Social Trading Tools for Brokers: Benefits, Core Features, and Top Platforms in 2026

Social trading continues to gain traction among retail: more than 92 million active users were recorded in 2023. Traders gravitate toward these platforms to study real strategies and follow experienced peers in a coordinated environment.

For brokers, these tools strengthen engagement and provide clients with clearer guidance and new opportunities. Integrating social or copy trading creates a more predictable onboarding funnel and a user base that interacts with the platform more consistently.

In this guide, we outline what value this feature creates for both sides of the marketplace and which social trading tools for brokers will define competitive offerings in 2026.

Key Takeaways

- Social and copy trading platforms now serve tens of millions of traders and are becoming a baseline expectation for new retail accounts.

- For brokers, social trading users typically trade more often, onboard faster, and stay active longer, which lifts revenue per client.

- Modern platforms let brokers run copy trading, PAMM, and MAM under a unified infrastructure.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

What Is Social Trading and Copy Trading?

Social trading turns a trading platform into a network where users watch each other’s decisions in real time and follow public strategies. Such platforms let less experienced traders observe how more seasoned participants react to market events.

The mechanics of copy trading are the backbone of these platforms. A trader (the follower) connects their account to a strategy provider, and the system mirrors each new trade according to predefined rules. Position size usually scales by balance or risk, so a provider with a $50,000 trading account can still guide a follower with $5,000 without manual recalculation.

Here are the main components of such a system:

- A social trading platform hosts the interaction and performance data.

- A copy trading software handles execution, turning a provider’s trade into synchronized actions across follower accounts.

- The trade copier is the module that reads those decisions and translates them into live orders for followers.

A well-structured social trading environment helps new users understand how strategies work, while giving advanced traders a way to expand their reach. Industry surveys show that a growing share of new accounts now interact with at least one trading signal provider during the first months of activity.

What is a Social Trading Platform?

From a brokerage standpoint, a social trading platform is the middleware that connects your trading servers to a community layer where clients can publish strategies, follow profiles, and allocate capital to selected providers. It works alongside the main trading stack and does not interfere with existing execution logic.

The platform reads activity from provider accounts and applies allocation rules to follower accounts in real time. Its job is to ensure that each replicated position reflects the provider’s intent with clear tracking of fills and account impact.

Most brokers integrate the social layer on top of MT*4, MT*5, or cTrader. Such a setup preserves existing pricing and risk models while opening a new engagement channel within the client portal and a mobile trading app.

Grow your Business with Copy, PAMM & MAM in One Platform

Flexible Investment Management for Traders & Investors

Supports Multiple Strategies Across Asset Classes

Seamless Integration with Existing Trading Infrastructure

Why Do Brokers Need Social Trading Tools?

Social trading is one of the strongest drivers of trader activation and platform stickiness today. Market data and industry adoption rates reflect this shift clearly.

Global social-trading ecosystems surpassed tens of millions of active users, and platforms such as eToro publicly report more than 30 million registrations. Most new traders already expect a social layer when choosing where to open an account.

