Top Trading Platforms for Brokers to Partner with

The brokerage landscape has changed quite a bit in recent years, gradually lowering barriers for smaller entities to compete. Before the digital transformation of the 2010s, brokerage companies were predominantly large corporations possessing massive capital and established international presence. Now, it is possible to become a broker with much less initial capital, connections, and jurisdictional power.

However, the modern brokerage field is more competitive than ever due to slight market saturation. While there’s still a lot of space for new entrants, it is crucial to distinguish your business from the average offerings within the field.

Points of differentiation should primarily be your service quality, freedom of choice, advanced trading tools, and the synergy your different systems produce to create a singular user experience. To achieve that, selecting top trading platforms for brokers is imperative. Let’s discuss.

Key Takeaways

- Online trading platforms can simplify numerous operations for online brokers and elevate their profit margins.

- Partnering with online trading platforms gives brokers access to currency selections, analytics tools and diverse trading instruments.

- Interactive Brokers, MetaTrader, B2TRADER, TradeLocker and cTrader are all excellent choices for potential partnerships.

The Importance of Trading Platforms for Brokerages

Emerging brokerage companies operating in small- and medium-sized trading markets mostly rely on white-label solutions and other tools to simplify their initial market penetration costs. For the same reason, online brokers often partner with trading platforms to acquire trading instrument options, powerful liquidity channels, ready-made analytics tools and various other digital capabilities.

This mutually beneficial partnership allows an online broker to avoid many arduous tasks and development responsibilities and significantly shortens the time-to-market period.

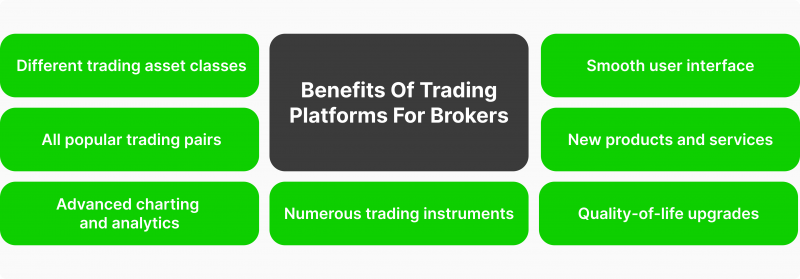

Moreover, partnering with online trading investment platforms levels the playing field for brokers, allowing them to compete against larger organisations that offer a large ecosystem of trading options. Here’s what a startup broker can receive from the best online day trading platforms:

Wide Selection of Currency Pairs

With popular currencies becoming too saturated for their own good, traders and investors often seek alternative trading options to raise their profit margins. Whether it’s crypto, FOREX, or other commodities, the top asset pairings are only profitable for whale investors or a long-term futures trading practice. Retail traders must diversify their portfolios to reap consistent and measurable returns.

So, online brokers must provide a wide range of asset offerings across different asset classes, regardless of their niche. If it’s FX, a competitive broker should have at least 30 of the popular pairings. The same is true in the crypto landscape. The best-ranked online trading platforms can easily provide access to an order book that facilitates these diverse pairings.

Access to Trading Instruments

Aside spot trading, today, instruments like derivatives, social trading subsets, contracts for difference and many others have become popular, allowing investors to diversify their strategies and create long-term roadmaps to success. So, as a broker, you must be able to provide the most popular trading tools and instruments to your target audience.

The same is true for advanced trading methods like exchange-traded funds (ETFs). With trading platform partnerships, your brokerage will gain access to polished, well-functioning trading tools for crypto, FX, and stock market audiences.

Charting, Analytics and Complementary Tools

Charting is one of the most important capabilities that every modern broker should possess. In 2024, it no longer makes sense not to present your customers with data visualisation related to price charts, trend indicator movements, and other important data variables. Online trading platforms often have state-of-the-art integrations, receiving charting data from industry leaders like TradingView, CoinmarketCap, and others.

You can leverage their integrations and receive charting capabilities without extra hassle. Moreover, best online brokers should also have analytics tools to assess various tradable assets and analyse specific pairings.

Trading platforms have many analytics tools readily available to be integrated into your service bundle. The same goes for various complementary tools to elevate the customer experience and create a comprehensive hub for their trading needs. With trading platforms, you won’t have to design, develop and stress-test your in-house solutions for charting, analytics and other digital solutions.

New Technologies and Quality-of-Life Feature Updates

The trading field is quite dynamic, with industry leaders offering numerous upgrades, new indicators for analytics, advanced charting options and other complementary tools to elevate the level of precision in investments.

When investors open a trading account, they expect all the latest bells and whistles the trading landscape provides. Keeping up with technological innovations and new products can be tricky for a smaller or mid-sized company.

Partnering with trading platforms will liberate you from this task, letting your brokerage business divert funds into growing your target audience. Instead of spending thousands on designing and developing system upgrades and new products, you can automatically equip your business with the best tools and solutions from your trading platform partner.

Margin trading and derivatives have become globally popular for traders with limited investment budgets.

