Guide to Starting a Multi-Asset Brokerage in 2024

Articles

The fintech field is actively changing due to emerging trends and innovative practices that invite retail traders to invest. Investors are increasingly seeking diversification through a multi-asset trading approach, spreading their risk across various asset classes to mitigate market volatility and maximise returns potentially.

This trend presents a compelling opportunity for entrepreneurs looking to enter the brokerage space. This guide delves into the intricacies of launching a multi-asset brokerage business in 2024, equipping you with the knowledge and strategies to navigate this exciting yet complex venture.

Key Takeaways

- Multi-asset brokerages have become popular within the crypto and forex market sectors.

- Constructing a multi-asset brokerage is exponentially more complex compared to simple brokerage business models.

- The toughest part is acquiring liquidity for different asset classes without bloating the capital costs.

- Regardless of the difficulty, building a multi-asset brokerage will yield significant dividends in the future.

Unveiling the Multi-Asset Landscape: A Growing Trend in 2024

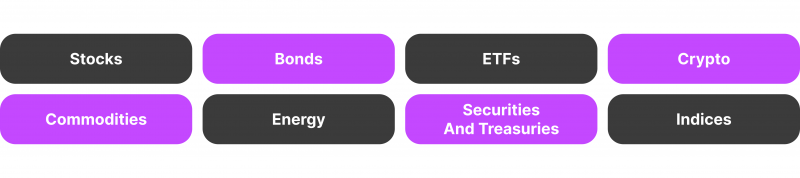

Gone are the days when investors solely focused on stocks or bonds. Today, a growing appetite for diversification is driving a surge in multi-asset investing. This approach allows investors to spread their risk across various asset classes, including equities (stocks), fixed income (bonds), exchange-traded funds (ETFs) that offer exposure to a basket of assets under a single holding, commodities like gold and oil, currencies (forex) for capitalising on currency fluctuations, and even cryptocurrencies like Bitcoin that are gaining traction and offering new investment opportunities.

This shift in investor behaviour presents a compelling opportunity for aspiring brokers. By offering a comprehensive suite of assets, you can cater to the rising demand for diversification and attract a broader client base.

Why Should You Offer Multiple Asset Classes?

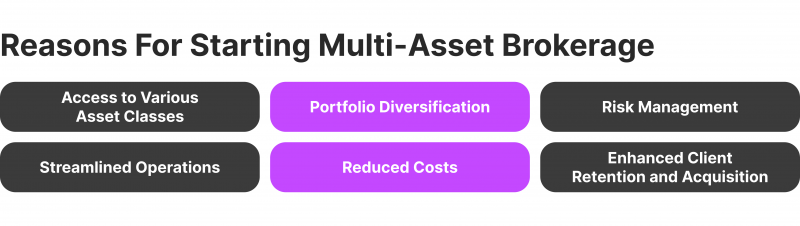

There are several advantages to offering a multi-asset platform for your brokerage. First, you can increase your market share by catering to diverse investment needs compared to a single-asset brokerage. This allows you to attract a wider range of clients, from those seeking traditional stocks and bonds to those interested in newer asset classes like cryptocurrencies. Second, offering a one-stop shop for all asset classes fosters client loyalty and reduces the need for them to seek services elsewhere. This can lead to increased customer satisfaction and retention.

Third, multi-asset brokerages have the potential to generate income from various sources, including commissions, fees, and interest on margin accounts. This diversification of revenue streams can contribute to a more stable and profitable business model. Finally, a multi-asset approach not only benefits you as a broker but also empowers your clients to construct well-rounded and potentially more successful investment portfolios by spreading their investments across asset classes with varying risk profiles.

AI algorithms can analyse vast amounts of data to identify subtle relationships between different asset classes. This allows for more nuanced diversification strategies that can potentially outperform traditional methods.