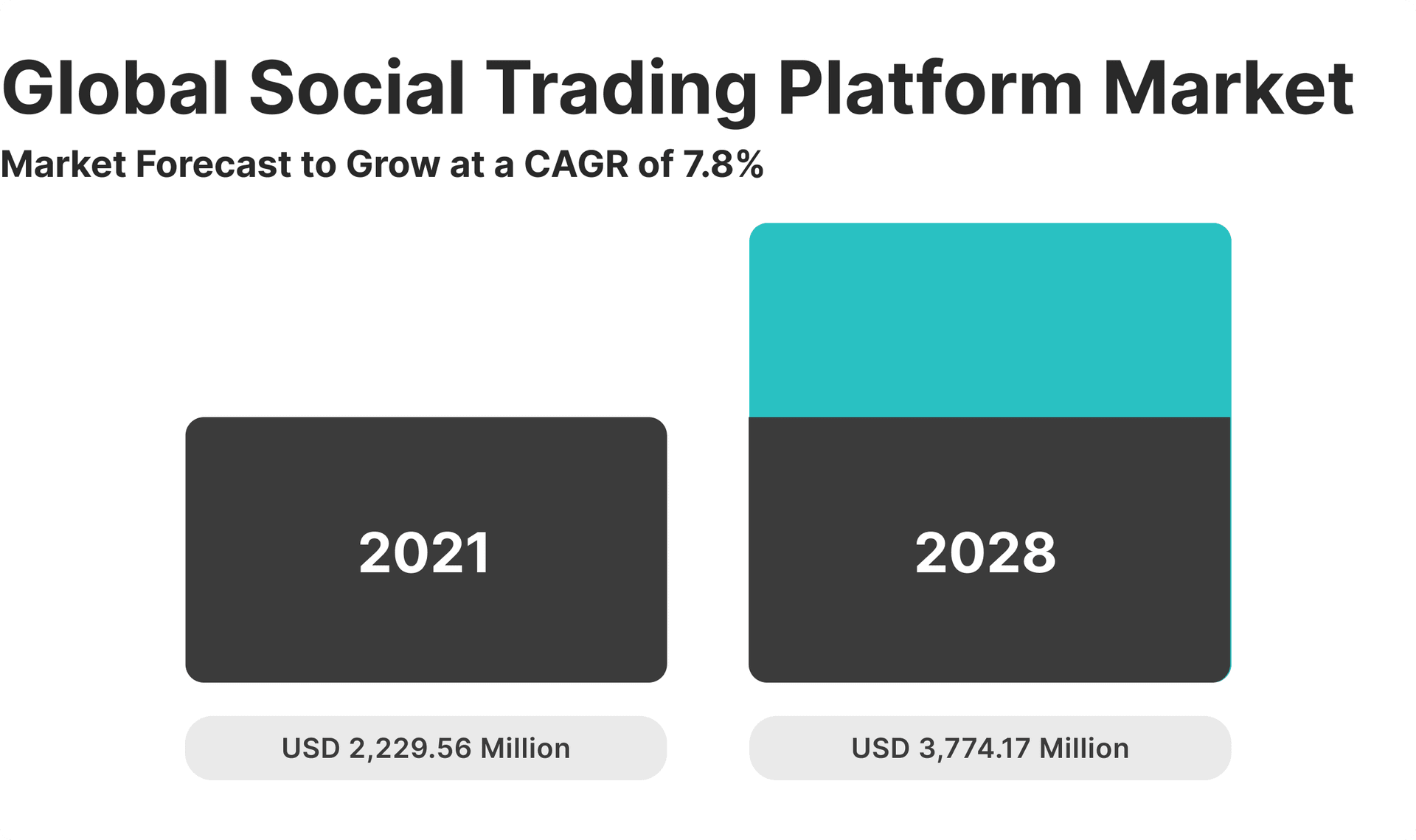

The market itself is expanding at a steady pace. The social and copy-trading segment exceeded $2.2 billion in 2023, with forecasts indicating a climb toward $4 billion by 2030. That growth rate shows strong behavioural demand among retail users.

For brokers, the business impact appears in measurable client behaviour. Traders who interact with social features execute more frequently and sustain longer activity cycles. In several published cases, copy-trading participants generated many more trades per user. Thereby, social trading improved revenue efficiency for businesses adopting these tools.

Key data points:

- Market Size: ~$2.2B in 2023, projected ~$4B by 2030 (CAGR ~7–8%).

- User Adoption: 90M+ users on major platforms; rapid expansion among traders under 35.

- Trading Frequency: Social and copy users show higher execution activity.

- Activation Speed: Copy-enabled accounts reach first trade faster.

- Investor Expectations: 30–40%+ of new investors rely on social insights.

For brokers, social trading turns into a direct growth driver. It strengthens retention and elevates the overall trading experience for a generation that expects interaction as part of the platform.

Key Factors When Choosing a Social Trading Platform

Selecting a social trading platform is ultimately a business decision. Careful evaluation of each feature of a solution helps you avoid costly rebuilds later and ensures your infrastructure scales with demand.

Below are the factors that have the greatest impact on long-term ROI:

Platform Reliability

A social trading system must process trades, allocations, and performance updates without delays. Even brief interruptions can distort execution quality for followers. Vendors should demonstrate consistent uptime backed by monitoring data rather than generic claims.

Integration Requirements

A platform that connects cleanly with your CRM, trading servers, and payment flows reduces manual work and lowers maintenance costs. Brokers save the most when integrations support account sync, permissions, and notifications without custom patches.

