Order Management System Explained: How Does it Work?

Trading is a set of complex, reticulated systems and services that provide one function — access to capital markets. Among a large variety of such systems, an order management system fulfils the most important function in the infrastructure of a brokerage company — managing orders.

This article will tell you what an order management system is and how it works. You will also learn its advantages and what it means for traders and brokers.

Key Takeaways

- An order management system is a software platform designed to facilitate and manage the execution of trade orders.

- Brokers and dealers utilise an OMS to fulfil orders for different types of securities, allowing them to track the progress of each order throughout the system.

- A robust OMS enables firms to monitor positions in real time and helps prevent regulatory violations by ensuring compliance with relevant rules and standards.

What is an Order Management System?

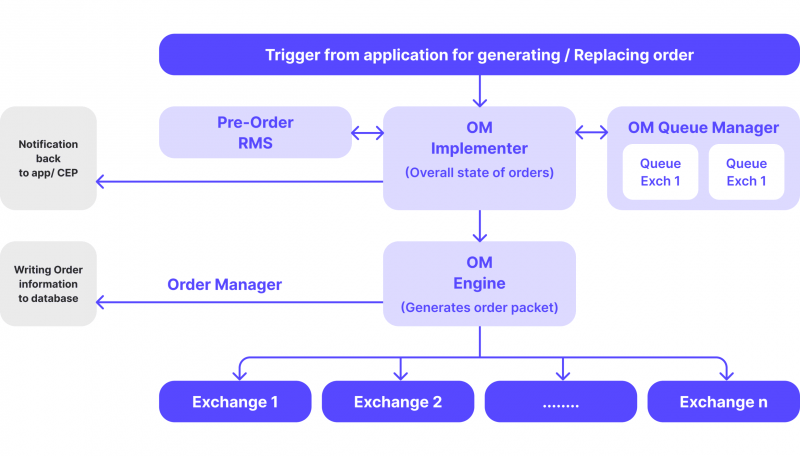

An order management system (OMS) in trading is a software platform that facilitates the entire lifecycle of trade orders, from placement to execution and settlement. It enables traders, brokers, and asset managers to efficiently manage and track buy and sell orders across various financial instruments, such as stocks, bonds, derivatives, and currencies.

The OMS streamlines the trading process by providing real-time market data, automating trade execution, and ensuring compliance with regulatory requirements, making it a crucial tool for modern financial markets.

An OMS typically routes orders to the most suitable exchange based on price and execution quality and allows traders to select which exchange to send the order to manually.

The Role of Order Management System in Financial Markets

The role of an order management system in financial markets is to streamline and automate the trading process, enhancing efficiency and accuracy across various market participants. An OMS connects traders, brokers, and asset managers to financial exchanges and other liquidity providers, allowing them to execute trades quickly and with minimal errors.

Key roles of OMS in financial markets include:

Trade Execution

OMSs facilitate the seamless placement and execution of buy and sell orders by automatically routing them to the most suitable trading venues, including exchanges, ECNs, or dark pools. The system evaluates various factors such as price, speed, and liquidity to ensure that traders achieve the best possible execution under the prevailing market conditions.

Additionally, OMSs often support advanced order types, enabling users to implement complex trading strategies more efficiently.

Real-Time Market Data

OMSs have real-time market data feeds that provide up-to-the-second price quotes, bid-ask spreads, and trading volumes. Traders rely on this information to make informed decisions, react to market movements, and capitalise on opportunities.

Real-time data integration helps traders adjust their strategies on the fly, enabling them to act on emerging trends, price fluctuations, and news events. This access to live data ensures that decisions are based on the most current information, which is particularly critical for high-frequency trading and dynamic markets.

Order Tracking and Management

An OMS offers comprehensive tools for real-time tracking and managing multiple orders across various asset classes and exchanges. Traders can monitor the status of their orders from the moment they are placed until they are fully executed or settled, ensuring transparency and control throughout the trade lifecycle.