Key Considerations for Launching a Multi-Asset Brokerage

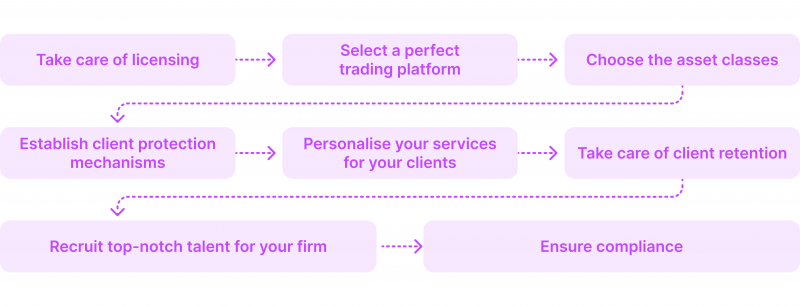

Launching a multi-asset brokerage in 2024 demands strategic planning. Understanding your target audience is critical. The general strategy for building a strong, sustainable and competitive multi-asset brokerage can be divided into eight parts. These crucial steps include licensing considerations, a trading platform selection, asset classes, client relationship systems, personalisation, compliance and innovation.

By carefully considering these aspects, you can lay the groundwork for a successful multi-asset brokerage launch. Remember, meticulous planning, a well-defined target audience, a robust financial strategy, and a talented team are key to navigating this competitive market. Let’s go over each of these steps in greater detail.

Navigating the Licensing Landscape in 2024

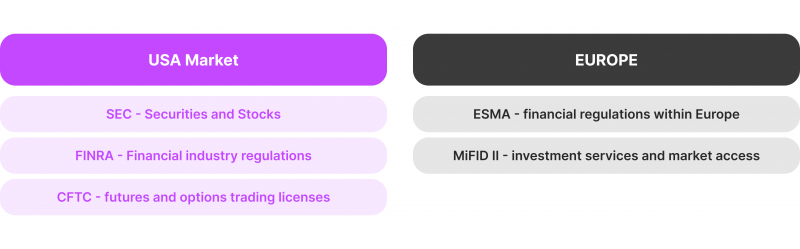

Operating a multi-asset brokerage necessitates navigating a complex web of regulations. The specific licenses you require depend on your location and the asset classes you offer. For the purposes of this article, let’s break down the regulatory requirements of two major multi-asset liquidity zones in the world – the USA and Europe.

In the case of the USA, The Securities and Exchange Commission (SEC) regulates the offering and trading of securities. Depending on the services you provide, you may need to register as a broker-dealer with the SEC. FINRA (Financial Industry Regulatory Authority) sets licensing and conduct standards for securities firms. Becoming a FINRA member ensures adherence to industry best practices. Finally, the Commodity Futures Trading Commission (CFTC) regulates futures and options trading. If you offer these instruments, CFTC registration might be necessary.

On the other hand, European jurisdiction contains the following regulatory bodies. The European Securities and Markets Authority (ESMA) oversees financial market regulation across the European Union (EU). Depending on your location within the EU, you may need authorisation from the national competent authority (NCA) responsible for financial services.

The Markets in Financial Instruments Directive (MiFID II) is a key piece of EU legislation governing investment services and market access. Compliance with MiFID II is crucial for offering investment services within the EU. Depending on the specific asset classes you offer, additional licences may be required. For example, cryptocurrency activities might necessitate authorisation under regulations specific to your EU member state.

Consulting with legal and financial professionals experienced in multi-asset brokerage regulations is highly recommended, as navigating the intricacies of licensing can be challenging. They can ensure you adhere to all necessary regulations and operate your brokerage compliantly.

Choosing the Right Trading Platforms

Your trading platform is the lifeblood of your multi-asset brokerage. It should be robust, user-friendly, and secure to inspire confidence in your clients. When selecting a platform, prioritise features that comprehensively support all your chosen asset classes. This includes offering advanced order types like stop-loss orders, take-profit orders, and trailing stops, which cater to sophisticated investors employing complex trading strategies.

