How to Choose a White Label Prop Trading Solution: Complete Guide

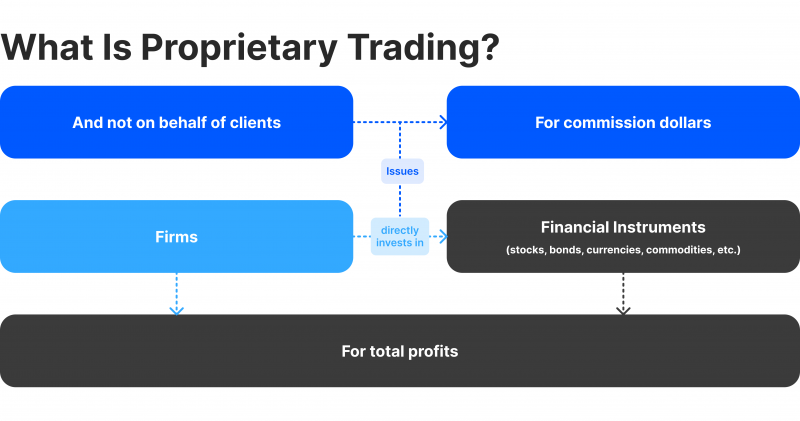

Prop trading, being a universal concept in the context of investment initiatives in the capital markets, helping to increase their level of liquidity and effectiveness, has become one of the modern trends that has allowed the creation of a new direction in the development of institutional investment concepts based on trading with own funds.

This development provoked the birth of companies offering access to prop trading based on the White Label model, which gives access to all the advantages of a ready-made solution developed by specialised providers.

This article is designed to empower you with a comprehensive understanding of what a white label prop trading solution is and how it operates. You will also gain insights into the advantages of this solution and the process of finding a dependable provider to launch a brand-new prop trading system.

Key Takeaways

- Prop trading white label application offers the business direct access to the equity markets, allowing it to trade financial products using its own funds.

- Among the outstanding distinguishing features of white-label prop trading software is the possibility of gaining unique advantages by trading users’ funds to achieve their investment goals.

- The white label prop trading solution provider provides all-around support and assistance for using the WL solution, as well as complete training in the basics of prop trading.

What is a Prop Trading Firm?

Prop trading offers distinct advantages compared to traditional investment firms. They can assume more risk and pursue potentially higher returns. By using their own capital, they enjoy greater flexibility in making trading choices and can seize short-run market prospects. These firms often specialise in specific asset classes or trading strategies, such as equities, options, futures, or foreign exchange, further enhancing their appeal.

The capacity and effectiveness of traders play a huge role in shaping the long-term viability of a prop trading venture. These traders are primarily long-time traders with extensive familiarity with the markets, possessing exceptional analytical abilities and risk supervisory skills. They diligently observe market conditions, analyse data, and make trades based on their evaluation of market patterns and chances for profit.

A prop trading firm’s profitability is intrinsically tied to its traders’ trading prowess, underscoring the importance of attracting and retaining exceptional individuals to maintain competitiveness within the financial sector.

Among the financial institutions that are usually involved in prop trading are investment brokerages, commercial banks, hedge organisations and any other structure that is a source of liquidity.

What is White Label Prop Trading Solution?

A white-label prop trading solution encompasses a ready-made and fully functional trading platform that is made available to companies. This solution empowers them to establish and manage their own prop trading venture without extensive development or customisation.

In the context of prop trading, “white label” refers to the software and platform supplied by a third-party supplier. This enables users to brand and modify the solution according to their needs and prerequisites. This lets businesses take advantage of the white-label provider’s resources and experience while concentrating on their primary trading activity.

By utilising a white-label prop trading solution, users can swiftly enter the field of prop trading without the burden of building their own trading platform from scratch. This turnkey solution offers a cost-effective and efficient way to establish and operate a prop trading business, providing access to superior trading features, market metrics, and infrastructure while allowing for customisation and branding to suit the unique needs of the traders.