Scalability

Growth in user activity places a load on databases and analytics dashboards. A scalable platform must handle rising follower-to-provider ratios and larger strategy networks without performance issues. This directly affects expansion planning and regional rollouts.

Compliance and Oversight Tools

Regulators increasingly scrutinize trading activity. Your platform needs controls for suitability checks, audit logs that capture each action tied to a client, and more. These tools cut the risk of enforcement issues during licensing reviews or audits.

Risk Management Capabilities

A broker must be able to control allocation rules or max exposure. When these controls sit inside the platform rather than as external processes, it becomes easier to keep follower risk aligned with internal policies and jurisdictional rules.

Benefits of Integrating Social Trading Tools Into Your Brokerage Business

Social trading tools for brokers reshape how a company creates value on both sides of the book. The same infrastructure that guides inexperienced traders also supports higher activity from experienced users, which feeds directly into revenue, retention, and product stickiness.

Enhanced User Engagement and Community Building

A social layer turns forex trading from an isolated task into an ongoing interaction with the platform. When clients have access to visible performance histories and strategist commentary, they return more often and spend more time evaluating opportunities. Activity becomes habitual, which leads to stronger day-to-day retention.

Increased Trading Volume Through Copy Trading

Copy trading accelerates participation because it lowers the barrier to executing a trade. New users begin trading earlier, while active users maintain a steadier rhythm because strategy updates prompt them to stay aligned with market conditions. Many brokers report a noticeable lift in monthly order counts once copy modules are introduced, driven by the consistency these tools create in user behaviour.

Revenue Diversification Opportunities

A social ecosystem widens the commercial model of a broker. Performance-based fees on profitable copied strategies, transparent subscription tiers for access to specific providers, and structured management fees on pooled setups each add a separate line of income. This creates resilience in the revenue base, as income reflects the quality of the environment the platform provides.

Improved Customer Lifetime Value

Clients who rely on structured guidance are less likely to abandon the platform in the early months. These clients also demonstrate stronger referral patterns, since they share environments that help them progress. Over time, this produces a healthier, more durable client book that justifies ongoing investment in product development.

Launch Social Trading Without the Stress

Get a fully integrated social trading layer that connects seamlessly with your existing CRM and risk engines.

Key Features in Social Trading Tools for Brokers

A modern social trading stack must support automation, compliance, transparency, and scale. These foundations determine whether a broker can run a program that attracts high-value traders and handles large communities without operational strain.

Here are the key features your social trading solution must have:

Trade Copier Engines

A trade copier automates how a follower’s account reacts to the master’s activity. The engine reads each new trade and applies predefined allocation rules without manual input.

Effective systems must react quickly, since delays create slippage and weaken trust. Most brokers use FIX protocol or API bridges to deliver instructions instantly, even during volatile sessions when order flow intensifies.

Customizable Signal Provider Dashboard

A provider dashboard gives strategists one environment to track results and adjust commercial terms. Clear analytics help them evaluate how their strategy behaves over time.

Metrics often include drawdowns, long-term return patterns, and more. Dashboards with transparent data attract higher-quality traders and produce steadier follower conversion.

Integrated Risk Management and KYC

Social trading tools for brokers must screen both professional traders and followers before activity begins. Integrated KYC modules verify identities and capture required documents, while suitability checks confirm whether a client understands the risks of following leveraged strategies.

Regulated financial markets expect brokers to maintain audit trails that show why each account gained access to a specific feature. A built-in compliance layer handles this workload by storing approvals and monitoring behaviour patterns. This protects the broker from regulatory gaps and prevents clients from entering relationships that do not fit their profile.

Leaderboards and Performance Analytics

Leaderboards guide traders toward reliable strategies by ranking providers with metrics that reflect real skill. Systems often include filters for risk-adjusted return, consistency, and account history, since these factors correlate more closely with sustainable behaviour.

Analytics must remain clear and resistant to manipulation. Platforms increasingly rely on verified track records and time-weighted calculations to prevent artificial outperformance.

When leaderboards feel trustworthy, follower acquisition becomes significantly easier. Many brokers report that transparent rankings shorten the decision cycle for new users.