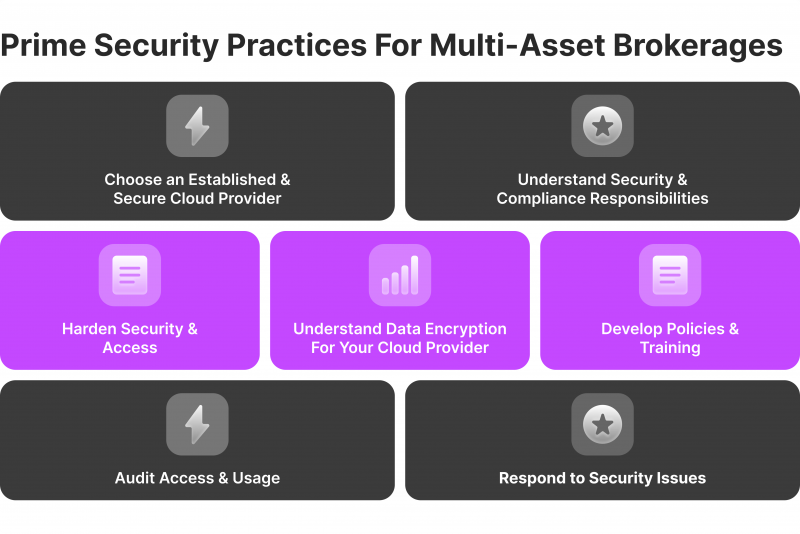

Real-time market data and access to comprehensive research tools empower your clients to make informed investment decisions. Look for a platform that integrates with reliable data feeds and provides insightful research reports, fundamental analysis tools, and technical charting capabilities. Robust security measures are non-negotiable. Ensure the platform utilises multi-factor authentication, encryption protocols, and regular security audits to safeguard client data and financial assets.

Invest in a platform with a user-friendly interface that is intuitive and easy to navigate for both novice and experienced investors. Mobile compatibility is crucial in today’s on-the-go world. Choose a platform with a dedicated mobile app that allows clients to monitor their portfolios, execute trades, and access essential features from anywhere.

Selecting the Assets for Your Multi-Asset Portfolio

The asset selection for your multi-asset portfolio hinges on two key considerations: your target audience and the regulatory environment you operate. Research investor preferences in your target market to understand which asset classes are most in demand. Are you catering to conservative investors seeking stability or targeting growth-oriented clients comfortable with higher risk? Ensure you comply with all regulations governing the offering and trading of each asset you choose.

Partner with legal and financial professionals experienced in multi-asset brokerage regulations to navigate this complex landscape. Prioritise assets with high liquidity to ensure smooth execution of client trades. This minimises the risk of clients encountering difficulties entering or exiting positions due to a lack of market activity. Offer a diverse range of assets with varying risk profiles to cater to different investor needs.

This might include traditional asset classes like stocks, bonds, and ETFs, which offer a balance between risk and return. You can further expand your offerings to include commodities like gold and oil, which can act as hedges against inflation, or cryptocurrencies like Bitcoin, which offer the potential for high returns but also carry significant risk. Consider starting with a core selection of established asset classes and gradually expanding your portfolio as your business grows and regulations evolve.

Essential Features for Client Protection

Building trust with your clients is paramount in the financial services industry. Implement robust security measures to demonstrate your commitment to protecting client data and financial assets. This includes employing multi-factor authentication, which requires an additional verification step beyond just a username and password. Encryption protocols safeguard sensitive client information, while regular security audits by independent firms identify and address potential vulnerabilities.

Segregated client accounts ensure client funds are held separately from your operating capital. This protects client assets in the event your brokerage encounters financial difficulties. Transparency and clear communication are key to fostering trust with your clients. Provide clients with concise and easily understandable information about fees, commissions, risks involved in different asset classes, and order execution policies. Responsive customer support allows you to address client inquiries and concerns promptly.