Here’s how a white-label prop trading solution typically operates:

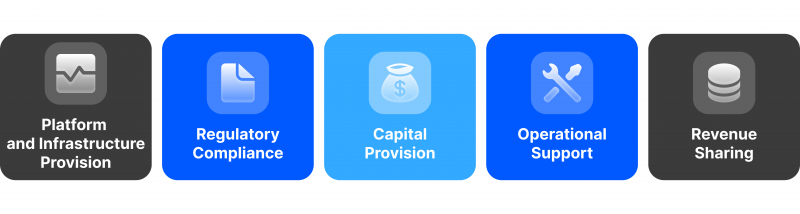

Platform and Infrastructure Provision

The white-label prop trading provider furnishes a wide-ranging trading platform that encompasses basic technology, software, and equipment required for operating a prop trading enterprise. This includes order execution systems, risk management tools, compliance systems, and other indispensable trading features.

Regulatory Compliance

The white-label prop trading provider oversees the regulation and legal components of operating a prop trading project to ensure adherence to pertinent financial regulations. This encompasses securing essential licenses and registrations, establishing compliance mechanisms, and overseeing regulatory reporting.

Capital Provision

In numerous instances, the provider of prop trading white-label services may extend access to capital or facilitate the acquisition of capital from investors for individuals or corporations utilising the white-label solution. This arrangement enables end-users to capitalise on the provider’s financial resources and support in establishing and running their exclusive trading enterprise.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Operational Support

The white-label provider offers intensive operational support, encompassing trading strategy development, risk tracking, back-office functions, and ongoing technical and customer support. This enables end-users to concentrate on trading actions while the provider oversees administrative and operational aspects.

Revenue Sharing

The provider of white-label solutions typically generates revenue by receiving a portion of the profits or trading volume generated by the solution’s end-users. This revenue-sharing model enables the provider to capitalise on the platform and infrastructure they have developed.

Benefits of the White Label Prop Trading Solution

Prop trading is one of the fastest-growing areas of investment practice within the currency markets today because it provides certain advantages related to risk and capital management. This is especially important when working with multiple trading products and in the context of several markets.

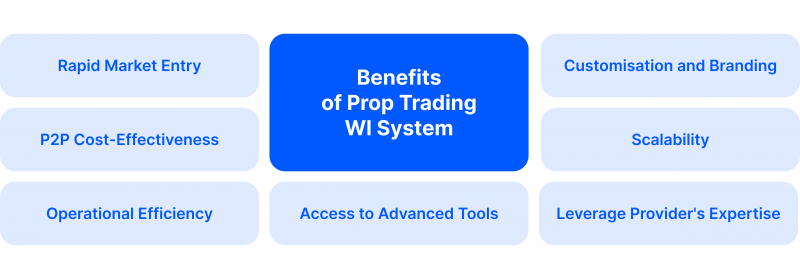

Such popularity became a catalyst for high demand for intermediary services related to the possibility of using software that provides full access to prop trading based on a convenient and efficient system. As a consequence, the sphere of White Label solutions designed to meet this demand began to develop, which allowed the use of a ready-made product and the following advantages:

1. Rapid Market Entry

As a white-label solution aimed to provide individual traders and small businesses with a quick and simplified means of setting up and launching their own prop trading business, without having to invest time or money into developing everything on their own, the white-label solution is ideal for entities of any form or type.

2. Cost-Effectiveness

When comparing the development of a proprietary trading platform from the ground up with the option of using a white-label solution, it becomes evident that opting for the latter suggests a more cost-effective approach to establishing a prop trading operation. The initial capital investment required is notably reduced.

3. Operational Efficiency

By taking advantage of the existing prop trading system and infrastructure, users can devote their time and energy to their core trading activities and strategies without being burdened by the technical aspects and constant maintenance. This allows for a more efficient and focused approach to trading, enabling users to make rational decisions and optimise their trading performance.

4. Access to Advanced Tools

The white-label proprietary trading solution is designed with a multifaceted set of professional trading tools, including charting capabilities, technical analysis indicators, order types, and risk management features.

It also provides access to real-time market analysis feeds, such as price quotes and market depth information, as well as a robust infrastructure, including secure login systems, data encryption, and reliable support services, to ensure that end-users have a seamless and safe trading experience.

5. Customisation and Branding

Despite originating from a third-party source, the white-label platform is designed to offer extensive customisation and branding options. This allows users to tailor the platform to reflect their unique requirements and brand identity perfectly.

6. Scalability

The white-label platform is specifically crafted to accommodate the evolution of the prop trading venture. Its design enables smooth and effortless expansion without the necessity of reworking the foundational technology.