Multi-Asset Coverage

A social trading tool gains value when it supports a broad set of instruments, since providers can run strategies across currencies, indices, commodities, stocks CFD or cryptocurrencies without switching platforms.

Multi-asset capacity also widens the broker’s addressable market. Traders who diversify across several instruments tend to stay active longer, according to industry studies tracking retention behaviour.

Deep, Reliable Liquidity Across 10 Major Asset Classes

FX, Crypto, Commodities, Indices & More from One Single Margin Account

Tight Spreads and Ultra-Low Latency Execution

Seamless API Integration with Your Trading Platform

Automated Reporting and Compliance Tools

Reporting sits at the core of a social trading setup because money flows between many parties. The platform must track every copied trade and show a clear trail that finance and compliance teams can review quickly.

Strong systems generate daily and monthly reports automatically. They capture all financial operations in a consistent format that operations staff can reconcile with back-office and liquidity providers.

Compliance needs a separate lens. The same data feeds should flag abnormal behaviour and store full histories of approvals. When reporting runs through one automated engine, brokers scale follower numbers and strategy providers without adding headcount linearly, which keeps unit economics healthy as the program grows.

Community and Social Networking Features

Social trading for brokers only works when the community feels active and safe. Platforms use features such as profiles, comment threads, and direct messaging to keep traders in conversation around live strategies.

These tools need clear rules. Moderation workflows and basic identity checks help prevent spam and abuse, which protects serious users and preserves the value of the leaderboards.

Live streams and webinars deepen the relationship between successful traders and followers. Brokers that schedule regular events inside their platform often see higher attendance than external webinars, because users already stay logged in for trading.

Fee Configuration and Revenue Models

A flexible fee engine lets brokers match commercial terms to each segment of clients and jurisdictions. B2COPY, a modern social trading platform, supports many fee models that you can switch on or off in the admin panel:

- Performance fee

- Volume fee

- Subscription fee

- Joining (opt-in) fee

- Management fee

- Profit fee

With this toolkit, you can offer premium strategies with an entry fee, volume-driven programs for high-frequency flow, or long-term portfolios that use management and performance fees.

Cross-Platform Integration and Multi-Account Management

Many brokers run several trading platforms side by side. A cross-platform social engine solves this by connecting MetaTrader 4* or cTrader into one environment. B2COPY follows this model and lets your traders manage all linked accounts and strategies from a single interface.

For multi-asset or hybrid brokers, this approach keeps operations lean. Teams configure risk rules once, apply them across platforms, and monitor everything through one dashboard.

Flexible Money Management Models

Different client segments expect different account structures. Retail followers often prefer straightforward copy trading, while experienced investors look for managed solutions with clear allocation rules and professional oversight.

A mature social platform supports all three key models in one place:

- Copy trading for simple one-to-one or many-to-one following.

- PAMM for pooled capital with percentage-based allocation of results.

- MAM for managers who trade many accounts with tailored lot sizes or risk per client.

B2COPY let brokers configure these models inside a single ecosystem. That consolidation reduces shortens onboarding and gives clients a clean upgrade path as their capital and experience grow.

5 Best Social Trading Platforms for Brokers

Before selecting a social trading solution, a broker evaluates how the platform integrates with existing systems and scales under real order flow. The tools below reflect different approaches to these requirements, giving brokers a clear sense of available options and their practical strengths.

1. B2COPY

B2COPY gives fintech companies a unified system for managing provider strategies and follower accounts in real time. Its copier executes trades with low latency and supports proportional allocation, equity-based scaling, and reverse signals for hedged books.

The platform integrates with MT*4, MT*5, and cTrader through one control panel, which simplifies supervision for multi-platform brokers. Providers configure fees through six monetization models, including performance and volume-based structures, allowing precise revenue alignment across jurisdictions.

B2COPY fits brokerages that expect high strategy turnover or plan to scale aggressively, because its reporting functionality, KYC controls, and risk settings remove most of the operational strain that follows rapid user adoption.

Discover how B2COPY empowers brokers and traders with advanced copy trading, PAMM, and MAM solutions in one user-friendly platform.

16.05.25

2. eToro

eToro is one of the earliest large-scale social trading ecosystems, with millions registered users. Its model centers on public profiles and social discussion tools that introduce trading to audiences familiar with community-driven platforms.