Invest in a dedicated customer service team with a deep understanding of financial markets and the intricacies of your platform. Offering educational resources empowers clients with knowledge. Develop a library of informative articles, video tutorials, and webinars tailored to different asset classes and investor experience levels. This equips your clients to make informed investment decisions and navigate the financial markets with greater confidence.

Tailoring Your Services to Diverse Investor Needs

A successful multi-asset brokerage caters to a varied clientele by offering a range of services that cater to different investor needs and experience levels. Implement tiered account structures with different features and benefits based on account size and trading activity. Basic accounts cater to entry-level investors, while premium accounts offer advanced trading tools like margin trading (which comes with increased risk) and dedicated account managers for high-net-worth clients.

Provide access to research reports, market analysis tools, and educational webinars tailored to different asset classes and investor experience levels. Beginner investors might benefit from content focusing on investment fundamentals and basic trading strategies, while seasoned investors might appreciate in-depth analysis and advanced technical charting tools. Consider automated investing options like robo-advisors for clients seeking a hands-off approach.

These algorithms create and manage diversified portfolios based on an investor’s risk tolerance and investment goals. Develop personalised investment strategies for high net-worth individuals seeking tailored portfolio management solutions. Partner with experienced financial advisors to create customised investment plans that align with each client’s unique financial objectives and risk tolerance. By understanding your client’s needs and offering a range of services, you can ensure a positive customer experience, foster long-term relationships, and build client loyalty.

Reaching Your Target Audience

Reaching your target audience effectively requires a well-defined marketing strategy that leverages a multi-channel approach. Digital marketing channels like social media, search engine optimisation (SEO), and content marketing are powerful tools to connect with potential clients. Utilise social media platforms like Twitter and LinkedIn to share informative content, engage in industry conversations, and build brand awareness. Search engine optimisation (SEO) ensures your brokerage website appears prominently in search engine results for relevant keywords, driving organic traffic from potential investors actively researching multi-asset investing or specific asset classes you offer.

Content marketing allows you to establish yourself as a thought leader in the financial services industry. Develop informative content that educates potential investors about the benefits of multi-asset investing and the unique value proposition of your brokerage. Create blog posts, articles, infographics, and video tutorials that address common investor concerns, explain complex financial concepts in clear language, and showcase your expertise in the market.

Don’t underestimate the power of traditional marketing channels. Consider attending industry events and conferences to network with potential clients and industry professionals. Participating in conferences allows you to showcase your brokerage’s offerings, connect with potential partners, and stay abreast of the latest market trends in the multi-asset investment landscape. Building strategic partnerships with financial advisors or wealth management firms can also expand your reach. Partnering with established financial professionals allows you to leverage their existing client base and gain access to a wider audience of potential investors.

Recruiting Talent for a Multi-Asset World

Building a strong team is vital for the success of your multi-asset brokerage. In this specialised space, attracting top talent with the necessary skills and experience is crucial. Identify the key roles you need to fill, considering areas like compliance, technology, finance, and customer service. Focus on recruiting professionals with expertise relevant to your chosen asset classes.

For instance, if you offer cryptocurrency trading, attracting professionals with blockchain technology knowledge would be beneficial. Look for individuals who possess a strong understanding of financial markets, risk management principles, and relevant regulations. Don’t underestimate the value of soft skills—Prioritise candidates with excellent communication, teamwork, and problem-solving abilities. Cultivate a positive and collaborative work environment to attract and retain top talent in the competitive financial services industry.

Compliance and Risk Management

Operating multi-asset brokers necessitate a robust compliance and risk management framework. Stay informed about the ever-evolving regulatory landscape and ensure your brokerage adheres to all applicable regulations across the jurisdictions in which you operate. Partner with legal and compliance professionals to navigate the complexities of financial regulations specific to your chosen asset classes. It is also essential to prioritise protocols like know-your-customer (KYC) and anti-money laundering (AML).