7. Leverage Provider’s Expertise

Users can benefit from the white-label prop trading provider’s domain expertise, resources, and ongoing platform development without having those capabilities in-house. This allows them to leverage the provider’s specialised knowledge and continuous platform enhancements rather than independently developing and maintaining those capabilities themselves.

Other than that, by tapping into the white-label provider’s established infrastructure and technical resources, users can avoid the substantial upfront investment and ongoing operational costs associated with building a proprietary trading platform from scratch.

This makes the prop trading white-label solution a more cost-effective option for companies looking to enter the prop trading space while providing a sense of security and confidence.

How to Select a White Label Prop Trading Solution

Choosing a quality product or a reliable partner for cooperation is sometimes not an easy task, especially given the growing level of competition and the emergence of new solutions designed to solve certain customer problems.

Choosing a reliable provider of White Label prop trading solution is no exception and involves a process of considering key aspects based on security, usability, price, efficiency and a number of other characteristics that determine the quality and performance of the solution offered by the provider.

Such aspects include the following:

Platform Functionality and Flexibility

Ensure that the platform provides an extensive range of trading features, order types, and integrations with market data for specific trading needs and that identity and workflow are aligned with the platform’s ability to be customised and branded.

Technology Infrastructure and Security

Evaluate the provider’s technological framework, infrastructure, and data security protocols to guarantee reliability, scalability, and data safeguarding. Additionally, assess the provider’s strategies for disaster recovery and business continuity.

Regulatory Compliance

Make sure to confirm that the white-label platform meets the prerequisites of the regulatory frameworks in the specific markets you are targeting. Besides, verify that the provider possesses the appropriate licenses and certifications to conduct business in your jurisdiction.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Customer Support and Training

Evaluate how well the provider’s customer support services meet quality and responsiveness standards. Further, assess the availability and effectiveness of training resources and onboarding assistance.

Pricing and Scalability

It’s essential to grasp the pricing structure, which may involve setup fees, ongoing costs, and volume-based pricing models. Additionally, it’s crucial to confirm that the solution can easily accommodate the growth of your prop trading venture.

Provider’s Industry Reputation and Longevity

Researching the track record, market presence, and reputation among current clients of potential providers is essential. Give preference to providers with a well-documented history of delivering dependable and innovative white-label solutions.

Roadmap and Product Evolution

It’s essential to gain insight into the prop trading platform provider’s upcoming development methods, platform updates, and improvement frequency. Evaluating the provider’s capacity to stay abreast of changing market trends and technological developments is crucial.

Referrals and Case Studies

To gain a deeper understanding of the provider’s performance, customer satisfaction, and overall value proposition, it is advisable to actively seek out references and case studies from their existing clients.

Doing so lets you gather valuable insights and first-hand experiences to help you make an informed decision. These references and case studies testify to the provider’s capabilities and give you an accurate idea of what to expect.

Final Remarks

The popularity of prop trading is growing inexorably as another alternative method of managing funds within the framework of investment activities, as a consequence of which there is an increased interest and demand for white label products that enable the use of the full potential and appeal of such trading style.

At the same time, in order to find a reliable partner for working with such products represented by white-label prop trading solution distributors, it is necessary to conduct a holistic analysis of a number of factors and identify the best option based on individual preferences and prerequisites.

FAQ

What are the key factors when selecting a white label prop trading solution provider?

The key factors include platform functionality and flexibility, technology set up and security, regulatory enforcement, customer support and training, pricing and scalability, the provider’s sector-specific reputation and longevity, product roadmap and evolution, and available client references and case studies.

How important is the provider's technology stack and infrastructure?

The provider’s technology stack and infrastructure are crucial. You must ensure the platform is built on reliable, scalable, and secure systems that handle your trading volumes and data requirements.

What kind of customisation and branding options should I look for?

Seek a provider that offers extensive customisation and branding capabilities. This enables you to tailor the platform to your firm’s unique identity, workflows, and prerequisites, securing your clients’ cohesive and branded experience.

How significant is the provider's regulatory adhering to track record?

Ensure the provider fully aligns with the relevant legal requirements in your target markets and has the corresponding licenses and certifications to operate. This mitigates legal and reputational risks.