Essential Factors to Consider with a Trading Platform

While there are numerous benefits in selecting and partnering with the best online trading platforms, the selection process might become challenging. The list of online trading platforms grows daily as this sector has become quite saturated. So, it is crucial to choose your partnership carefully and evaluate the competency of your potential provider.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

The most important aspects are liquidity capabilities, technological prowess, legal compliance, and the ability to adapt to industry changes. Liquidity is arguably the most critical aspect in determining the breadth and depth of offered currency pairings. Without sufficient currency options, maintaining a steadily growing customer niche will be difficult.

Technical competency is crucial for trading platforms to ensure the efficiency of their systems, providing traders with instant execution, real-time data feeds and a smooth UI experience.

Legal compliance should also be assessed carefully. You and your trading partner should share the operational jurisdictions. Otherwise, you might not be able to legally use all of their products and features.

Finally, adaptability and overall performance are intangible parts of being a competent trading platform. Flexibility is the X factor in the modern trading environment since adapting to new market shifts and technical upgrades is essential.

Are Hybrid Partnerships Worth It?

Hybrid partnerships are becoming more and more popular for brokerages. Hybrid arrangements mean you can partner with several trading platforms at once and receive different features or products from each one. While it can be beneficial to create a multi-party partnership, you might be sacrificing the long-term stability and fluidity of your operations.

It is generally favourable to establish relationships with a single solution provider, regardless of the arrangement. Dealing with a single partner simplifies your workflow, streamlines your communications and minimises the confusion for your employees.

However, hybrid partnerships might be worth exploring in the case of niche product offerings. Sometimes, popular trading platforms are slow to adopt alternative trading instruments or unconventional trading tools. In these cases, partnering with multiple trading platforms might give you a competitive advantage.

5 Top Trading Platforms for Brokers to Consider

There are numerous promising choices in the current market that could facilitate a profitable relationship for online brokers. Modern trading platforms have become adept at providing varied services, high-quality trade processing and a premier user experience from top to bottom.

Below, we present some of the most optimal choices available for small and mid-sized brokers who have just entered the market or simply wish to expand the range and extent of their trade offerings.

1. Interactive Brokers

Interactive Brokers (IBKR) has emerged as the best institutional trading platform, offering an impressive package of analytics solutions, trade tools, and a diverse portfolio of asset classes.

From international access and risk mitigation to algorithmic trading solutions, IBKR provides numerous tools for traders to succeed in the long run. Partnering with IBKR’s ecosystem can help brokers provide industry-leading services without technical complications or constraints.

IBKR also falls under the jurisdiction of the financial services compensation scheme (FSCS), protecting its customers from any worst-case scenarios related to the platform’s solvency.

IBKR supports trading activities on desktop applications and mobile devices, expanding the range of data delivery and convenience for investors. IBKR will provide reliable and technically fluent solutions for online stock brokers, mutual funds, and any other B2B trading service providers.

2. MetaTrader

MetaTrader is renowned for its ability to deliver a seamless trading experience. Its intuitive user interface allows users to swiftly customise charts, currency or asset watchlists and engage in one-click trading.

MetaTrader also boasts a comprehensive set of charting and analytics tools. Every major trend indicator and financial ratio is present within the platform, offering seamless visual guidance to understand complex market movements.

Moreover, MetaTrader’s automated trading scripts allow users to set predetermined outcomes for their trading strategies, making it easy to mitigate risks and enter or exit positions in a timely manner. MetaTrader has access to a wide range of asset-class markets, including FOREX, crypto, commodities and many other types. Coupled with affordable trading costs, MetaTrader’s diverse trading services can easily accommodate customers on an international level.

So, partnering with MetaTrader can produce a great level of synergy for your brokerage business, letting you adopt best trading practices for your users without spending too much time and resources on building everything from scratch. As a result, you will seamlessly accommodate traders who wish to buy or sell investments swiftly and at a low cost.

