How Do You Become a PAMM Account Broker?

The Forex market is known for its high liquidity and potential to generate massive profits. As of 2025, the daily trading volume in this market has reached an astonishing $7.5 trillion. With such figures, it’s no surprise that many are interested in joining the industry.

If you’re considering entering the brokerage business, your venue should offer exceptional services and features to set it apart from the competition. One such service is PAMM (Percentage Allocation Management Module). Here, we will discuss what being a PAMM account broker means and how to ensure the best software for PAMM activities.

Key Takeaways

- PAMM offers a promising investment opportunity for individuals to invest money and leverage the skills of an experienced Forex trader to generate returns.

- A successful PAMM ecosystem involves investors, professional traders, brokers, and a robust, scalable software solution.

- Brokers operating PAMM accounts must navigate strict regulations and implement measures to ensure transparency, reporting, and investor protection.

- White-label PAMM solutions offer a resource-efficient way for brokerages to provide customisable and compliant services.

Why Offer PAMM Accounts?

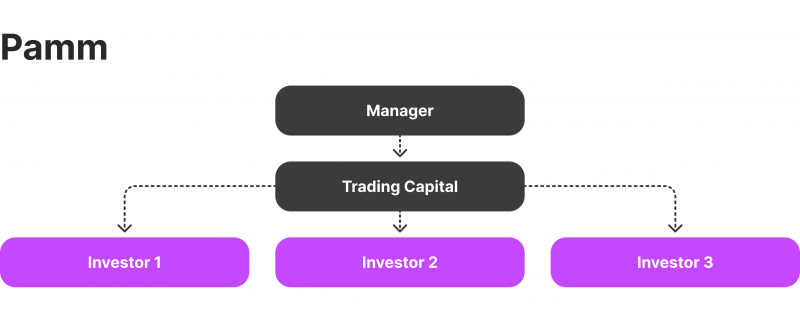

But what is a PAMM account? PAMM accounts are a popular investment vehicle among many Forex investors. They pool the capital of fund contributors and entrust it to the hands of experienced professionals. PAMMs offer a compelling proposition: the opportunity to capitalise on the Forex market’s potential without needing direct trading expertise.

As a PAMM account broker, you can leverage this growing demand and position your brokerage as a trusted intermediary between investors and money managers. By offering a robust Percentage Allocation Money Management platform, you can attract a diverse clientele, ranging from novice investors seeking passive income to seasoned traders looking to manage a larger pool of funds.

Elements of the PAMM Ecosystem

There is a network of components that work together to facilitate the management and performance of PAMM accounts, including:

Investors

Investors in a PAMM scheme are individuals or entities who contribute their capital to the pooled fund. They benefit from the potential returns generated by the trader’s expertise without the need to participate actively in the trading process.

Traders or Money Managers

The trader or fund manager is the experienced Forex professional who manages the PAMM account. They are responsible for executing trades, implementing risk management and multiple trading strategies, and generating returns for the investors. Crucially, the PAMM manager also contributes their own capital to the pooled account, aligning their interests with those of the investors.

The PAMM Broker

As the broker who offers such services, your role is to facilitate the interaction between investors and traders, providing the necessary infrastructure and support, including offering a robust PAMM platform, handling administrative tasks, and ensuring regulatory compliance.

The Platform

The PAMM software is the technological backbone of the whole ecosystem. It handles the allocation of funds, the distribution of returns, and the real-time monitoring and reporting of the account’s performance. As a broker, your choice of PAMM platform will be a critical factor in the success of your brokerage.

Regulatory Considerations for PAMM Brokers

The PAMM landscape is subject to certain regulatory requirements similar to that of a broader brokerage scene. As an aspiring broker, you must ensure the legitimacy and compliance of your brokerage by navigating this regulatory landscape with meticulous care.

Licensing and Regulatory Compliance

Depending on your location and the markets you wish to serve, you may need to obtain specific licences and regulatory approvals to operate as a PAMM account Forex broker. Consider collaborating with a financial adviser or legal expert. They can help you navigate the requirements and avoid potential pitfalls.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

In general, you will need to adhere to the regulations set forth by regulatory bodies such as the Financial Conduct Authority (FCA), National Futures Association (NFA), and Australian Securities and Investments Commission (ASIC).

