separately. Instead, B2BROKER can provide you with complete assistance on the road to launching your exchange platform.

Final Thoughts – Simplifying the Crypto Exchange Development

Finding a reliable development company is the key to jumpstarting your crypto exchange business. Proper cryptocurrency development services will help your exchange develop a solid technical foundation and prepare to integrate a list of external tools and resources.

Once everything is handled, you will have a fully-fledged crypto exchange that operates optimally and provides customers with all the relevant exchange features they desire. The best part is that you won’t have to employ a full-scale development team to achieve this setup. Instead, every system will be maintained by respective technology providers in exchange for respective monthly fees. As a result, your exchange system will run like clockwork without extra costs or complications.