Although eToro operates as a closed system rather than a plug-in solution for forex brokers, its design helped shape user expectations around transparency and community engagement.

3. ZuluTrade

ZuluTrade connects brokers to a broad network of strategy providers and offers follower protection through configurable limits and performance filters. Its multi-broker architecture allows each firm to define local risk rules while sharing access to the global provider base.

The platform is relevant for brokers expanding into multi-asset coverage because its provider lists span forex, commodities, indices, and crypto.

4. MetaTrader* Signals

MetaTrader Signals gives traders a simple, platform-native way to copy verified strategies directly inside MT*4 or MT*5. This reduces onboarding friction as users stay within the interface they already know.

The model suits brokers that want minimal integration work, though fee controls and compliance visibility are more limited than in dedicated social trading platforms.

5. cTrader Copy

cTrader Copy provides built-in social trading for brokers already operating on cTrader. Strategies are available across desktop, mobile, and web terminals, and users can filter providers by risk, history, and profitability.

Brokers can restrict trading strategies to in-house providers or open access to the full public list, which gives them flexibility in how they position the product. The system is straightforward to deploy and fits firms seeking fast activation without large engineering work.

Upgrade Your Brokerage with cTrader

Deploy a complete cTrader White Label with built-in copy trading and deep liquidity access in just weeks.

Implementation Steps for Successful Social Trading

Launching social trading works best when you have a clear rollout plan. It reduces incidents after go-live and helps you prove ROI on infrastructure, licensing, and acquisition spend.

1. Plan Your Infrastructure

Start with capacity planning for peak sessions and high-impact news events. Map how trade copier traffic, pricing feeds, and reporting jobs hit your servers, then design latency budgets and failover rules that keep trading service available during stress.

2. Select a Trusted Technology Partner

When you shortlist vendors, check real integration cases with MT4, MT5, cTrader, or your in-house stack. Validate their security audits, uptime records, and support SLAs, because these factors determine how quickly you recover from production incidents.

3. Configure Risk and Compliance Modules

Before inviting users, set firm-wide limits for leverage, allocation caps, and provider access. Build AML scenarios around copy flows, and ensure that every copied trade leaves a traceable record that your compliance team can export in a standard format.

4. Onboard Traders and Signal Providers

Define quantitative entry rules for providers, such as minimum track record length and maximum drawdown. Prepare clear guides for followers that explain risk settings and fees, then back this with campaigns that channel new accounts into the social environment.

5. Launch and Monitor Performance

Treat the first months as a controlled pilot. Track adoption rate, average copied volume per account, incremental revenue per social trader, and incident counts. Use these metrics to refine limits, marketing, and product UX before you scale to your full client base.

Empower Your Brokerage With B2COPY

B2COPY gives your brokerage a ready-made social trading layer that plugs into MT4, MT5, and cTrader and scales with thousands of follower accounts. Over 500 institutional clients already use B2BROKER technology across liquidity, CRM, and risk infrastructure.

With more than 10 years in the market, B2BROKER helps you launch copy trading, PAMM, and MAM under one stack instead of assembling separate modules. If you plan to upgrade your trading offering for 2026, our team can scope an end-to-end deployment and migration path with you.

Ready to Grow Your Community?

Equip your brokerage with B2COPY’s advanced copier, PAMM/MAM modules, and flexible fee structures today.

Frequently Asked Questions about Social Trading Tools for Brokers

- What if my brokerage only has a small user base?

Social trading helps small brokers grow by attracting beginners who prefer guided trading and by increasing activity among existing users.

- How do I handle region-specific regulations for social trading?

Modern platforms offer geo-blocking and automated suitability checks to restrict access based on the user's location.

- What is the minimum budget needed to implement social trading?

Entry-level setups often start around $3–5k per month, while mid-tier and enterprise implementations require higher licensing, hosting, and support budgets.

- How do social trading platforms prevent manipulation?

Platforms use automated algorithms to verify trade history and detect artificial performance patterns. Only real, verified accounts are displayed on leaderboards to ensure transparency.

- Can traders lose more money with copy trading than with regular trading?

Risk exists, but platforms mitigate this through mandatory allocation limits and equity guards. These tools ensure followers disconnect automatically if a strategy exceeds a defined loss threshold.