Transparency and Reporting

Top PAMM accounts are subject to stringent transparency and reporting requirements to safeguard the interests of both investors and traders. As a broker, you must ensure that your copy trading platform provides detailed, real-time reporting on the account’s performance, transactions, and any changes in the trading strategy or management decisions.

Moreover, as part of your operational best practices, you must also implement robust AML (Anti-Money Laundering) procedures to prevent any illicit activities and maintain the integrity of your business.

Investor Protection Measures

Protecting your clients’ rights and investments is of paramount importance. This may involve segregating client funds, implementing secure fund management protocols, and clearly disclosing the risks associated with having a PAMM portfolio.

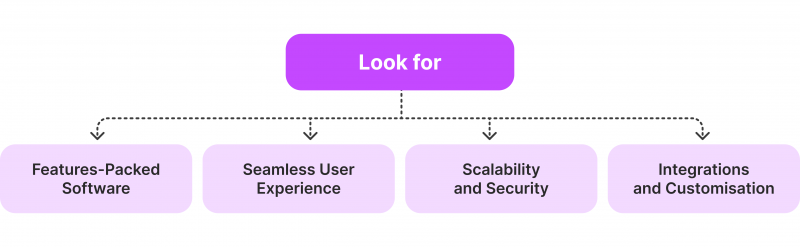

How to Select an Effective PAMM Platform

The foundation of a successful PAMM account brokerage lies in designing and implementing robust, user-friendly, and scalable copy trading software.

Features-Packed Software

Your PAMM platform should be equipped with a comprehensive suite of features that cater to the needs of both investors and PAMM managers. This may include real-time performance tracking, automated fund allocation, transparent reporting, and intuitive trading portfolio management tools.

Seamless User Experience

Ensure that your PAMM platform is designed with a focus on user experience, catering to market participants of all skill levels. You need to have a streamlined onboarding process, clear and informative dashboards, and seamless accessibility across different devices and platforms.

Scalability and Security

Look for software which offers robust infrastructure, reliable data storage, and secure data processing capabilities to ensure the continuous and reliable operation of your PAMM offering.

Integrations and Customisation

Your PAMM platform should be compatible with other Forex trading tools, market data providers, and third-party services to enhance your client’s overall experience.

The Benefits of Choosing a White Label PAMM Solution

If you are considering offering PAMM fund strategy to your clients but are worried about the regulatory and technical complexities involved, a white-label solution may be the perfect option for your business.

Regulatory Compliance

Choosing a reputable white-label provider means leveraging their existing regulatory approvals and licences. This way, you can focus on expanding your brokerage rather than navigating regulatory requirements.

Technical Support

White-label software is backed by robust technical support teams capable of managing any platform-related issues or updates. As a result, your time and resources can be dedicated to acquiring and retaining clients.

Customisation Options

Despite using a white-label solution, you can still maintain your brand identity and offer personalised services to your clients. Many white-label providers offer customisation options, such as branding the platform with your logo and design preferences.

B2COPY: Modern Solution for Daring PAMM Brokers

If you are looking for a comprehensive, advanced, and customisable PAMM platform solution, B2COPY can be the perfect fit for your brokerage.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

The B2COPY platform from B2BROKER offers brokers, prop trading firms and financial institutions a robust solution for copy trading, PAMM, and MAM accounts. This software combines significant performance capabilities with flexible personalisation options, processing transactions at lightning speed—over 1,500 deals per second. It boasts extensive connectivity, supporting more than 5,000 investors linked to a single PAMM account manager and over 1,000 to a PAMM master.

B2COPY is continually evolving, with new features in development, including a cross-server copy trading solution for brokerages operating multiple trading servers on MT4, MT5, and cTrader platforms. Additionally, a multi-platform copying solution is being created to accommodate users’ preferred trading environments.

Currently, B2COPY serves over 65 active brokers, manages more than 16,000 master accounts, and oversees around 40,000 investment accounts.

Conclusion

PAMM accounts are an attractive passive income option for investors and a lucrative business opportunity for Forex brokers and professional fund managers. To become the best broker for PAMM account services in the market, you need a robust platform, experienced technical support team, regulatory compliance, and customisable options.

A white-label PAMM software can be a solution. Take the time to research and understand your options before making a decision that will impact the long-term success of your brokerage.