Implement a comprehensive risk management strategy to identify, assess, and mitigate potential risks associated with your business operations. This might include market risk, operational risk, and credit risk. Develop internal controls and procedures to safeguard client assets and ensure the integrity of your trading platform. Regularly review and update your compliance and risk management framework to adapt to changing regulations and industry best practices.

Embracing Innovation in the Multi-Asset Space

The fintech landscape is constantly evolving, presenting exciting opportunities for multi-asset brokerages. Stay ahead of the curve by embracing innovation and incorporating the latest technological advancements into your business. Consider integrating AI and machine learning into your platform to offer features like personalised investment recommendations and fraud detection.

Explore the potential of blockchain technology to enhance security and transparency in your operations. Staying informed about emerging technologies and their potential applications in the financial services industry allows you to differentiate yourself from competitors and provide a superior user experience for your clients.

Multi-Asset Broker Trends to Watch in 2024 and Beyond

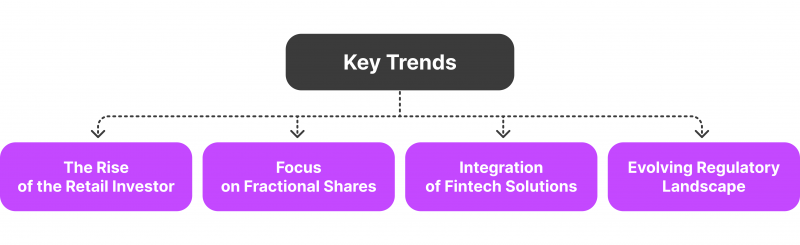

The multi-asset brokerage landscape is undergoing a metamorphosis. Here are some key trends poised to shape the industry in 2024 and beyond:

The Rise of the Retail Investor

Retail investors are increasingly seeking diversification through multi-asset investing. Brokerages that cater to this growing demographic by offering user-friendly platforms, educational resources, and fractional share investing will be well-positioned for success. As retail investors become a more prominent force, expect to see a shift towards educational tools and investment strategies tailored to their needs.

Focus on Fractional Shares

Fractional shares are democratising investing by allowing individuals to purchase portions of high-priced assets. This makes previously inaccessible assets like high-value stocks or even fine art more attainable for a wider audience. We can expect brokerages to expand their fractional share offerings to encompass a broader range of assets, further breaking down barriers to entry for retail investors.

Integration of Fintech Solutions

Financial technology is revolutionising the way brokerages operate. The continued integration of AI-powered investment tools, robo-advisors, and blockchain technology is likely to become commonplace. AI can personalise investment recommendations and enhance fraud detection, while robo-advisors offer automated investing solutions for clients seeking a hands-off approach. Blockchain technology has the potential to improve security and transparency within the industry. By embracing these advancements, brokerages can streamline operations, enhance user experience, and potentially gain a competitive edge.

Evolving Regulatory Landscape

The regulatory environment, particularly for emerging asset classes like cryptocurrencies, is constantly in flux. Brokerages that prioritise staying informed and adapting their offerings to comply with changing regulations will ensure long-term sustainability. Partnering with legal and compliance professionals can be instrumental in navigating this complex landscape.

By understanding and capitalising on these trends, multi-asset brokerages can position themselves for success in the ever-changing financial landscape.

Final Thoughts

Launching a multi-asset brokerage in 2024 presents both challenges and exciting possibilities. Careful planning, a well-defined target audience, a robust financial strategy, and a talented team are the cornerstones of success in this competitive market. Prioritising client protection, embracing innovation, and staying informed about regulatory changes are crucial for establishing a thriving brokerage that caters to the evolving needs of investors in the multi-asset world. Remember, building trust and fostering long-term client relationships are the hallmarks of success in this dynamic industry.