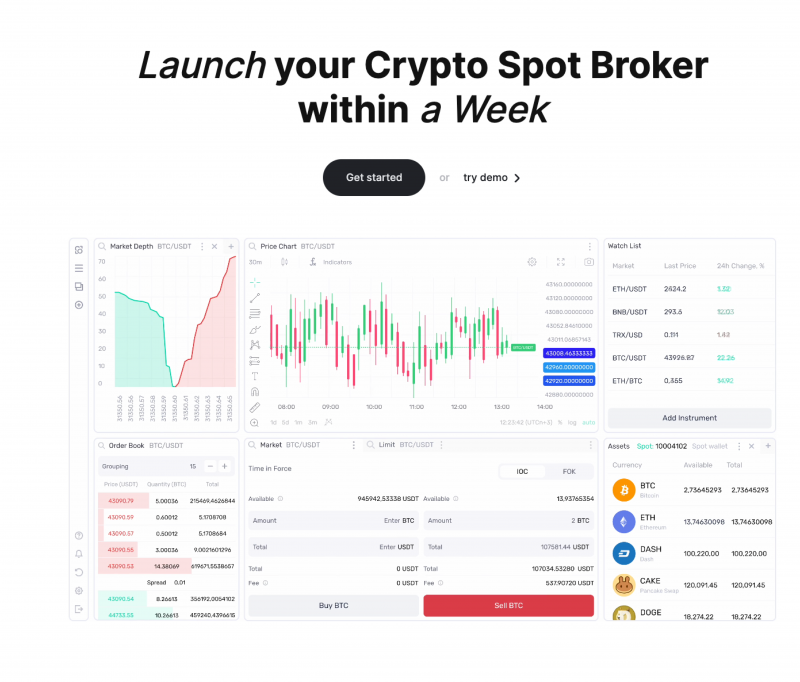

3. B2Trader

Recently Launched by B2BROKER, the B2TRADER Brokerage Platform (BBP) was designed to accommodate broker companies that wish to enter the field of crypto spot trading. B2TRADER offers state-of-the-art processing capabilities, executing trades at a 1 ms rate and providing live data updates every 100 milliseconds.

With over 3000 trading instruments spread over eight asset classes and powered by B2Broker’s extensive ecosystem, B2TRADER is an excellent partnership option for brokerage companies.

Any company that wishes to lower the crypto entry barriers can swiftly acquire BBP and set up spot trading options within a single week. The system is optimised to integrate seamlessly with different types of online trading platforms, raising the level of efficiency and reducing the time-to-market period.

BBP employs leading tech solutions from Amazon, CloudFlare, Kubernetes, and other cutting-edge tech systems. As a result, BBP offers maximum speed and bandwidth for brokers to accommodate instant crypto spot trading. The TradingView extension further elevates the charting and visualisation capabilities.

Finally, BBP is enriched by B2Broker’s trading ecosystem, allowing brokers to integrate CRM & back-office, payment processing and white-labelling options. However, B2Broker’s ecosystem goes even deeper, providing FIX API connectivity options and numerous integrations to make the brokerage workflow simpler for businesses.

All of these tools and services are available at market-low trading fees, allowing you to maximise your brokerage profit margins.

4. TradeLocker

TradeLocker confidently presents state-of-the-art solutions that can be easily accessed by professionals and newcomers alike. In addition to the usual offerings of charting, analytics, speedy execution, varied asset classes, and API integrations, TradeLocker presents several exciting features that might be hard to find elsewhere.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Firstly, TradeLocker presents the Micro-lot trading option, allowing investors with limited funds to elevate their chances of success and profitability. Micro-lot trading lets users participate in trading with smaller trade sizes, which is a great option for newcomer traders to test their strategies.

TradeLocker also presents a unique spin on one-click trading, letting users set up trades beforehand and conveniently establish stop-loss and take-profit levels. TradeLocker also boasts the TradingView integration in full force, harnessing the charting capabilities of an industry-leading analytics platform.

Combined with deep liquidity channels and accessibility across all popular devices, TradeLocker’s functionalities are well-rounded for all types of traders. As a result, TradeLocker can serve as a reliable and effective partner in building optimal brokerage services.

5. cTrader

Last but certainly not least, we have the cTrader trading platform to round out the list of optimal partnerships. cTrader is an excellent example of what a modern trading platform should look and function like.

From in-depth charting and analytics and advanced order execution options to near-instant execution, cTrader creates an effective trading environment for users. cTrader also provides advanced trading options like margin, copy and algorithmic trading, satisfying the demands of newcomer or part-time traders.

Moreover, cTrader provides multi-asset options for trading, going beyond FX and offering instruments like CFDs for online stock trading, commodities and indices. As a result, cTrader has become one of the best online CFD trading platforms. Algorithmic trading is not as simple for newcomers, presenting a steep learning curve for beginners. However, learning this trading approach is certainly worth it in the long run.

So, if you decide to partner with cTrader, your brokerage account will feature numerous investment options and trading strategies, allowing you to increase your revenue streams and profitability.

Final Takeaways – Simplifying Your Growth Roadmap

As a broker, acquiring a trading platform can drastically reduce your operational responsibilities and the technical complexity related to running a brokerage business. The biggest online trading platforms have already figured out how to optimise the trading experience for newcomer and professional traders. So, you can tap into this well of knowledge, experience and practical expertise for your own benefit.

However, before selecting the final choice, you should conduct a thorough research that ensures the transparency and reliability of the selected trading platform. Otherwise, your partnership might not be as fruitful as you’d hoped.

FAQ

What are the benefits of partnering with trading platforms?

Trading platforms can provide trading instruments, analytics tools, liquidity channels and an expertly crafted user interface, creating an ideal environment for your users.

Can I minimise costs by partnering with a trading platform?

Trading platforms will help you save costs in several departments, including in-house development resources, technical maintenance expenses, and costs associated with creating new products or features on your brokerage platform. However, you should remember that Despite using a trading platform as your partner, you will still have to pay capital gains tax on your profits.

How can I verify the reliability of a trading platform?

Thanks to the internet, it has become much easier to access online trading platforms review of many types. You can analyse customer reviews, check the platform’s licensing, and assess their track record over the years without any hassle or prolonged research periods.