In addition, an OMS allows users to modify, cancel, or split orders as market conditions evolve. The system also tracks order history, enabling traders to review and analyse past trades for performance insights or compliance checks.

Compliance and Reporting

OMSs play a crucial role in helping traders, brokers, and asset managers meet stringent regulatory needs by automating compliance checks and generating detailed reports. These systems ensure that all trades are subject to market conditions and policies, such as pre-trade risk limits, position size restrictions, and reporting obligations.

OMSs also maintain audit trails for every order, providing a clear record of execution times, prices, and order modifications. This reduces the risk of non-compliance, simplifies regulatory audits, and ensures that firms can respond quickly to any inquiries from regulatory bodies.

Portfolio and Risk Management

For asset managers, an OMS is invaluable in managing multiple portfolios simultaneously. The system offers real-time insights into portfolio composition, asset allocation, and market exposure, allowing portfolio managers to assess risks and ensure alignment with investment mandates.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

The OMS can also enforce pre-trade compliance checks, ensuring that each order fits within predefined strategies, risk tolerances, and client-specific mandates. It enhances decision-making and enables proactive portfolio management by offering a centralised view of portfolios and associated risks.

Efficiency in High-Volume Trading

In fast-moving and high-volume markets, OMSs significantly enhance operational efficiency by automating repetitive tasks such as order routing, execution, and reporting. This reduces the risk of manual errors, which can be costly in volatile markets. OMSs also ensure that large, complex orders — common in institutional trading — are executed precisely and quickly.

By automating workflows and offering real-time monitoring, OMSs make it easier for traders to handle high volumes of trades efficiently, improving performance and minimising execution costs. This is especially crucial for institutional investors, hedge funds, and brokerage firms dealing with large order blocks or high-frequency trading strategies.

Importance of Order Management System for Traders, Brokers, and Asset Managers

An order management system is important for traders, brokers, and asset managers because of its ability to streamline operations, enhance trade execution, and manage risks effectively. Here’s how OMS is vital for each group:

For Traders

OMS empowers traders to execute orders across diverse exchanges and asset classes swiftly. It provides access to real-time market data, enabling quicker and more well-informed decision-making, which is particularly valuable in tumultuous market conditions. Moreover, traders can closely monitor the real-time status of their trades, ensuring precise execution, modification, or cancellation of orders as needed.

OMS facilitates algorithmic and high-frequency trading, enabling traders to deploy intricate strategies with minimal manual intervention. Through the automation of the order placement and execution process, an OMS diminishes the likelihood of manual errors, thereby enhancing trade precision.

For Brokers

An OMS helps brokers manage large volumes of orders from multiple clients efficiently, ensuring timely and accurate execution across different markets. Brokers can seamlessly handle orders from different clients, ensuring proper trade allocation and settlement. OMSs also provide tools for managing client portfolios and handling complex orders.

Brokers must adhere to strict regulatory requirements. An OMS helps automate reporting, ensuring that all trades comply with market regulations and minimising the risk of penalties. By enhancing the speed and accuracy of order execution, OMS enables brokers to offer better service to clients, building trust and long-term relationships.

For Asset Managers

An OMS allows asset managers to execute and manage trades for multiple portfolios from a single interface. It provides real-time visibility into order status, performance, and market conditions, enabling effective decision-making.

Asset managers can easily allocate trades across different accounts or portfolios, ensuring that the appropriate amount of assets is distributed as per client mandates.

Furthermore, OMS integrates with profile management tools to provide asset managers with insights into portfolio risk exposure and market volatility, enabling proactive risk management. It offers detailed reports on trade execution, portfolio performance, and compliance, allowing asset managers to track and analyse performance for better decision-making.

Benefits of Using an Order Management System in Trading

The benefits of using an OMS in trading are numerous, particularly for traders, brokers, and asset managers who require speed, accuracy, and efficiency in managing their trades. Here are the key benefits:

Improved Efficiency

An OMS software automates many manual tasks, such as order placement, execution, and reporting, reducing the time spent on administrative tasks. This allows traders and brokers to focus more on strategic decision-making.

With automated workflows and real-time market data integration, an OMS enables quicker trade execution, which is crucial in fast-moving financial markets.

Better Trade Management

Traders can track their orders in real time, ensuring they stay informed about the status of each trade. This allows them to make adjustments quickly if market conditions change.

An OMS supports a wide variety of order types, including complex ones like limit orders, stop-loss orders, and algorithmic orders, giving traders greater flexibility in their strategies.

Error Reduction

By automating the trade lifecycle, an OMS reduces human error, such as entering incorrect trade details or misplacing orders. This ensures more accurate and reliable trading processes.

The system automatically checks the validity of orders against predefined rules, reducing the likelihood of errors related to compliance, risk management, or market rules.

Enhanced Compliance and Regulatory Reporting

OMSs automatically generate reports for regulatory compliance, audit trails, and financial disclosures, helping firms meet regulatory obligations without manual effort.

The system keeps a detailed record of every transaction, enabling thorough tracking and auditing of trades for compliance purposes.

Cost Savings

Automating processes through order management system software reduces the need for extensive manual labour, thereby cutting operational costs. By minimising errors in order entry and execution, an OMS helps avoid the financial losses associated with trade mistakes.

Greater Risk Management

An OMS can be configured to perform pre-trade checks to ensure trades align with risk management policies, such as position limits or portfolio restrictions. This reduces the risk of unauthorised or excessive trading.

With real-time data on positions, trades, and market movements, an OMS provides insights that help traders and asset managers manage their risk exposure more effectively.

Enhanced Trading Strategies

Many OMS platforms support algo trading strategies, allowing traders to implement complex trading algorithms that are carried out based on pre-set parameters like price, volume, or timing.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

An OMS enables traders to manage multiple asset groups (stocks, bonds, FX, derivatives) from a single platform, making diversifying portfolios and implementing cross-asset strategies easier.

Better Client Management for Brokers

Brokers using OMS can manage large volumes of client orders efficiently, ensuring accurate execution and allocation across portfolios.

Brokers can generate customised reports for clients, providing detailed information about order execution, performance, and costs.

Increased Scalability

An OMS order management system allows institutions to handle large volumes of trade and scale their operations without compromising performance. This is especially valuable for institutional traders and asset managers dealing with multiple portfolios and high-frequency trades.

OMSs can connect to multiple trading venues, allowing firms to execute orders globally and across various markets, enhancing their reach and liquidity access.

Improved Decision-Making

An OMS provides real-time data and analytics, helping traders and portfolio managers make more informed decisions. The system can analyse performance metrics, market trends, and risk factors to optimise trading strategies.

Asset managers can use an OMS to maintain oversight of multiple portfolios, track performance, and adjust positions based on real-time data, improving overall portfolio performance.

Conclusion

Order management technology is crucial in modern trading environments, serving as the backbone for managing and executing trade orders efficiently. Its importance cannot be overstated, as it facilitates real-time oversight, abidance with regulatory requirements, and the seamless tracking of various securities throughout their lifecycle. As the financial markets continue to evolve, driven by advancements in technology and increasing regulatory scrutiny, the role of OMS will only grow more significant.

Firms investing in effective OMS solutions will be better positioned to adapt to changing market dynamics, improve operational efficiencies, and enhance their trading strategies. In the fast-paced world of finance, the OMS will remain integral to achieving optimal execution and maintaining a competitive edge.

FAQ

What is an order management solution in trading?

An order management system in trading is a specialised software platform that helps traders and financial entities manage the entire lifecycle of trade orders.

How does a system order management facilitate trade execution?

An OMS automates the order routing process, ensuring that buy and sell orders are directed to the most appropriate trading venues, such as exchanges or dark pools.

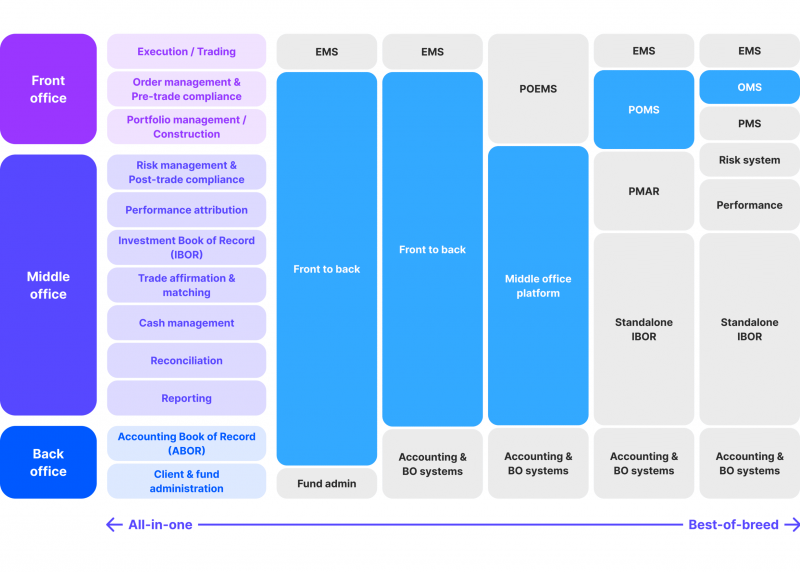

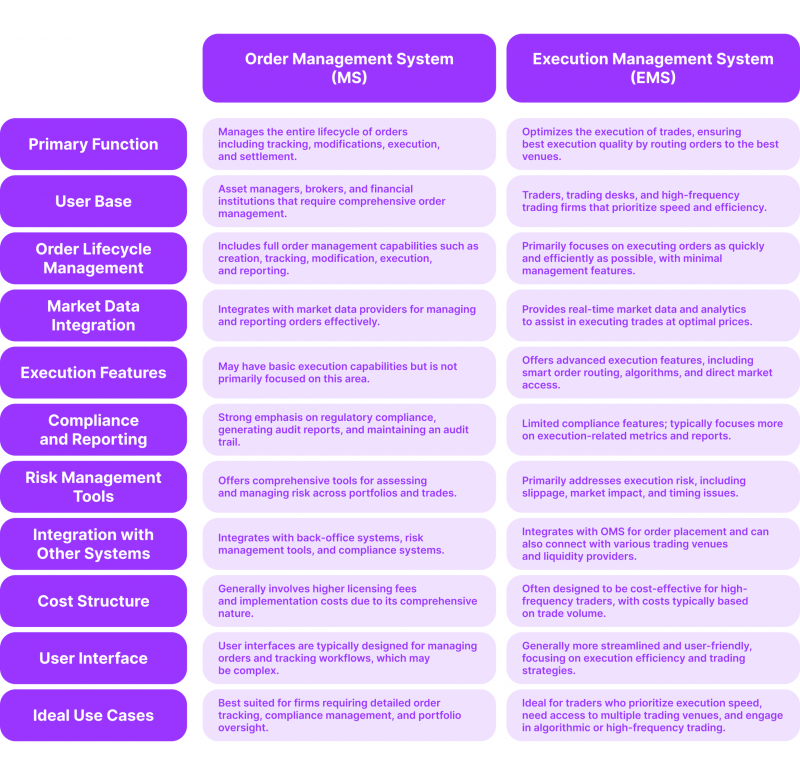

How does an OMS integrate with other trading systems?

Many OMS platforms can integrate with other trading systems, such as execution management systems (EMS), risk management tools, and market data providers.

Can an OMS support algorithmic trading strategies?

Yes, many modern OMS platforms are designed to support algorithmic trading modes, countenancing traders to create automated trading models that can process trades predicated on specified factors, such as price movements, volume, or time intervals.